Viewpoints | May 31,2025

Jan 9 , 2021

By Nasreen M. Adem

China and Ethiopia have a long economic history, which is only growing as the former becomes wealthier and asserts its global vision. Ethiopia must seize the opportunity by addressing key challenges and opportunities in the overall nature of the investment, writes Nasreen M. Adem (nasreen.m.adem@gmail.com), a private sector development expert with a background in management consulting and public policy advisory and development.

Sino-Africa economic and development relations have a long history. In modern times, it dates back to the 1950s. However, it was mainly since the Chinese economy underwent a rapid economic transformation in the 2000s and subsequent implementation of the Go Global Strategy that Chinese foreign direct investment (FDI) flows to Africa increased dramatically.

In the five years beginning 2003, the annual Chinese FDI flow into Africa surged from 75 million dollars to 5.4 billion dollars, according to the China Africa Research Initiative. These flows peaked in 2008, reaching 5.5 billion dollars due largely to the purchase of shares in Standard Bank of South Africa by the Industrial & Commercial Bank of China (ICBC).

From 2014 onwards, Chinese FDI flows to Africa have exceeded that of the United States with South Africa, the DRC, Mozambique, Zambia and Ethiopia as the largest recipients. China's flagship global development strategy, the Belt & Road Initiative (BRI), has also contributed to increased investment, a trillion dollars already earmarked for roughly 70 countries across the globe. The impressive investment trend aside, the pattern of Sino-Africa trade relationship remains unbalanced, as African countries have consistently run trade deficits with China since 2012. This has led some commentators to suggest that the uneven trade relationship and its negative implications for terms of trade is potentially damaging for Africa’s economic diversification and industrialisation prospects.

Africa’s exports to China have continued to be dominated by primary commodities, while the region’s imports are predominantly high-value industrial or manufacturing products. Sino-Africa trade relations have further entrenched Africa’s dependence on commodity exports and exacerbated the vulnerability of the continent to negative external shocks.

Interestingly, the exception in this scenario is Ethiopia because of increasing Chinese investment in the manufacturing sector at the industrial parks. Approximately 60pc of FDI flows to Ethiopia have been targeted at manufacturing activities, including from China.

China has been a reliable partner in supporting African countries in their development ambition. This has been demonstrated by the support that many African countries received from China after the outbreak of the Covid-19 pandemic and the subsequent economic crisis. The launch of the "Mask Diplomacy" at a summit of leaders from China and Africa in early June was an essential initiative in fighting the pandemic. The support provided by the Alibaba Foundation to several African countries, particularly the distribution of the much-needed personal protection equipment (PPEs) through the African Centre for Disease Control (CDC) was timely and highly appreciated. This was implemented in collaboration with Ethiopian Airlines and Ethiopian Logistics & Cargo Services.

Still, it is hard to conclude that the relationship is merry and beneficial without a further assessment of Chinese investment in Africa. Chinese companies are the fifth largest foreign investors in Africa (after France, the Netherlands, the US and the UK), with a 43-billion-dollar stock of FDI as of 2017, according to UNCTAD.

This investment is characterised by different macro and micro features highlighted in a recent report published by the DFID-ESRC Growth Research Programme. Chinese firms investing in Africa contribute to substantial job creation for African workers, with high localisation rates and most jobs created being at the low and semi-skilled levels. These companies are found to build the skills of host countries’ workers. While the previous discourse favoured European firms in skills transfer when compared with Chinese firms, comparative research finds no difference between the two, especially in managerial knowledge transfer to locals.

Wages paid by Chinese firms is also, on average, not different from those paid by other firms. In some cases, Chinese firms are found to offer better non-wage benefits to workers, such as accommodation or financial support.

The same cannot be said for Chinese engagement in the informal sector, according to the report. It has been an issue, specifically in Africa’s natural resources. It is highlighted by the negative impact of Chinese actors in informal agriculture, mining and trade along two fast-developing trade corridors connected to the Indian Ocean.

The report highlights that Chinese investments contribute to increased economic growth at the macro level, mainly through investments in productive sectors (mostly manufacturing). They are predominantly market-seeking, rather than efficiency or export-oriented.

Chinese financing has contributed to unblocking the bottleneck to economic growth, supporting infrastructure building, promoting further economic activities and generating spillovers. However, consumer goods imported from China compete with and negatively affect industries. This has led some observers to conclude that competition from Chinese imports is causing de-industrialisation by crowding out local firms from the domestic market.

Chinese investments in Ethiopia are similarly complex. Among the first waves of investors to take advantage of the opportunities presented by Ethiopia’s growing economy, the initial flow of Chinese investments into Ethiopia (which coincided with China’s Go Global policy) was largely made by state-owned enterprises in the construction and energy sectors. Much of the financing was obtained through the Export-Import Bank of China.

China has emerged as a key investor and source of employment opportunities in Ethiopia. In 2018 and 2019, the percentage of Chinese investment projects to total FDI projects has climbed to 60pc, making China the biggest source of foreign finance, according to the most recent available data from the Ethiopian Investment Commission (EIC).

Out of 804 Chinese investment projects licensed in the five years beginning January 2015, almost half have become operational. Not surprisingly, the total number of investment projects licensed by the Commission dropped significantly this past year, due largely to the COVID-19 pandemic and the economic shock that followed. When compared to the 184 projects in the same period the previous year, the number of projects registered in 2020 was not even one-third as many. This represents a mere 9.5 million Br, in sharp contrast to the 22.2 billion Br recorded this period. Half this amount was recorded in a single year, 2017, for instance.

