Editorial | Feb 27,2021

Apr 22 , 2022.

Most African countries top the list when ranked on the prevalence of conflict, food insecurity, poverty or lack of essential services. Ethiopia is no exception to this. On the contrary, those same countries are at the bottom on lists that rank investments, ease of doing business, trade, industry, or even "happiness." A rare outlier is a mobile money. Kenya shines as a role model even for societies in advanced economies.

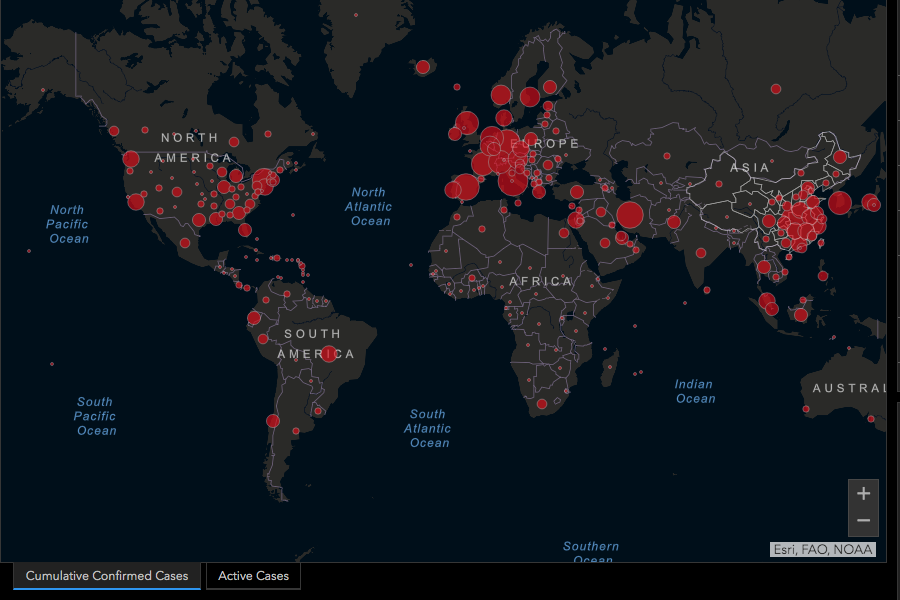

It is astounding how far ahead of the rest of the world sub-Saharan Africa is adopting mobile money and the digital platforms stimulating what is now known as the "sharing economy". GSM Association, an industry organisation representing mobile network operators, records over 600 million registered accounts in the continent, with the second-highest, East Asia and Pacific, standing at only 328 million. Sub-Saharan Africa accounts for over two-thirds of the world’s mobile transactions volume and makes up for 63 billion dollars of the 95 billion dollars in total value. It is an atypical lead in a technology front from a part of the world that attracts attention for the wrong reasons.

There are few rays of hope when it comes to Ethiopia’s economy. The construction industry is coming to its knees; manufacturing never took off; the mining sector has been quelled mainly due to conflicts; and the agriculture sector, where two-thirds of the labour force is tied up, is a generational source of disappointment, if not an embarrassment to successive leadership.

The information and communications technology (ICT) sector may have remained far less developed than regional peers such as Kenya. But it is having its day, with a glimmer of dynamism when it is direly needed. It is doing this while it continues to be hammered by the old habits of policing and protectionism thrown at it by the government. The shackles of regulations have put all their weight, holding its players back from unlocking their potential.

At the forefront of what, if done right, could be economically transformative is the telecom sector. There currently is only one player, Ethio telecom. But it is a testament to the power of competition that, even before Safaricom Ethiopia Plc began operations, the state-owned enterprise moved in ways it never did before. Its executives tried to charm subscribers with fees slashed, airtime credit introduced, a mobile payment platform launched, and was almost partially privatised. Perhaps for the first time in Ethio telecom’s existence for over a century, it acts as a business entity.

What competition - or the fear of it at the moment - induced in Ethio telecom could be a subject of academic literature to establish the thesis that "competition is consumer sovereignty."

