Radar | May 31,2025

Industrial water bottlers have lodged complaints and a plea for assistance before the authorities at the Ministry of Trade & Industry, claiming that issues with foreign currency shortages and disruptions in the supply of raw materials have placed them in dire straits.

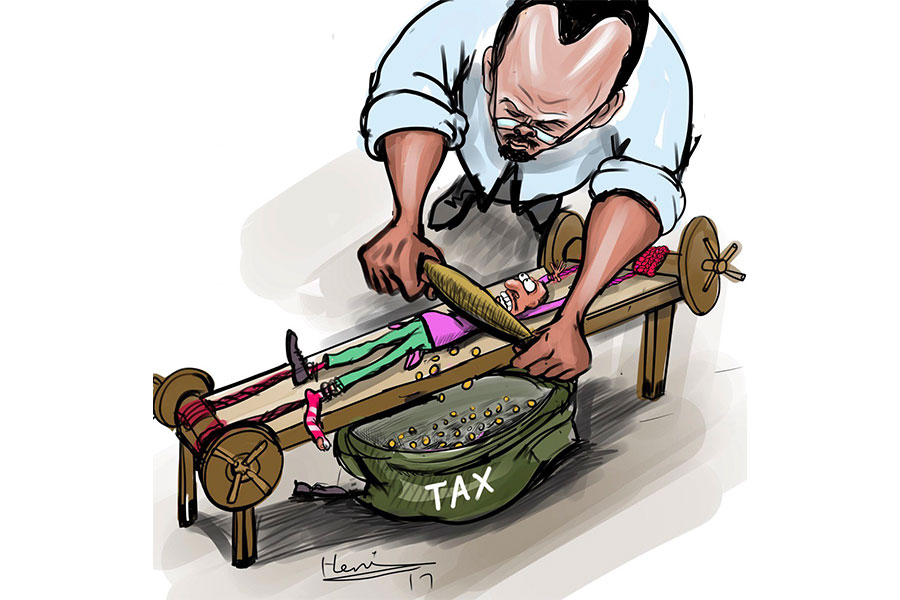

The industry's complaints were submitted to the Ministry through the Ethiopian Bottled Water, Soft Drink, Fruits & Vegetable Processing Industries Association, run by Getnet Belay. Leaders of the Association, which is comprised of 83 members, have also filed their complaints with the Customs Commission, claiming taxation imposed on importing raw materials is "unfair," Ashenafi Merid, the Association's general manager, disclosed to Fortune.

Data is hard to come by to understand the industry, although an average of nine million bottles of water is produced hourly, according to industry sources. The lowest rate of bottling at any individual plant is 8,000 litres an hour, while the largest plant bottles 120,000 litres an hour. At full capacity, the industry may produce close to 77 billion litres a year, alluring for many entrepreneurs aware of the potential market worth hundreds of billions of Birr.

Nonetheless, the water bottling industry was already struggling from a decline in demand due to the cancellations of meetings, conferences and exhibitions brought on by the COVID-19 pandemic. However, the industry began to show signs of revival after the national state of emergency was lifted late last year. According to insiders in the industry, things looked like they were turning around until a series of issues surfaced at the beginning of this year.

Water bottlers now report that they are struggling with foreign currency shortage problems, a lack of raw materials, disruptions due to power outages, and the overpricing of raw materials necessary for production.

The bottlers claim that foreign currency shortages have hindered importing raw materials, forcing them to source from the local market, which has exhibited price increases of up to 150pc in recent months. The price for a kilogram of polyethylene terephthalate (PET), an essential component of bottled water, has increased from 52 Br to 120 Br.

Abyssinia Springs, one of the over 100 water bottling companies operating in the market, is currently producing at 40pc capacity, Amare Kassa, manager of Great Abyssinia Plc, disclosed to Fortune.

"We're close to laying off employees or closing the factory," he said.

Managers at the bottling companies believe prices of locally-sourced raw materials have increased because producers face the problems of power outages and shortages of foreign currency. Although bottle producers have increased their prices by 100pc, adding production costs and losses to the supply cost, bottled water plants are obliged to buy because they have no choice, according to a manager of a raw material importing company, who asked to remain anonymous.

"We're both in a dilemma," the manager told Fortune.

Operating in an underdeveloped market with fierce competition, the bottlers are not in a position where they can push the climbing costs onto their customers. Many are simply resorting to cutting back on production and labour costs, as is the case with Konjo Water.

The company used to produce in a 24-hour production cycle but has cut that down by two-thirds to stay afloat, according to Amaha Kebede, marketing manager.

Another bottler, Hagere Water, is on the verge of shutting down, according to their general manager, Tinsae Zeleke.

A few of them have already closed their plant. Tsega Water Bottling Factory, which opened just a year and a half ago and employed over 100 people, stopped production last month due to problems sourcing raw materials.

According to Solomon Alamirew, a consultant with more than two decades of experience in accounting and management, the shortage of foreign currency to import raw materials is not peculiar to the bottling industry.

"The country is at a stage where it is impossible to import medication, let alone raw materials for bottled water production," he told Fortune. "It's a luxury."

However, the shortage of foreign currency that besieged several industries across the economy is one among a series of bottlenecks the bottling industry faces, according to a study the Association commissioned by experts from Addis Abeba University, upon the request of the Ministry of Trade. Although submitted three months ago, leaders of the Association have yet to hear from the authorities, according to Ashenafi.

"We're still waiting for answers before the industry dissolves," he told Fortune.

Authorities say they are doing what they can to help but are engulfed by so much demand from so many industries. They cite an agreement signed with Ethiopian Electric Power (EEP) last week to address power outages. They see the manufacturing sector's survival as indispensable to the country's economy; they have helped industries access foreign currency partly taken away from priority areas such as the health sector, says Kassa Alamiraw, public relations team leader and representative director at the Ministry.

“We're distributing the limited foreign currency as much as possible,” said Paulos Berga, advisor to the State Minister at the Trade Ministry.

But there is a limit to what they can do, according to some of the officials. Laws cannot be amended regularly, according to Paulos.

"We can't bring taxes down to zero," Paulos told Fortune. "But at least we brought the amount down, and we'll study the sector again in the future and make other amendments if necessary.”

Paulos referred to a five-percentage-point reduction to 10pc the Ministry of Finance introduced on excise taxes, following the Association's recommendations to the Ministry of Trade.

While he recognises that the industry's trouble is sure to affect the economy as a whole, Solomon expressed that he does not believe that the government is disregarding the bottlers.

"[The government] is prioritising sectors that are more critical, especially with the pandemic worsening and weakening the economy," he said.

PUBLISHED ON

Apr 03,2021 [ VOL

22 , NO

1092]

Radar | May 31,2025

Radar | Aug 17,2019

Fortune News | May 04,2019

Radar | Jun 15,2019

Fortune News | Apr 26,2019

In-Picture | Nov 24,2024

Fortune News | Sep 28,2024

Fortune News | Jun 19,2021

Fortune News | Apr 26,2019

Commentaries | Nov 16,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...