Exclusive Interviews | May 17,2025

In an unprecedented move, the central bank has published its inaugural stress test report, uncovering potential fault lines within the financial sector that could pose systemic risks to the country's financial health. The "Financial Stability Report", a deep dive into the economic and financial ecosystem, coincides with a period marked by global economic uncertainty and domestic upheavals, including persistent droughts and regional conflicts.

The report discovered that the banking industry, which holds an overwhelming 96.1pc of the country’s total financial assets as of June 2023, generally maintains robust health if traditional metrics like capital adequacy and liquidity ratios are deployed. However, the stress tests reveal vulnerabilities that could jeopardise stability. While overall profitability stays stable, a high concentration of credit among a select few borrowers in the manufacturing and trade sectors — a factor that poses a considerable risk — remains a worrying trend.

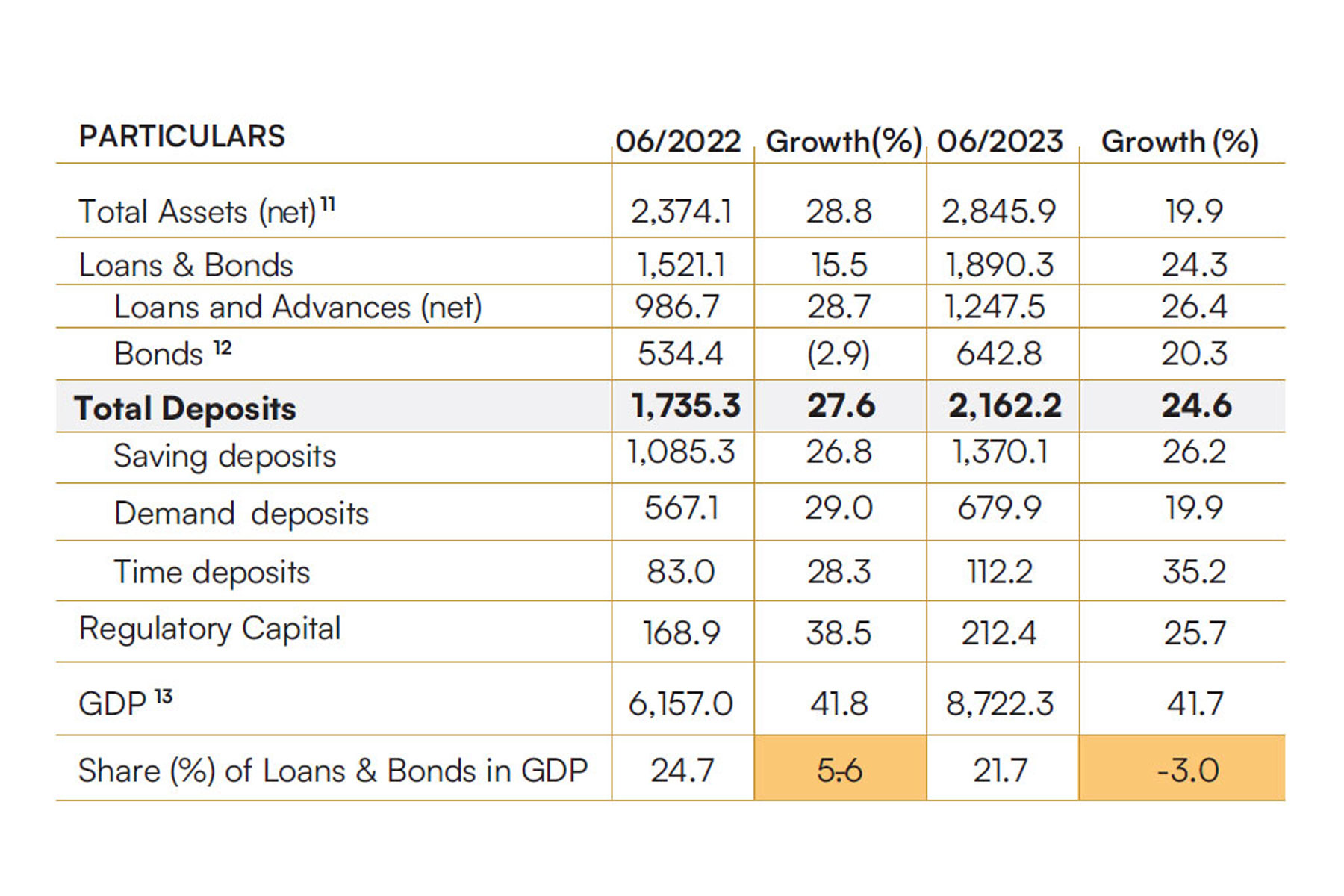

The financial stability report disclosed a high degree of credit concentration, with the top 10 borrowers in the banking industry holding nearly 23.5pc of the total 1.9 trillion Br in loans and advances. This translates to 21.7pc of GDP. Another startling revelation was that a mere 0.5pc of borrowers with a credit exposure of above 10 million Br held nearly three-quarters of the banking sector's loans. Total deposits reached a healthy 2.2 trillion Br, with a high loan-to-deposit ratio. The ratio of loans and bonds to deposits has dipped slightly to 90.3pc, but it remains significantly high, suggesting a major portion of depositors' money is tied up in loans.

