Radar | Jun 25,2022

Feb 20 , 2021

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

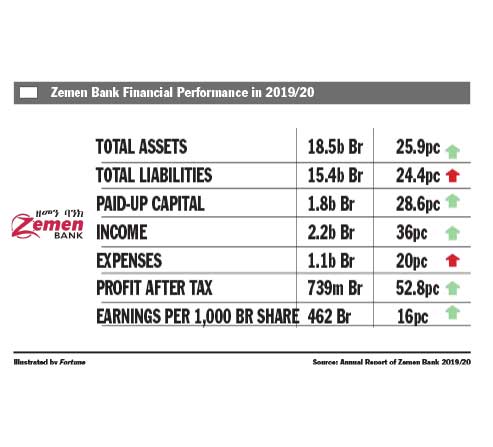

The massive surge in profit after tax helped Zemen’s earnings per share (EPS) to rise by 64 Br to 462 Br.

The massive surge in profit after tax helped Zemen’s earnings per share (EPS) to rise by 64 Br to 462 Br. Zemen Bank achieved remarkable profit growth in the last fiscal year, amassing 739 million Br. The Bank’s profit soared by 52.8pc, one of the strongest growth rates among competitors.

The massive surge in profit after tax helped Zemen’s earnings per share (EPS) to rise by 64 Br to 462 Br. The EPS grew significantly even though the paid-up capital of the Bank expanded considerably to 1.8 billion Br, a 28.6pc jump.

The impressive performance of Zemen must have been good news to its shareholders, according to Abdulmenan Mohammed, a financial statement analyst based in London, the United Kingdom.

Daniel Abebe, a founding shareholder at Zemen, is already excited by the performance of the Bank. At the beginning of the year, Daniel had a fear that the Bank would not register satisfactory growth, mentioning his reservations about one of the directors he believed should not have been included on the board.

"But it didn't happen," he said. "The board directors and the management did well in dragging the Bank away from slower growth."

Daniel adds that even though Zemen started making a profit in its first year of operations, its decent performance did not last for more than three years, and it has been struggling over the past couple of years.

One of the things that helped Zemen to recover, according to him, was resolving the issue related to the bankrupted Holland Cars, a local car assembly company. Zemen, the major lender for Holland, has been in a court battle to recover loans it gave to the company.

The main reason for the impressive profit performance of Zemen is the massive growth of income from financial intermediation and non-financial intermediation activities. Zemen's profit accounts for 5.3pc of the total profit recorded by the 16 private banks, which amassed 13.9 billion Br in net profit over the last fiscal year.

The massive growth of revenues, which is not matched by the growth in expenses, led to a remarkable increase in profit after tax, according to Abdulmenan.

Interest on loans, advances and National Bank of Ethiopia (NBE) bonds increased by 44.6pc to 1.5 billion Br, while income from fees and commissions swelled by 21pc to 539.5 million Br. Income from foreign exchange dealings also went up by 12.9pc to 126.2 million Br, making Zemen one of the few banks that had positive results in forex dealings. Most banks reported a loss from this line of business over the reporting period.

The Bank's expenses on interest for deposits grew by 11.7pc to 593.4 million Br, personnel and other operating expenses surged by 37.3pc to 298.3 million Br and 27.3pc to 200 million Br, respectively.

At the end of the last fiscal year, Zemen’s workforce grew to a total of 998 employees, who work at 52 branches across the country. Last year, the private banking industry underwent a considerable branch network expansion, increasing the total number by 714 to 4,593.

Even though Zemen started with a single branch concept, it currently operates with multiple branches, according to Daniel, who doubled his shares over the past 12 years.

“As long as it’s profitable, it doesn't matter,” he said.

Zemen’s outstanding loans and advances stood at 9.7 billion Br in the last fiscal year, increasing by 27.6pc. Its total deposits reached 14.4 billion Br, a 24pc rise. The loan-to-deposit ratio of Zemen increased to 67.4pc from 65pc.

"Despite this increase, the loan-to-deposit ratio of Zemen is lower than that of many banks," said Abdulmenan. "It seems that Zemen has some room to increase the ratio."

The provision for the impairment of loans and other assets rose by 1,177pc to 5.6 million Br.

The management should be appreciated for keeping this provision at such a low level, according to Abdulmenan.

The total assets of Zemen expanded by 25.9pc to 18.5 billion Br. Its investments in NBE five-year bonds dropped by 12.5pc to 2.8 billion Br. These investments account for 15.1pc of the total assets and 19.5pc of the total deposits of the Bank.

Liquidity analysis indicates that the liquidity level of Zemen increased in value and relative terms. Its cash and bank balances increased by 72.7pc to 4.4 billion Br. Zemen's ratio of liquid assets to total assets increased to 23.6pc from 17.2pc. The Bank's ratio of liquid assets to total liabilities increased to 28.4pc from 20.5pc.

The liquidity level of Zemen is higher than many of the banks, according to the expert.

"Zemen needs to utilise its higher level of liquidity for profit-generating activities such as extending more loans," recommended Abdulmenan.

Zemen has capital and non-distributable reserves of 2.6 billion Br and a capital adequacy ratio (CAR) of 26.5pc.

This shows that Zemen had a solid capital base, which should be used efficiently, according to Abdulmenan.

Zemen achieved a remarkable performance last year despite all the challenges it faced, according to Abebe Dinku (Prof.), the board chairperson of Zemen.

Abebe stated that Zemen had started the year with a positive global and domestic economic outlook until the outbreak of the Novel Coronavirus (COVID-19) pandemic at the end of the second quarter of the last fiscal year.

"The pandemic has had a more severe impact on the performance of the banking industry,’’ he said. "It's resulted in slowing economic activities, rising costs, increasing non-performing loans and health and safety concerns among customers and employees.’’

PUBLISHED ON

Feb 20,2021 [ VOL

21 , NO

1086]

Fortune News | Mar 16,2019

Fortune News | Feb 04,2023

Radar | Nov 27,2018

Viewpoints | Sep 02,2023

Radar | Jun 14,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...