Frustration simmered among business owners who gathered at the Inter-Luxury Hotel, on Guinea Conakry Tito St. to discuss the impact of tax policy on the private sector last week. The Addis Abeba Chamber of Commerce & Sectorial Associations (AACCSA) hosted the event, which exposed deep concerns about unclear regulations, bureaucratic hurdles, and alleged corruption.

Attendees lamented a complex tax code that left businesses confused and vulnerable. The National Tobacco Enterprise (NTE) urged authorities to investigate the impact of tax claims on business closures and unemployment. Yayehyirad Abate, director of corporate affairs & communications, expressed concern over 'unfounded' tax claims that have potentially forced companies to shut down.

"We need research to understand how many businesses have closed due to these claims," he said.

He criticised the misinterpretation of tax codes by officials, recalling a recent instance where authorities demanded that bank transactions could be considered taxable income, a requirement lacking legal basis according to Yayehyirad.

"Businesses need to first exist," he said.

The lack of coordination between the Ministry of Finance and tax authorities was also pinpointed as a source of confusion for taxpayers. This disconnect, Yayehyirad argued, creates confusion for taxpayers who struggle to understand their obligations. He said that better communication between government departments is crucial to ensure predictable tax regulations.

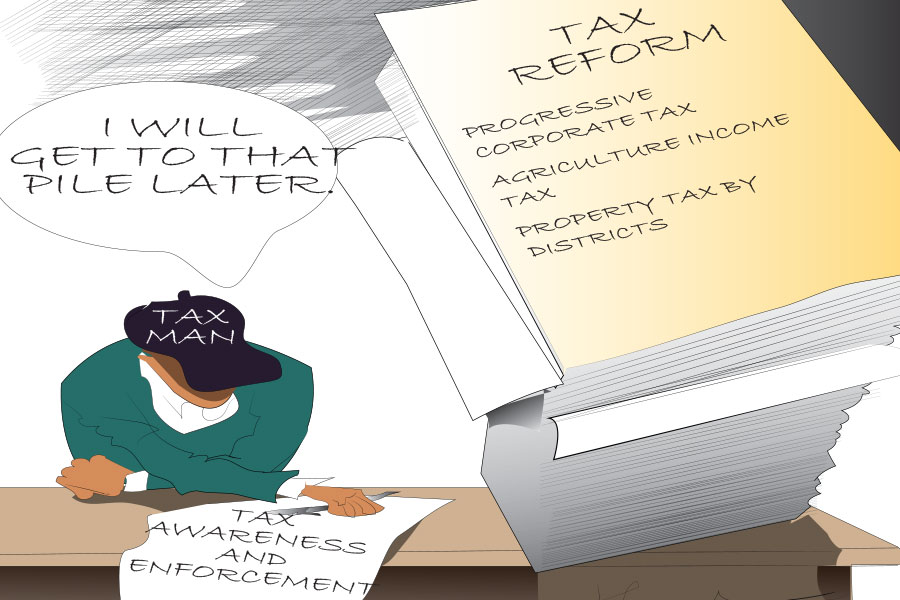

Ethiopia's tax system involves shared collection responsibilities between federal and regional authorities. A combination of 10 duties and levies currently contributes to the national tax revenues, which amounted to 612 billion Br last year. The government has plans to broaden the tax base in the coming year through new levies on property, the introduction of excise tax stamps, and the expansion of the Value Added Tax (VAT) category.

However, difficulties persist in efficiently collecting tax with business leaders questioning the government's approach to property tax. Arega Yirdaw (PhD), president of Unity University and former CEO of MIDROC, questioned the paradox of a growing government relying heavily on an already strained tax base. He argued that tax collection is increasing without a corresponding rise in citizen income, making it difficult to broaden the tax base.

A recent amendment to Addis Abeba's wall and roof tax through a letter from the Tax Bureau while the official property tax proclamation remains under review, was called by Arega. This lack of clarity creates confusion and burdens citizens, particularly pensioners facing new levies on their property.

Arega recommends tax incentives, such as small write-offs for married couples or homebuyers, as a more sustainable way to broaden the tax base. This approach, common elsewhere, could encourage wider participation in the tax system.

A sarcastic remark was made by local businessman Yihunlign Tigabu, who expressed widespread corruption issues as a fundamental impediment to the tax administration's efficiency.

"Tragically, the only incentives are bribes," he said.

According to Yihunlign, a trend where tax collectors ask for bribes or threaten customers with hefty obligations has become alarming. A host of other participants echoed similar statements of an industry-wide practice where the failure to bribe results in business being caught up in a convoluted legal wrangle.

The Addis Abeba City Administration Revenues Bureau, despite collecting 103 billion Br this year, was on the receiving end of a large portion of the allegations. Ahmed Mohammed, deputy head of the Tax Law Enforcement Bureau, said an active campaign to lower the human contact involved in the process is underway, with nearly 62pc of tax collection now digital.

"Corruption is a major problem," he told Fortune. "We're doing a lot to address it."

According to Tesfaye Mergiya, head of the tax and customs training centre at the Ministry of Revenues, the federal tax institution is one of the eight selected sectors included in the Civil Service reform. He believes a depoliticisation campaign plans to professionalise service delivery.

"Tax reform requires political will," Tesfaye said.

The tax dispute resolution process itself presents a hurdle for businesses. Bekele Tsegaye, general manager of Bekas Chemicals Plc, expressed fear that disputes with tax authorities could lead to the closure of one of his factories. Tsegaye's factory, employing around 650 people, faces a potential shutdown due to a disagreement with the tax bureau over how much cash they should hold in their bank accounts.

He said the requirement to pay a large portion (half for the first appeal and 75pc for the second) of the disputed tax amount upfront before the case can proceed is discouraging most from appealing.

"Every time we move higher up the appeal process, we pay large sums," he said.

Experts like Ashcalew Ashagre (PhD), lecturer and consultant, point to a lack of professionalism and transparency within the tax system itself. According to Ashagre, the limited focus on taxation in the education system is spread across various legal documents, which makes it difficult for both taxpayers and officials to navigate the system effectively.

"Anyone who can add and subtract is not a tax professional," Aschalew said.

He proposes a two-pronged approach to address these issues: the creation of a taxpayers' union to empower citizens to advocate for reform and major government investment to improve the professionals.

PUBLISHED ON

[ VOL

, NO

]

Radar | Jun 04,2022

Agenda | Nov 20,2021

Editorial | Feb 23,2019

Fortune News | Jan 05,2019

Fortune News | Jul 17,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...