Fortune News | Dec 01,2024

Debub Global Bank experienced a mixed performance from its operations last year, struggling to match the profitability levels observed in the industry or its records from just a few years ago.

This development underscores the financial sector's challenges in an ever-changing market where the Bank's capacity to adapt and improve will determine its long-term success. The banking industry has seen significant expansion in recent years. Private banks, such as Awash, Abyssinia, and Dashen, have led the way in assets, loans and advances, deposits, and profitability. Meanwhile, relatively younger banks, including Abay, Addis, Enat, and Debub Global, have demonstrated more modest financial performance.

Debub Global's assets, loans, and deposits have experienced moderate growth compared to the industry average. However, its total capital and capital adequacy ratios outpace it, indicating a strong capital base. Despite this, the Bank's return on assets, equity, and earnings per share (EPS) growth remains below the industry average, suggesting potential profitability issues.

In the 2021/22 fiscal year, Debub Global netted a profit of 277.16 million Br from its operations, growing by 42.2pc. Nevertheless, its profit ranked the lowest among its peers, such as Enat Bank (314.18 million Br), Abay Bank (933.3 million Br), and Addis International Bank (344.9 million Br).

This performance resulted in an EPS of 182 Br, up from the previous year's 166 Br but significantly lower than the 323 Br it posted in 2019. With a profit margin of 18pc, Debub Global Bank trails industry leaders, suggesting that the Bank may need to focus on cost management strategies to enhance profitability. While not the lowest, the Bank's asset turnover of 0.08 indicates room for improvement in deploying assets to generate revenue. Debub Global exhibited a moderate level of financial leverage compared to its peers, with an equity multiplier of 7.0.

The Bank's return on equity (ROE) of 10.08pc placed it in the middle range compared to its competitors. Enat Bank, boasting the highest ROE of 15.18pc, has set a benchmark with a high-profit margin, better asset utilization, and moderate financial leverage. With the highest asset turnover, Oromia International Bank generates more revenue from its assets.

To enhance its profitability and ROE, Debub Global can concentrate on improving cost management and better utilization of assets, according to experts. The Bank's total assets increased by 21.2pc to 14.09 billion Br, exceeding Addis Bank's 10.8 billion Br, but three times lower than Abay Bank and three billion Birr short of Enat Bank's 17.21 billion Br.

Debub Global's growth in profit was driven by a surge in interest income and a drop in general administrative expenses. Its cost-to-income ratio and net interest margin are marginally higher than the industry average, highlighting areas where cost and interest rate risk management could be improved.

Interest on loans, advances, and central bank bills soared by 56pc to 1.72 billion Br, hailed by experts as an "impressive growth". The Bank disbursed loans and advances of 9.35 billion Br, an increase of 14pc. This performance has improved from the previous year, earning third place, trailing Enat Bank (11.21 billion Br) and Abay Bank (26.9 billion Br). The loan-to-deposit ratio decreased to 85pc from 95.3pc. Loans and advances account for 66pc of its total assets, two percentage points lower than the industry's average.

However, income from service charges and commissions plummeted by 41.4pc to 198.94 million Br, while the figure for foreign exchange dealings shows a decline of 36.3pc to 139.3 million Br. Foreign assets constitute a mere 0.9pc of total assets, significantly lower than the industry's average of 1.8pc.

A Branch Manager who requested anonymity noted that reaching deposit mobilization and client acquisition goals was challenging last year. He observed a severe forex shortage in recent years.

"The management should look closely into this," said Abdulmenan Mohammed, a financial statement analyst based in London.

Tesfaye Boru (PhD), president of Debub Global Bank, attributed the decline in foreign gain to the 70pc retention ratio banks are forced to surrender by the central bank. Addressing some of the 18,000 shareholders who met at the Millenium Hall on Africa Avenue (Bole Road) in December 2022, he characterized last year as a "time for reassessment, repositioning, and proactive moves."

Tesfaye has two decades of industry experience, beginning his career at Hibret Bank as a loan officer. He graduated from Addis Abeba University, studying management and economics. He later completed his postgraduate studies in business administration and a PhD in business leadership from the University of South Africa.

He held various positions at Abyssinia and Zemen banks before joining Debub Global. Tesfaye served as vice president for two years at Debub Global before being appointed to run the Bank following Addisu Habba's resignation in 2019.

