Fortune News | Feb 27,2021

Federal agencies will soon use the state-owned Commercial Bank of Ethiopia (CBE) as their facilitator for electronic payments, paving the way for close to 198 federal government entities to settle payments using electronic platforms, including POS.

It is part of the government's push to digitise the economy – the Ministry of Trade & Industry is launching a digital platform to enable online business license registration and the Ministry of Revenues working with the CBE to allow online tax payments.

A directive drafted by the Ministry of Finance sets out to designate the CBE as an electronic payment facilitator for recurrent payments such as salaries, procurements, and administrative expenditures like daily allowances and fuel expenses. The decision has left private bank leaders furious.

"This isn't fair," said Hailemelekot Teklegiorgis, former board chairperson of Addis International Bank. "It would legitimise the unfair competition prevalent in the industry."

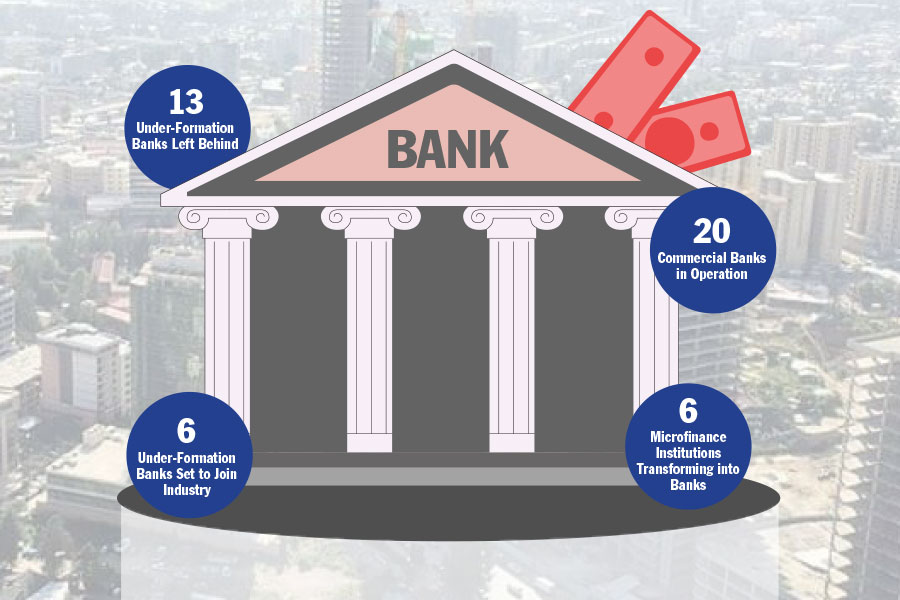

It is not unusual for federal agencies to prefer the CBE over private banks, a source of apprehension for leaders of the 19 private banks, which command less than 50pc of market share. Industry observers see the latest move by the Ministry as another policy instrument that will help the CBE consolidate its position in the increasingly competitive industry.

Abdulmenan Mohammed, a long-time observer of the financial sector, amplified this sense of misgiving over the CBE's preferential treatment from the state.

"Almost all state-owned enterprises and budgetary organs use the CBE by default," he told Fortune. "But, including a provision in a directive that excludes the private banks is very unjust."

The latest directive aims to replace cash-based transactions in federal offices and universities with an electronic payment system. Signed by Ahmed Shide, minister of Finance, it has become effective beginning July 2, 2021.

The directive, officials at the Ministry hope, will introduce modern transactions, reduce the use of checks or cash, and curb corruption and misuse of public funds.

“The need for cash and checks will be insignificant and stopped completely in due time,’’ said Habtamu Mengesha, head of the Ministry's Legal Directorate. Traditional payment requests, such as petty cash holding, will become digitised, curtailing the possibility of abuse of public funds.

Federal offices and institutions use traditional payment methods for procurement and administrative expenses, although many have been paying salaries electronically for the past few years.

The directive dictates that purchase payments should be made available electronically once an office receives a payment request form filled out by the seller and within five days of the provision of attachments. Pro forma based and small purchases are to be made electronically through a point of sales (POS) terminal with a debit card to be issued by the CBE. Once an institution's sales officials approve the purchase, the purchase amount gets transferred to the debit card.

More than 10,000 POS machines are available in the country, recording 4.85 billion Br in transactions last year.

One of the institutions set to benefit from the directive is St. Paul’s Hospital Millennium Medical College. Its senior specialist for procurement and contract management, Abayneh Muluy, sees expenses for office supplies and medicines in cases of emergency are made through a drawn-out process, including five procurement letters. They are also limited to no more than 200,000 Br for a single transaction.

"Electronic payment would enable us to address all these," said Abayneh.

Nonetheless, the unreliable provision of internet service remains a concern for procurement people like Abayneh.

"Network fluctuations and lack of coverage would affect the efficiency of the e-payment system," Abayneh told Fortune.

Officials at the Ethiopian Coffee & Tea Authority, another federal institution using digital payment cards to pay for fuel for two years in partnership with Total Ethiopia and the National Oil Ethiopia (NOC), have faced problems with e-payment. Recently, the Authority went digital to cover allowances for employees in fieldwork.

"We're forced to carry lots of cash on field trips, which is risky," said Mohammed Shemsu, manager at the Authority. "Electronic payment faces so many challenges, from individuals not having bank account books for payment to bank transfer systems completely losing network connection."

He stressed that banks need to be more flexible until e-payment systems reach a better standard.

Mohammed, however, believes electronic payment is the future.

The Ministry and the CBE are planning to provide training on online banking, preparation of user accounts, and purchase cards.

PUBLISHED ON

Jul 11,2021 [ VOL

22 , NO

1106]

Fortune News | Feb 27,2021

Radar | May 20,2023

Radar | Oct 07,2023

Sponsored Contents | May 03,2022

Fortune News | Sep 30,2021

Radar | Nov 28,2021

Agenda | Jan 01,2022

Fortune News | Oct 16,2021

Fortune News | Jul 02,2022

Radar | Apr 30,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...