What should be most exciting is many of these projects already in business are in manufacturing, at 84.9pc, followed by the construction and real estate industries.

All of this has meant that Chinese economic support and the opportunities they see here have been instrumental in helping develop key infrastructure in Ethiopia, including roads, railways, hydroelectric dams and telecom infrastructure. Chinese investments also played a significant role in the development of industrial parks, building one of the very first industrial parks, the Eastern Industrial Park Zone. Shortly after, the Ethiopian government developed an industrial park in Hawassa, with the involvement of a Chinese contractor.

Over the years, Ethiopia has been actively taking part in various forums created by the Chinese government - such as the China Africa Cooperation, China International Import Expo, and Belt & Road Initiative - to nurture and develop China’s economic and trade ties with other developing regions. Ethiopia has made deals on trade and investment facilitation with different agencies within the Chinese government and private sector associations.

Yet key challenges remain in the attraction of new investments. Some takeaways are worth highlighting.

There is a need to foster development along diverse value chains instead of focusing on specific sectors or isolated projects. Chinese investments in Ethiopia are predominantly targeted at the manufacturing and construction sectors, which is a welcome development. However, the negligible Chinese investments in agriculture despite export potential needs rethinking and to be remedied both through the government's sectoral prioritisation and Chinese investors’ focus.

Another is the need for joint ventures and other forms of longer-term partnerships to maximise the benefits from foreign investment. Most Chinese investors (93pc) were structured as limited liability companies. However, the most effective way to strengthen knowledge transfer from foreign firms is through long-term collaborations such as joint venture arrangements.

The price of failing to learn from the presence of foreign investors in the country and develop domestic production capacity could be high as demonstrated by the challenges that Ethiopia and other low-income countries faced in the aftermath of the COVID-19 onset. Countries that faced fewer problems in producing an adequate supply of personal protective equipment and other medical supplies were those that had already developed manufacturing capacity and quality control capability.

Thus, creating the link between overseas investment and the domestic economy should be the main focus of investment facilitation objectives. It is also essential to develop country-specific investment attraction strategies. Currently, the government has a sector rather than a country-based strategy. Although this approach has been successful in drawing in large-scale investment, by focusing on sectors, unfortunately, it tends to gloss over the specific needs and investment opportunities open in the source country.

Given that China is one of the largest contributors of FDI inflows to Ethiopia, it is time that the latter begins to consider developing a country-specific investment strategy for China.

Yet another gap that needs attention is the retention of existing investment projects and encouragement of re-investment through an effective aftercare service. Chinese investment flows into Ethiopia are declining. While this is partly due to the Covid-19 pandemic, other possible explanations include downward trends of global FDI flows, slowing down of industrial park development and the general decline in China’s overseas investments, a trend projected to last longer if the current trajectory and effects of COVID-19 continue.

PUBLISHED ON

Jan 09,2021 [ VOL

21 , NO

1080]

Viewpoints | May 31,2025

Fineline | Apr 04,2020

Viewpoints | May 08,2021

Fortune News | May 18,2019

Editorial | Dec 11,2020

Editorial | May 28,2022

Commentaries | Aug 25,2024

Radar | Apr 21,2024

Fortune News | Sep 14,2019

Radar | May 25,2019

Photo Gallery | 156287 Views | May 06,2019

Photo Gallery | 146571 Views | Apr 26,2019

My Opinion | 135227 Views | Aug 14,2021

Photo Gallery | 135086 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

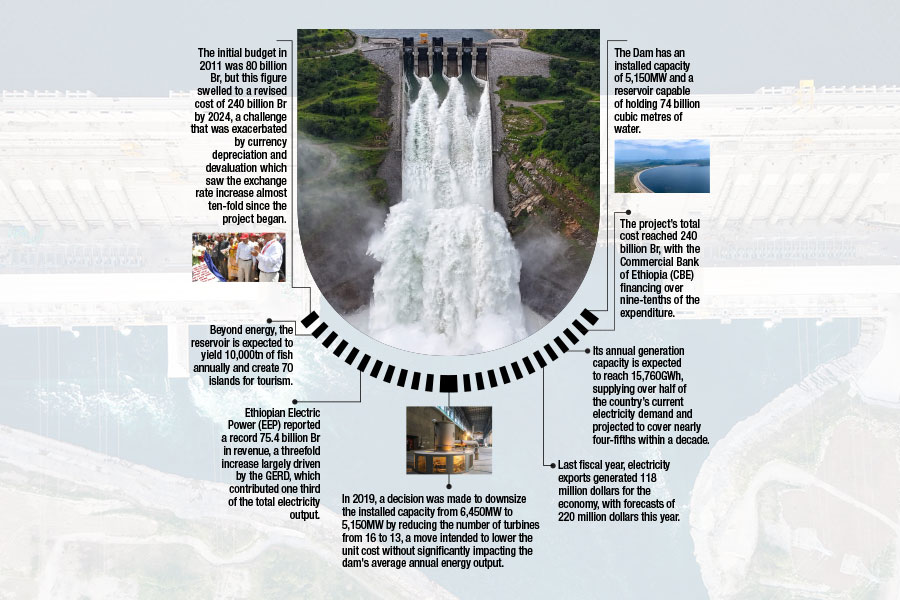

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...