Under his watch, the Bank saw a considerable expansion in interest expenses. Interest on savings increased by 56pc to 813.32 million Br. However, salaries and benefits increased by a reasonable 12.3pc to 429.28 million Br, while expenses on general administration went down by 10.3pc to 453 million Br, attributed to the reduction of loss of foreign exchange dealing functions by 20pc to 245.67 million Br.

Tesfaye said the management monitored expenses while applying cost-controlling mechanisms such as managing the branch-to-employee ratio. Debub Global's branches increased to 133.

Bikila Hurissa (PhD), the board chairman, stated that the Bank has invested considerable resources to launch new technology-enabled products and scale up its operations to enhance customer experience, streamline internal processes, and boost efficiency to offer high returns for shareholders.

Bisrat Hailemariam, who bought shares worth 200,000 Br three years ago, anticipated rewarding dividends. Last year, he earned 18,000 Br, a dividend that dismayed him and prompted him to sell his shares. However, he has fallen short of buyers.

"It's not worthwhile," said Bisrat.

Debub Global was incorporated in 2012 with 138.9 million Br paid-up capital, which has increased by 17.27pc from the previous year to 1.63 billion Br. It had capital and non-distributable reserves of two billion ETB and a capital adequacy ratio of 22.9pc. Its total capital represents 15pc of its total assets, outperforming the industry average of 11pc.

The Bank has mobilized deposits of 10.99 billion Br, an increase of 26.3pc. This stood below the 32.4 billion Br and 13.05 billion Br raised by Abay and Enat banks, respectively, but slightly more than the 7.9 billion Br raised by Addis International Bank. Debub Global's deposits account for 78pc of total liabilities, falling short of the industry average of 91pc.

The Bank's liquidity level increased in value and relative terms. Cash and bank balances rose 65.4pc to 2.25 billion Br, pushing its ratio to the total assets from 11.69pc to 15.97pc.

Tesfaye interpreted this as evidence that the deposit was successfully disbursed as loans. However, Abdulmenan urged him to improve further to avoid any liquidity issues.

PUBLISHED ON

Apr 15,2023 [ VOL

24 , NO

1198]

Fortune News | Dec 01,2024

Viewpoints | Sep 10,2023

Viewpoints | Dec 21,2019

Radar | Jun 30,2024

Radar | Jun 29,2019

Radar | Feb 10,2024

Fortune News | Sep 01,2024

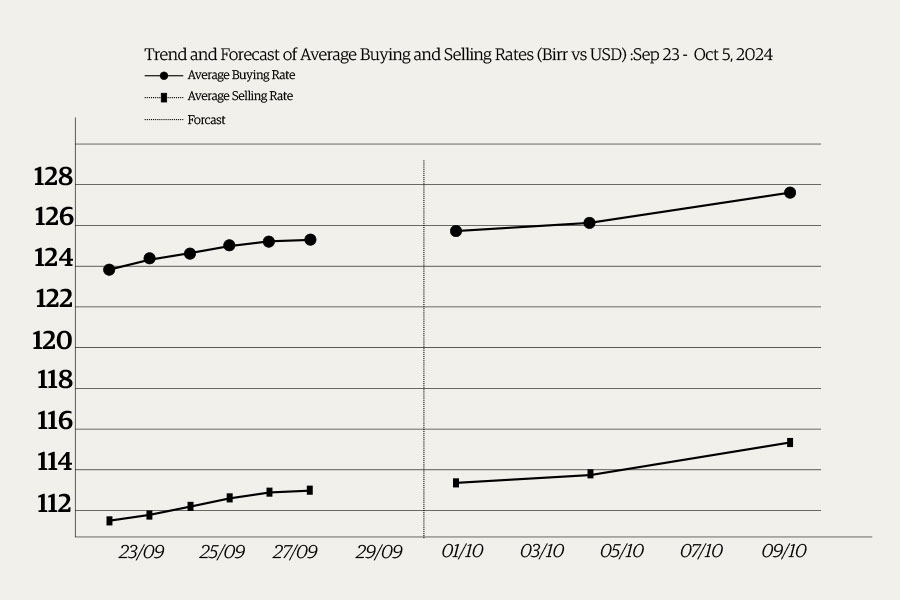

Money Market Watch | Sep 28,2024

Fortune News | Oct 08,2022

My Opinion | Jun 24,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...