Editorial | Apr 25,2020

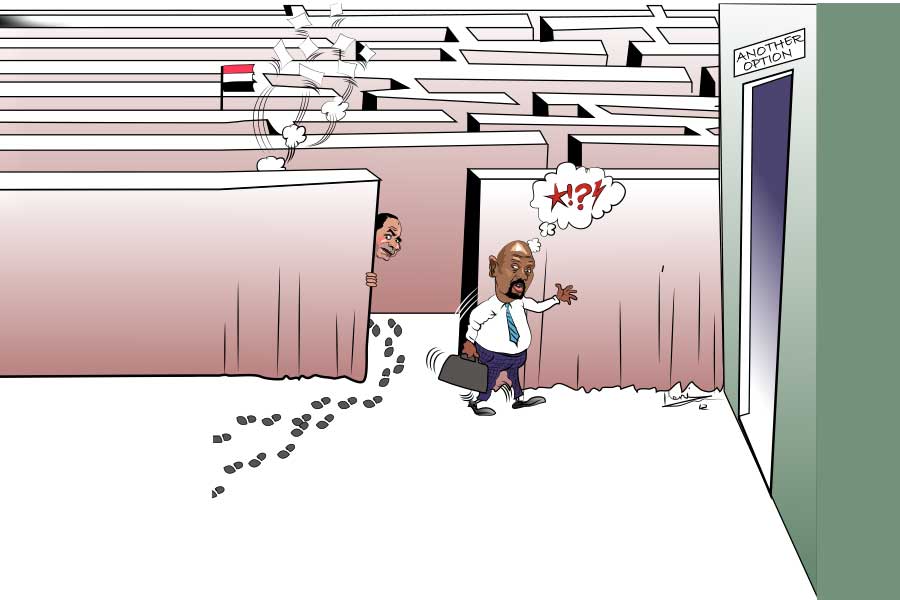

Demanding higher compensation, oil retail companies have refused to sign an agreement for a new payment scheme that requires the retailers to pay the cost of oil they receive upfront. The companies argue that the new payment modality, which requires them to bring unconditional payment guarantees, squeezes their profit margin.

The modality was supposed to take hold on March 10, 2021; however, the companies are hesitant to sign the contract unless an adjustment is made to the compensation. When bringing unconditional payment guarantees from financial institutions, the oil companies must pay a service fee and interest. This is an additional cost for them while their one percent profit margin remains constant.

The new payment scheme requires oil retailers to pay 10pc of the cost of the oil they receive upfront and provide the remaining in unconditional payment guarantees over the following three months. The amount they will have to pay upfront is scheduled to increase to 25pc three months after starting the new modality. In a year, the companies will be expected to cover the entire cost upfront.

The agreement was supposed to be signed last week, and contracts have been sent to oil retailers. Still, they have not been signed as pre-conditions have not been met, according to Alemayehu Tsegaye, communications director of the Ethiopian Petroleum Supply Enterprise.

The dispute heated up while the city was hit by a fuel supply shortage that lasted over three weeks. The shortage occurred days after the government announced a 20pc adjustment on the benzene retail price in two rounds.

For years, transactions were done using a credit-based method whereby the companies settle payment post-sale. With the new payment system that was initially announced in September 2019, the Enterprise stated that the difficulty in collecting debt has been rising as the number of oil companies increases.

The sector has been beaten up for 30 years, according to Bruck Girma, general manager of Dalol Oil, one of the 34 operational oil companies in the country.

"Oil companies haven't enjoyed sufficient returns on their investments in comparison to other sectors, and they lack the capacity to shift to an upfront payment system," he said.

Bruck also agrees that the amount of payment offered by the government is inadequate, stating that the commission banks require for an unconditional payment guarantee is 2.5pc.

This is a steep amount considering the margin the companies make is just about one percent, according to Bruck.

The government promised that the prices incurred by oil companies during the implementation of the new modality would be compensated. As a means of doing that, slight price increases on benzene and diesel were made this past week to compensate for loan costs that petroleum companies incur. The price of benzene was increased by four cents a litre, while diesel saw a hike of 14 cents a litre.

The Enterprise has studied and drafted an appropriate amount of compensation for costs incurred. It has forwarded it to the Ministry of Trade & Industry, which has the final say on approval, according to Alemayehu.

Following the approach of the date of implementation, some oil dealers have received letters from oil companies stating that they will have to pay 10pc to 100pc of the cost upfront, according to Ephrem Tesfaye, a board member at the Association of Petroleum Dealers. The letters still have not been rescinded.

"The dealers are incapable of paying upfront with the slim profit margins they have, and taking out loans might be problematic as they are unable to provide collateral," Ephrem said.

Dalol is facing problems in readying their payments before the new payment scheme takes hold, according to Bruck.

"We're trying our luck with banks," he said, relating that he remains pessimistic about it working out.

Eshete Asfaw, state minister for Trade & Industry, stated that the latest change is part of the government's reforms, and nothing will stop it from taking hold.

"We're investigating the calculations," he said, "and we'll readjust the price if we find it reasonable."

Eshete, who indicated that the requests seem reasonable, affirms that the price increase was pushed to customers to cover the costs incurred by companies in financing payments.

The implementation of the new payment modality seems to be rushed and infeasible, according to Serkalem Gebrekristos (PhD), an expert with two decades of experience in petroleum supply. He argues that the system will cause financial strain on the companies and the dealers who are already operating on thin margins.

"If the sector was not so highly regulated in terms of price," said Serkalem, "the new scheme might work, since the companies could find a way to finance their costs."

If the stakeholders cannot reach an agreement, it might be wise to involve independent professionals to perform a study, according to Serkalem.

PUBLISHED ON

Mar 13,2021 [ VOL

21 , NO

1089]

Editorial | Apr 25,2020

Editorial | Jun 20,2020

Radar | Nov 20,2021

Radar | Oct 09,2021

Fortune News | Apr 03,2021

Radar | Nov 21,2018

Fortune News | Sep 28,2019

Commentaries | Jan 01,2022

Fortune News | Nov 16,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...