Feb 1 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Its income from foreign exchange dealings also went up

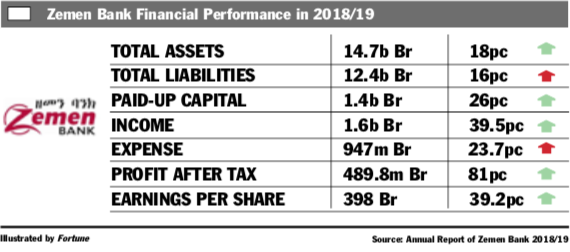

Zemen Bank Financial Performance for the fiscal year 2018/19

Zemen Bank Financial Performance for the fiscal year 2018/19 Zemen Bank got back on track during the last fiscal year, reversing the previous year's disappointing meagre profit growth by registering 81pc growth in net profit .

Last year, the Bank netted 489.8 million Br profit - boosting earnings per share by 112 Br to 398 Br, news that delighted shareholders. Two years ago, Zemen's profit ticked up by only two percent.

Abebe Dinku (Prof.), board chairperson of the Bank, remarked in his statement to shareholders that Zemen achieved the promising performance despite the challenges in the economy.

"Although the country has been experiencing economic growth, the overall macroeconomic imbalances remain challenging," he wrote, "and we've witnessed and [been] confronted by major obstacles during the year."

A surge in external debt, inflation, a widening of the trade deficit mainly due to poor export performance, the government budget deficit and exchange rate instability were the major obstacles mentioned by the board chairperson.

The surge in all income activities helped the Bank to amass the huge profit. Interest on loans, advances and NBE bonds increased by 42pc to one billion Br, while income from fees and commissions swelled by 39pc to 446 million Br. Income from foreign exchange dealings also went up by 14pc to 111.8 million Br.

The management of Zemen should be applauded for such achievements, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

The main focus of Bank officials was credit management and controlling non-performing activities, as well as focusing on international banking services, according to Dereje Zebene, president of Zemen, which commenced operations in October 2008.

The Bank's expenses have also soared, however, at a lower rate than the growth in income. Interest paid on deposits grew by 20pc to 531.2 million Br, while personnel and other operating expenses surged by 28pc to 416.3 million Br.

Abdulmenan cautioned the management to closely follow personnel and other operating expenses.

The new 17 branches opened in the reporting period and recruitment of new employees were the causes for the spike in expenses, according to the president.

"Zemen is also working on purposive human capital development," said Dereje.

In the last financial year, Zemen disbursed loans and advances of 7.6 billion Br, an increase of 52pc. It mobilised deposits of 11.6 billion Br, an increase of 14pc. The loan-to-deposit ratio of Zemen increased to 65pc from 48.8pc.

"The growth in the ratio is remarkable," said Abdulmenan. "The Bank has some room to increase its loan-to-deposit ratio, but it should take extra caution when doing that.”

The management of Zemen has also reversed a provision for the impairment of loans and other assets by 440,000 Br, contributing to improved profit performance of the Bank.

The provision for the impairment of loans and other assets has succeeded due to proper loan follow up, according to Dereje.

The president also explained that Zemen was aggressively working with businesses to avoid loan impairment.

"When businesses of our clients were in a problematic situation," Dereje said, "we 'evergreen' the loan by providing additional loans or rescheduling the payment time to help them from defaulting."

Zemen invested 3.2 billion Br in NBE five-year bonds only last year, an increase of 33pc. This investment accounts for 22pc of total assets and 28pc of the total deposits of the Bank.

The total assets of Zemen expanded by 18pc to 14.7 billion Br.

Liquidity analysis shows that the liquidity level at Zemen dropped in value and relative terms. Cash and cash equivalents went down by 38pc to 2.5 billion Br. The ratio of liquid assets to total assets decreased to 17pc from 32.6pc, and the ratio of liquid assets to total deposits went down to 22pc from 39.6pc.

Zemen managed to significantly reduce liquid resources accumulated in the preceding years by providing more loans and advances.

"It's a good move," commented the expert.

The paid-up capital of Zemen was boosted by 26pc to 1.4 billion Br. Zemen’s capital adequacy ratio fell to 26pc from 30.2pc.

“Zemen is still a well-capitalised bank,” said Abdulmenan.

Sisay Asefa, a shareholder since the establishment of Zemen, says he is satisfied with the Bank's performance.

“It's not only striving to pay dividends," said Sisay. "It's also working at customer handling, which creates clients that have confidence in the Bank."

In the last fiscal year, the Bank was able to register 9,362 internet users and worked with 94 worldwide correspondent banks. It operates 68 Automated Teller Machine (ATM) and 40 Point of Sale (PoS) terminals. Approximately 71.2 million Br is withdrawn from the Bank's ATMs on a monthly basis.

PUBLISHED ON

Feb 01,2020 [ VOL

20 , NO

1031]

Fortune News | Feb 02,2019

Radar | Jan 18,2020

Radar | Jan 16,2021

Viewpoints | May 18,2019

Sponsored Contents | Mar 03,2022

Sunday with Eden | Nov 16,2024

News Analysis | Feb 10,2024

Fortune News | Mar 09,2019

View From Arada | Apr 30,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...