Radar | Apr 08,2024

Wegagen Bank recovered from the profit slump it faced two years ago and netted 831.9 million Br in the last fiscal year, a 34pc rise from the previous year. A significant surge in financial and non-financial intermediation revenues helped the Bank in amassing higher profits.

Its earnings per shares (EPS), the net profit divided by the total number of shares owned by its 3,600 shareholders, also rose by 57 Br to 313 Br.

This is a remarkable performance for a mid-tier bank, according to Abdulmenan Mohammed, a financial statement analyst based in London. He attributed the increase in EPS to the growth in profit after tax combined with a reasonable rise in paid-up capital.

The Bank’s paid-up capital reached 2.9 billion Br at the end of last year, 16pc higher than the previous year.

Wegagen managed to recover and record growth despite the tough year, according to Tefera Molla, vice-chairperson of the board of directors at Wegagen.

The past fiscal year is peculiar as it witnessed different global incidents that have influenced the economic conditions, one of the major ones being the Novel Coronavirus (COVID-19) pandemic, according to Tefera. At the national level, the pandemic has also put pressure on the country’s economy, he added.

"Despite the challenging environment at the global and national levels," remarked Tefera, "the Bank continues to be profitable and managed to record increments in the key performance indicators."

The major reason for a massive increase in profit after tax is a significant rise in financial and non-financial intermediation revenues. Interest income on loans and advances, treasury bills, National Bank of Ethiopia (NBE) bonds and other deposits rose by 29.5pc to 3.2 billion Br. Non-interest earning activities – such as service charges and commissions – jumped by 75.5pc to 1.1 billion Br.

The growth in interest and non-interest income, which was driven by an increase in lending, is impressive, according to Abdulmenan.

The swelling income was accompanied by a rise in expenses. Interest paid on savings soared by 20.6pc to 1.2 billion Br due to expanding deposits. Salaries and benefits increased by 38.5pc to 1.1 billion Br, and other operating expenses surged by 42.4pc to 838.3 million Br.

Last year, the Bank opened 43 new branches, pushing its branch network to 383. Wegagen's total number of employees, excluding outsourced staff, rose to 4,907, showing an increment of eight percent compared to the preceding year.

In the reporting year, the Bank maintained a provision for the impairment of loans and other assets of 216.2 million Br, a sharp jump of 162.7pc.

This shows that a considerable amount of loans and advances went sour, according to the expert, who advises the management to watch its loan portfolio closely.

Wegagen disbursed loans and advances of 23.7 billion Br, a 47pc expansion, and mobilised deposits of 30.1 billion Br, an increase of 28pc. The loan-to-deposit ratio of Wegagen went up to 77.2pc from 68pc.

“The increase in the loan-to-deposit ratio helped Wegagen earn more interest income,” said Abdulmenan.

The investments in NBE bonds dropped by 20pc percent to 5.4 billion Br. These investments account for 14pc of the Bank's total assets and 18pc of its total deposits.

Wegagen increased its total assets by 28pc to 38.2 billion Br.

The liquidity position of Wegagen increased in value terms and relative terms. Its cash and bank balances went up by 48.6pc to nearly 6.4 billion Br. The ratio of liquid assets to total assets increased from 14.4pc to 16.7pc, and the ratio of liquid assets to total liabilities also increased from 16.8pc to 19.2pc.

Wegagen's capital adequacy ratio (CAR) decreased from 24.1pc to 19.8pc.

“This must've been mainly due to increased lending activities,” said Abdulmenan. “Despite the reduction in CAR, Wegagen has a strong capital base.”

Fasil Kebede, a founding shareholder at Wegagen, says that the Bank's performance was better last year, mentioning the performance swing over the past couple of years. He joined the Bank with 200,000 Br worth of shares, and after investing the dividends he receives annually, he has grown that number by over five-fold.

However, Fasil fears that this success might not continue in the coming years since new banks joining the sector might snatch customers away from existing banks. He recommends that management think outside the box in order to retain their customers.

"The executives should be creative in obtaining new customers and more business, such as collecting utility payments and taxes," he said.

The management should also come out and underline the Bank's independence and non-affiliation with a regional or federal government to build the confidence of customers and shareholders, according to him.

Four months ago, Birtukan Gebreegzi joined the Bank as its sixth CEO, replacing Abay Mehari, former chief credit officer at the Commercial Bank of Ethiopia, who resigned his presidency.