No less promising is the increasing availability of electronic payment platforms, from Ethio telecom's Telebirr to Arifpay; and, efforts in expanding public services to the internet.

The impacts are perceptible.

It is no longer necessary to visit a ticket office to book a flight or conduct bank transactions at a branch (with limits). Ride-hailing companies have made transport services a great deal safer and more convenient, all the while bringing down costs. The most vital impact of the information technology sector, more than enhancing convenience, is its impact on financial inclusion and intermediation, primarily through mobile banking. Sub-Saharan Africa’s leadership in the mobile money scene is not because the region has better digital or financial infrastructure. It is because it does not.

The rest of the world, especially the advanced economies, have such well-developed payment systems such as internet banking and credit card systems that the pull factor of mobile payment options (which only matured over the past decade) is low. In sub-Saharan Africa, where there is virtually no alternative to cash payments, mobile money provides the most affordable alternative for leapfrogging. Unlike most other non-cash banking alternatives, mobile money can be used with feature phones, the predecessor to smartphones, and SMS messages when users are offline to facilitate transfers. For populations in rural areas, it can be transformative.

Facilitating transactions is only a piece of the puzzle on the value of mobile banking in revolutionising finance. The more transactions there are, the more data can be gathered on households and businesses. This allows for a credit-risk profile to be developed, which is critical for expanding access to credit – the driving force of modern economies.

Kenya and its journey with M-Pesa, a mobile payment system operated by Safaricom, is a testament to the power of digital. Research published in the academic journal Sciencediscovered access to M-Pesa has lifted two percent of Kenyan households out of poverty within seven years of its inception in the late 2000s. Women-headed homes were twice as likely to benefit. By the early 2010s, the impact of mobile banking had been evident.

Regrettably, Ethiopia is just beginning to pay attention.

Efforts over the past few years to bring it up to speed are encouraging, though, especially in building infrastructure and pushing for reforms, such as the liberalisation of the telecom sector. Unfortunately, the regulatory practice leaves a lot to be desired.

The information, communications and technology sector keeps facing obstacles that are entirely the making of policymakers' regulatory indecisiveness and knee-jerk reactions. The dragging of feet to protect domestic players and disadvantage foreign investors is on one side. It has contributed to lower than expected bids for telecom licenses and might even have cost the sector a third player with the potential to enter Ethiopia’s market. M-Pesa will likely get to operate, but the protectionism on open display during the bid likely cost the country half a billion dollars, according to the Prime Minister.

It is better late than never to make the playing field for the mobile banking fair.

The other problem is the ad-hoc moves that create uncertainty and an opportunity cost. This was no less evident during the suspension of digital remittance platforms such as CashGo and MamaPays last month or the long controversy Ride, a taxi-hailing company, has had with transport authorities over designations. Obviously, vested interests are trying to shield their legacy privileges behind policymakers' erratic and unhelpful behaviour.

Partly, these are regulatory gaps that need addressing, which can be forgiven, given that the technologies and the sector are on the new policy and legal frontiers. Policymakers' apparent reluctance to move forward in the absence of insight on how they function should be understandable. But the authorities' use of sticks and knee-jerk reactions threaten to smother a sector in its infancy that should otherwise be in a hurry to catch up with the rest of the world. The administration of Prime Minister Abiy Ahmed (PhD) should learn to police less, support more and open up the economy further as technology-driven sectors rarely progress in rigidity and closed ecosystem.

PUBLISHED ON

Apr 22,2022 [ VOL

23 , NO

1147]

Editorial | Feb 27,2021

Commentaries | May 11,2024

View From Arada | Jun 19,2021

Viewpoints | Jul 13,2025

Radar | Apr 19,2025

Editorial | Feb 16,2019

Commentaries | Feb 03,2024

Editorial | Apr 16,2022

Agenda | Sep 24,2022

Digital First | Mar 13,2020

Photo Gallery | 177254 Views | May 06,2019

Photo Gallery | 167460 Views | Apr 26,2019

Photo Gallery | 158099 Views | Oct 06,2021

My Opinion | 136976 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...