With some banks' sensitivity to a sudden shift in depositor behaviour, the repercussions of one or more borrowers failing could ripple across the financial sector, warns the report.

However, experts said the concentration of credit is not a new phenomenon, but its potential to inflict systemic damage has become increasingly apparent, prompting calls for tighter regulatory oversight.

The liquidity of banks, another critical aspect of the report, uncovered a precarious situation wherein if the 10 largest depositors of each bank were to withdraw all their funds simultaneously, 18 out of the 29 commercial banks would fall below the minimum regulatory liquidity requirements. The hypothetical yet plausible scenario casts light on the delicate balance banks maintain between accessible liquid assets and the demands of deposit withdrawals.

Several banks struggled to meet weekly liquidity requirements and real-time gross settlement system (RTGS) payments and exhibited mismatches in their liabilities and assets. The report found a decline in the ratio of liquid assets to deposits, uncovering banks may struggle to meet short-term obligations if faced with a surge in withdrawals. The overall ratio decreased by three percentage points to 24.2pc, while the ratio of loans to deposits rose by almost a single percentage point to 60.6pc.

Adding to these concerns, operational risks have escalated. The cost of fraud and forgeries in the banking sector has nearly doubled in the past year, reaching one billion Birr across 20 banks. These frauds involve fake financial instruments, embezzlement, ATM card thefts, and social engineering scams like phishing calls and texts as well as unauthorised bank guarantees. Recent unauthorised withdrawals at the state-owned Commercial Bank of Ethiopia (CBE) and robberies at three private commercial banks have further exposed the vulnerabilities in the financial sector.

Abdulmenan observed the banking industry's exposure to systematic risk due to CBE's dominant place although it meets the liquidity ratio of 15pc and the eight percent capital adequacy ratio under the central bank's stress scenarios.

"CBE overwhelms the industry," he said.

The total assets of the financial sector had grown to around 3.1 trillion Br, more than a third of the country's GDP. The 31 banks account for around 96pc of the asset base, and the CBE contributes almost half. Microfinance institutions had a two percent share, while insurance companies accounted for a mere 1.6pc.

Abdulmenan concurred with the report's finding that CBE's high exposure was due to the large loan transfer to the Liability & Asset Management Corporation (LANC), which soaked up nearly half a billion Birr of loans during its formation three years ago. CBE was also the only bank to enter the 'large' category according to the central bank's classification, with 27.5pc of the banking sector's total capital despite most of its paid-up capital being government-issued promissory bonds, which have yet to be paid.

According to the report, CBE’s capital position requires targeted policy and regulatory attention in the event of unfavourable circumstances. Abdulmenan also pointed out that the lack of disaggregated data on credit concentration between CBE and private banks is inconvenient to interpret due to the different credit exposures between the two.

Awash, Abyssinia, Dashen, Hibret banks and the Cooperative Bank of Oromia have entered the medium-size category, with combined capital amounting to 28pc of the sector's three trillion Birr assets.

Beyond domestic issues, Ethiopia faces external economic pressures, considerably from the geopolitical tensions fueled by the Russian-Ukrainian war and developed economies' tightening of monetary policies. These conditions have repercussions for Ethiopia, particularly affecting its agricultural exports, which are vulnerable to foreign exchange rate fluctuations.

Despite the pressures, the domestic economy displays resilience, says the report. The International Monetary Fund (IMF) forecasts a GDP growth of 6.1pc in 2023, increasing slightly to 6.2pc in 2024. A rebound in tourism and liberalisation efforts supports this growth, while inflation is expected to drop to 20.7pc, and the budget deficit to narrow to 2.5pc of GDP by 2024, reflecting improvements in domestic revenue collection and fiscal consolidation.

The stress report the National Bank of Ethiopia (NBE) released stated the need for regulatory improvements to safeguard against potential financial instabilities, including improving governance standards, enhancing credit risk management, and developing financial infrastructure to keep pace with rapid changes in digital financial services. Digital transformations in financial services can enhance financial inclusion but also require robust cybersecurity measures and regulatory frameworks to manage risks associated with digital transactions and services.