PUBLISHED ON

Mar 06,2021 [ VOL

21 , NO

1088]

Radar | Apr 08,2024

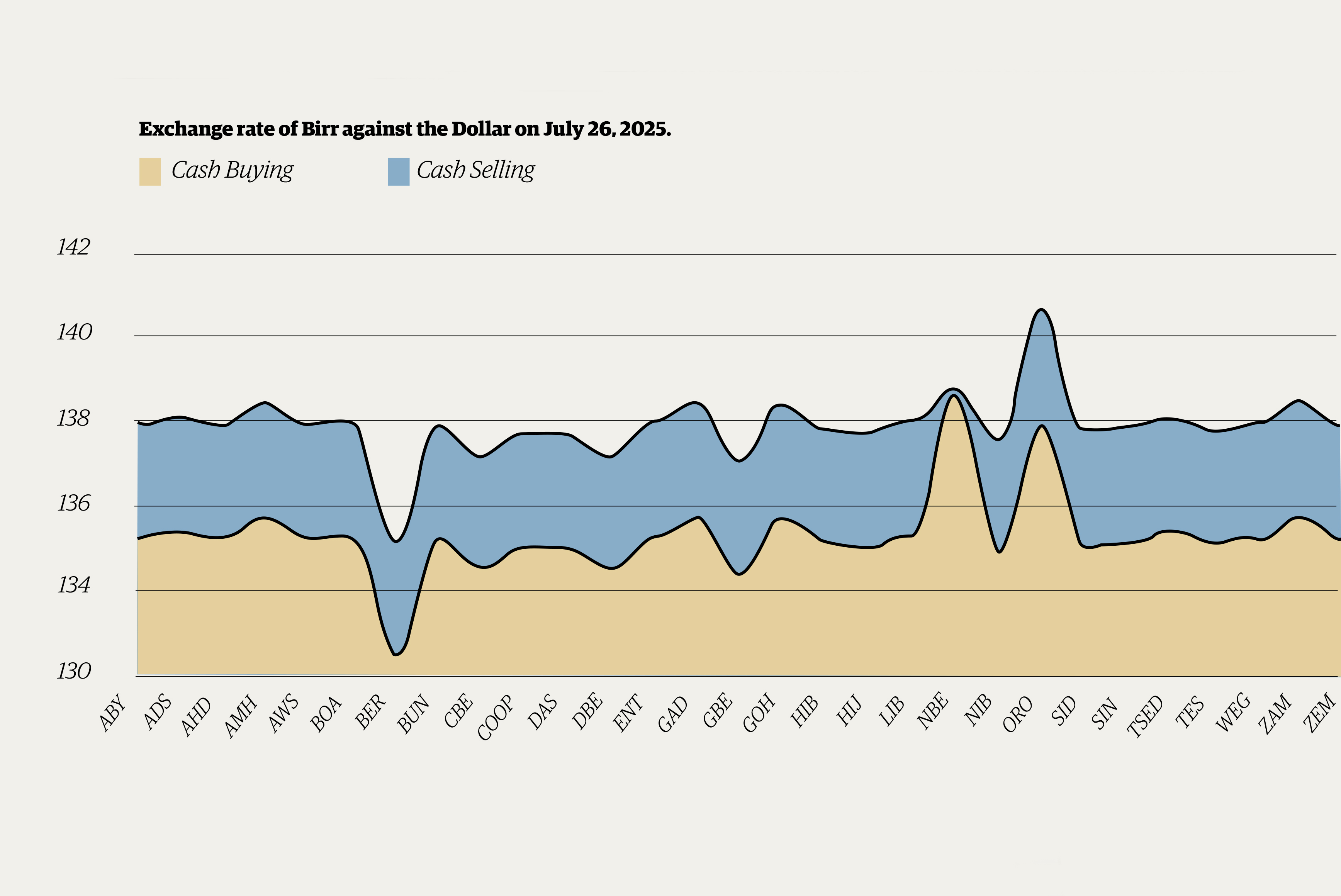

Money Market Watch | Jul 27,2025

Fortune News | Nov 21,2018

Fortune News | Feb 23,2019

Fortune News | Feb 13,2021

Radar | Sep 22,2024

Fortune News | May 24,2025

Radar | Sep 24,2022

Radar | Oct 02,2021

Radar | Aug 05,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...