Fortune News | Dec 25,2021

Jul 11 , 2021

By HAWI DADHI

Foreign nationals of Ethiopian origin are allowed to invest only in foreign currency should they get into the business of payments system operators or instrument issuers. The new rule comes into force just a year after the central bank partially liberalised the digital payment market.

The directive issued by the National Bank of Ethiopia (NBE) has been effective beginning July 1, 2021.

The central bank is yet to issue licenses to private fintech companies though it has received a dozen of applications from hopefuls such as ArifPay, ChapaPay, SantimPay and UniCash. The state-owned Ethio telecom has been awarded a license for its Telebirr mobile money service.

Commercial banks, where the forex escrow account of a newly licensed payments instrument issuer or system operator would be opened, are required to surrender 30pc of the forex invested by Ethiopian-born foreign nationals, according to the directive. The escrow accounts are to remain closed until the fintech company receives a full operational license, while initially subscribed shares must be paid in foreign currencies. The remaining 70pc is to be relinquished to the commercial bank where the blocked account was opened. Dividends for shareholders of foreign nationals are to be made only in Birr, says the directive.

The companies are responsible for making sure all shareholders are compliant with the directive and submitting a compiled document to the central bank.

A payment instrument issuer is required to register a paid-up capital of 50 million Br to engage in services such as mobile banking, microcredit, inward international remittance facilitation, and local money transfers. A system operator is to have between three million Birr and 300 million Br in paid-up capital, depending on the scope of services the firm provides. It can give services from payment processing to personalisation of payment cards, and from payment aggregation to solutions services.

The directive issued a few weeks ago has brought displeasure to industry insiders. A significant number of ArifPay's shareholders are foreign nationals of Ethiopian origin.

Habtamu Tadesse, its founder, says foreign nationals residing in Ethiopia for years have no means of earning foreign currency to buy shares in forex. Also a founder of a taxi-hailing company, Zay Ride, he finds the directive shortsighted and unable to consider the bigger picture on how these payment services would bring foreign currency income.

"It'll discourage investment," he told Fortune.

ArifPay has raised 140 million Br in equity.

"The foreign companies might devour us if we're not strong enough by then," he said.

Unlike ArifPay's misgivings with the directive, others like ChapaPay showed no objection to the directive, for they have raised equity from Ethiopian nationals.

Experts too, believe it is the right way to go.

Nurhassen Mudesir, a fintech expert currently working as a business development director at Yenepay Technologies, recognised the apprehension from ArifPay but believes that the central bank should have made the restrictions clear earlier.

"However, it's a much-needed directive," he said.

It provides clear guidance on how the newly formed companies can engage with the Ethiopian Diaspora, according to Nurhassen.

PUBLISHED ON

Jul 11,2021 [ VOL

22 , NO

1106]

Fortune News | Dec 25,2021

My Opinion | Feb 27,2021

Radar | Nov 27,2021

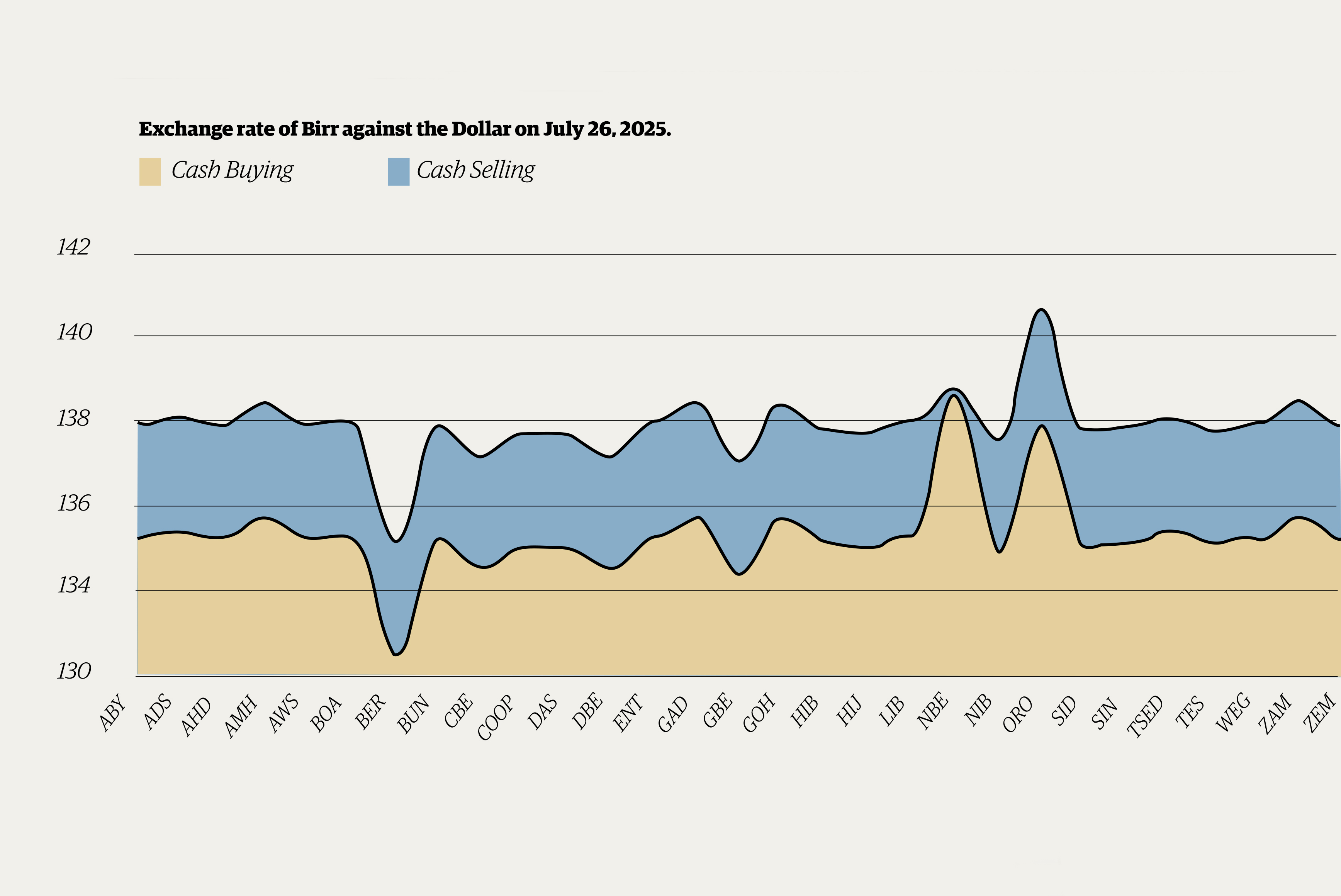

Money Market Watch | Jul 27,2025

Radar | Apr 01,2024

Delicate Number | Feb 05,2022

Radar | Jun 29,2025

News Analysis | Apr 22,2023

Radar | Sep 27,2025

Fortune News | Jun 05,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...