Exclusive Interviews | Jan 05,2020

Mar 14 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

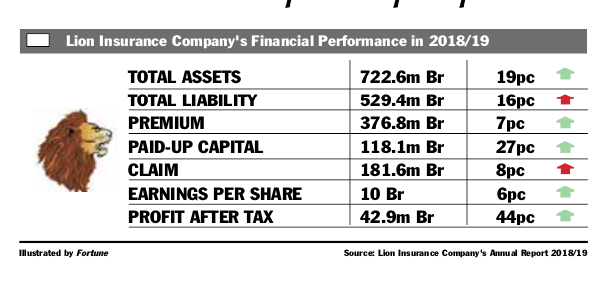

The firm's earnings per share has reached almost 10 Br, up from 9.44 Br. At the same time, Lion’s paid-up capital has risen by 27pc to 118.14 million Br.

The firm's earnings per share has reached almost 10 Br, up from 9.44 Br. At the same time, Lion’s paid-up capital has risen by 27pc to 118.14 million Br. Lion Insurance registered a substantial growth in profit in the last fiscal year, netting 42.9 million Br, a 44pc growth from the preceding year.

The firm's earnings per share has reached almost 10 Br, up from 9.44 Br. At the same time, Lion’s paid-up capital has risen by 27pc to 118.14 million Br.

Despite the challenging and competitive insurance environment, Lion's performance is commendable compared to its planned targets as well as its performance the preceding year, according to Gebru Meshesha, board chairperson of Lion.

"It was the most challenging year ... from the evident slowdown of the economic activity mainly due to the recurrence of instability in some parts of the country," he remarked in his message to the shareholders.

An increased retention rate and massive growth in investment income were the main factors for the growth in profits after tax.

Negassi Yoseph (PhD), CEO of Lion Insurance, also attributes the increase of underwriting results and investment income to the growth in profit that was registered last year.

During the reporting period, the company’s gross written premium has shown an increase of seven percent to 376.8 million Br. Out of the total gross written premium, Lion ceded 20pc to reinsurers. The retention rate at Lion increased by six percentage points to 80pc.

Lion’s income from investment activities increased considerably in the reported year. Interest income went up by 84pc to 25.2 million Br and dividend income grew by 72pc to 7.5 million Br. It also earned a commission of 21.1 million Br from reinsurers, five percent higher than the proceeding year.

Despite the increase in gross written premium and retention rate, the claims of Lion went up by a modest figure of eight percent to 181.6 million Br.

"This indicates that claims were well controlled," said Abdulmenan Mohammed, a financial analyst with close to two decades of experience. "Lion should maintain this practice."

Negassi says that the company used a different mechanism to save costs in relation to leakages by reaching accident sites quickly.

The management closely followed up on claims to control leakage by keeping a close eye on garage activities, survey activities, spare parts utilisation, staff integrity and taking timely measures when it was necessary, according to the CEO.

Parallel to income growth, the company's total expenses increased reasonably. Employees and general administrative expenses went up by 20pc to 99.2 million Br. It paid 22.4 million Br commission to agents, a three percent growth from the previous year.

"We encourage brokers and sales agents to work more with us and earn accordingly," Negasi said.

The total assets held by Lion increased by 19pc to 722.6 million Br due to the increase in cash and bank balances, statutory deposits, investment securities and the purchase of fixed assets and office facilities.

Out of the total assets, 284.2 million Br was invested in time deposits, shares and bonds. These investments represent 38.9pc of the total assets of Lion. The average ratio of private insurers is over 45pc.

The lower ratio of Lion must have been due to the considerable resources that were invested in properties, mainly buildings, and the holding of liquid resources, according to the expert.

Liquidity analysis reveals that the liquidity level of Lion went up in value terms. Its cash and bank balances increased by six percent to 94.8 million Br. Lion’s ratio of cash and bank balances to total assets went down to 13pc from 14.8pc. The liquidity level of Lion was above what was needed for running day-to-day operations.

“Lion should reduce its liquidity level by investing in income-generating assets,” recommended Abdulmenan.

However, the CEO argues that the company has been investing in accordance with the National Bank of Ethiopia’s directive and the liquidity position of the company.

Last year, its ratio of capital and non-distributable reserves to total assets increased by almost one percentage point to 21.4pc.

"This shows that Lion has a strong capital base," comments Abdulmenan.

Woldegabriel Naizghi, a shareholder of Lion for the past nine years and previously a board chairperson, appreciates Lion’s performance, making special mention of its achievements in income-generating investments and control of motor insurance claims despite the increasing number of traffic accidents.

"The firm should continue this profitability in considering new investments including on ICT infrastructure, which has already begun," he recommended.

PUBLISHED ON

Mar 14,2020 [ VOL

20 , NO

1037]

Exclusive Interviews | Jan 05,2020

Fortune News | Dec 26,2020

Fortune News | Oct 30,2021

Radar | Aug 03,2025

Fortune News | Feb 11,2023

Viewpoints | Nov 05,2022

Fortune News | Jun 08,2019

Exclusive Interviews | Jan 05,2020

Fortune News | Dec 25,2021

Commentaries | Aug 21,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...