The report also highlights the importance of sector-specific support, particularly for agriculture and export-oriented industries. Tailored financial products and risk management strategies could help address risks associated with these sectors and promote sustainable growth, said Abdulmenan Mohammed (PhD), a London-based financial analyst. He commended the central bank for publishing the report.

He told Fortune that publishing a financial stability report fulfils one of the primary responsibilities of a central bank.

"It's a laudable step," he said.

However, he wished to see details on the assumptions used in the risk stress tests. He said the elevated attention to the banking industry is "reasonable."

"In general, the industry is safe and sound," Abdlumenan told Fortune.

According to Abdulmenan, the risk stress tests should have been conducted on the policy changes that could occur if Ethiopia reached an agreement with the International Monetary Fund (IMF).

Another financial expert and banking veteran with a high reputation in the industry, Eshetu Fanataye, praised the report's transparency and said it set the stage for policy reform.

However, he viewed the report as ultimately serving as a reassurance of the status quo rather than a trigger for rigorous economic scrutiny.

"For the report to be genuinely impactful, it must address the critical issues more directly, ensuring that the financial sector not only appears stable but is genuinely robust," he told Fortune.

Eshetu disected the report, particularly in its methods of evaluating bank capital and liquidity. He argued that the evaluation of bank capital remains outdated, still based on standards set 25 years ago, lagging behind the current Basle III framework, which stated a minimum of 10.5pc of risk-weighted assets, potentially rising to 25pc depending on the bank’s leverage ratio. He also saw the liquidity assessment used as archaic.

According to Eshetu, modern standards prefer the Liquidity Coverage Ratio (LCR) and High-Quality Liquid Assets (HQLA) parameters, which are more stringent than the 15pc liquidity ratio banks currently use, which includes "assets of dubious quality."

"Banks are overextended is a claim contradicted by actual liquidity shortages noted in local and foreign currency transactions," said Eshetu, "indicating a disconnect between reported figures and ground realities."

He also questioned the report's accuracy, noting discrepancies between reported data and practical observations. He suspected the handling of NPLs, with banks reportedly ever-greening loans and restructuring debt to obscure the true health of their portfolios.

"External reviews of banks’ credit risks are essential to avoid such misrepresentations," he said.

According to Eshetu, the report also understated the credit risk within the banking industry, a critical oversight given the looming threats from regulatory policies such as mandatory bond purchases and caps on lending. These policies, intended to stabilise the financial system, may instead constrain banks’ ability to support their primary customers. While the report acknowledges external risks to financial stability, Eshetu believes it overlooked the internal risks stemming from aggressive lending practices, particularly in real estate and commercial mortgages.

Says Eshetu: "As the market for these assets contracts, banks face escalating credit risks that could destabilise the industry."

Liquidity risk, although classified as moderate in the report, appears more severe in practice. Central bank policies, coupled with banks' tendencies to chase higher returns, have strained liquidity to the point of affecting customer transactions, from real-time gross settlement systems to direct withdrawals. Fluctuating prices in foreign exchange and local currency markets pose yet another considerable risk, threatening the stability of small and large banking institutions.

"The volatility shows the need for a more robust regulatory framework to adapt to changing economic conditions and ensure long-term stability," said Eshetu.

The report reveals credit and liquidity risk stress under baseline (economy grows at 6.2pc): moderate non-performing loans (NPL) increase to 10pc due to drought, heightened conflict, or an increased forex crunch. The stress tests in the report simulate various scenarios, including severe conditions where NPLs could rise to 30pc. It warns that close to 12 banks could fall below the statutory minimum capital adequacy ratio of eight percent.

As of June 2023, the ratio of NPLs to gross loans in the commercial banking industry was 3.6pc, well below the maximum of five percent set by the central bank.

However, the report revealed that the state-owned CBE and most microfinance institutions transformed into commercial banks would not need additional capital even under these severe conditions.

According to the report, not all banks have the same requirement for capital injection.

Melkamu Solomon, acting president of Nib Bank, believes robust credit risk management systems are essential to prevent credit overconcentration.

"Specific risk appetite fuels credit risk," Melkamu told Fortune.

He also noted the importance of operational efficiency as digitisation advances, pointing out that some banks face significant liquidity risks, with a few depositors accounting for a large portion of their liquid reserves.

Total net income in the banking industry remained steady at around 62 billion Br year-on-year. Return on equity and return on assets reflected "sufficient" profitability at 25.7pc and two percent, respectively. However, a slight decrease in profits was observed due to increased provisioning for potential loan defaults and rising expenses associated with the sector's growing workforce of 187,450 employees.

PUBLISHED ON

Apr 13,2024 [ VOL

25 , NO

1250]

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...