Editorial | Apr 04,2020

Safaricom Ethiopia readies to launch its M-Pesa mobile money service before the end of September as one of its parent companies Vodacom Group Ltd indicated through a trading update released last week.

Although an official date for the launch has not yet been disclosed, Tewedaj Eshetu, public relations & communications manager at Safaricom Ethiopia told Fortune that they are actively working on it.

"It's clear that we have been preparing for some time now," she said.

Shops and supermarkets across the country have been draped by promotional logos of the service over the past few weeks while the company integrates its mobile money services with commercial banks; the latest being Hibret Bank set to be announced this week.

Safaricom is the first private telecom operator in Ethiopia challenging the 128-year monopoly of state-owned telecom service after getting the first international telecom license with 850 million dollars.

It has garnered over three million subscribers in its first year. Despite having launched its telecom services in October 2022, the Company received its Payment Instrument Issuer License from the central bank two months ago through its subsidiary Safaricom M-Pesa Mobile Financial Services Plc.

"Pesa" meaning money in Swahili; M-pesa is lauded as the most successful mobile money service in Africa with over 50 million customers across seven countries while recording over 314 billion dollars worth of transactions a year.

The International Finance Corporation announced a 257 million dollar debt and equity injection in Safaricom Ethiopia last month for the expansion of its communications network.

As Ethiopia takes multiple efforts towards digitisation, a stint of public services have made digital payment method compulsatory for users.

Following the mandatory cashless transaction for fuel payments, the state-owned Ethio telecom, which provides mobile money services through the Telebirr App has seen its users grow by over eight million since January.

Izedin Ahmed who runs a small kiosk around the Jemo area in the capital is eagerly awaiting the impending launch of M-Pesa. He sees himself becoming an agent if all the services provided in neighbouring Kenya are made available.

"Everything is going digital so it's good to have options," he told Fortune.

In Kenya, M-Pesa quickly caught on after its launch in 2007 primarily through text message modalities. It was preferred for its ease and simultaneous accommodation of a largely unbanked segment of the population into the financial fold, with 96pc of households having a mobile money account now.

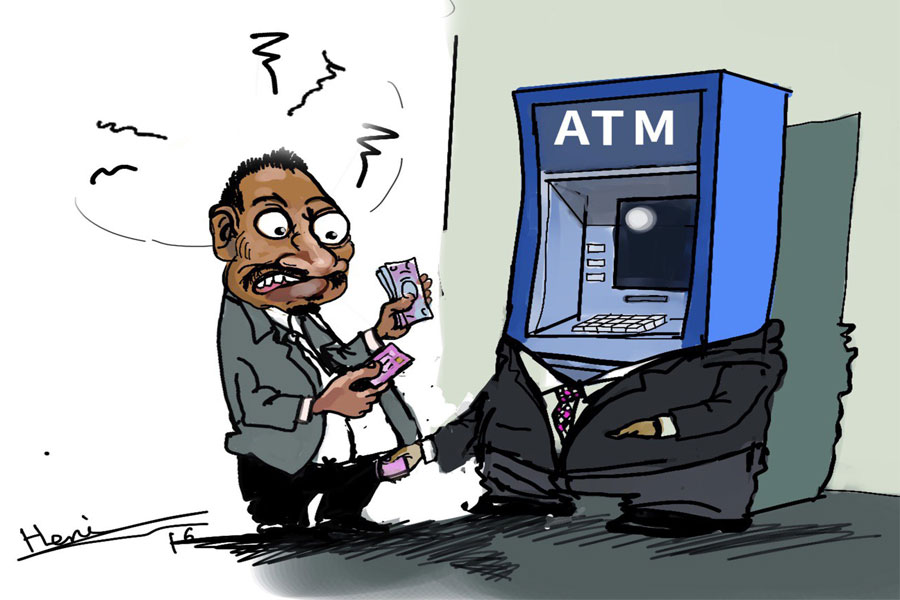

The creative use of agents that function like ATMs for receiving and depositing cash into electronic wallets has seen the service disrupt typical banking modalities and penetrate the financial sector.

However, mobile money adoption does not always have rapid absorption. Nigeria has only about half of the adult population with classical bank accounts with a mere 17pc of adults between 16-64 having mobile money accounts.

Aside from factors depending on mobile phone adoption, education and internet coverage, scepticism of technology, fraud, the tendency to spend more due to ease of access, and the temptation to be indebted were cited for shying away from the service, according to a study conducted by Emmanuel Mogaji last year.

The rapid acceleration towards digitisation has experts at crossroads.

While the majority welcome the unfolding digitisation which is occasionally compulsory, as holding great promise for the country, the absence of sufficient technical experts to regulate the digitisation of finance has raised concerns.

Nurhassen Mensur, a digital consultant active in several startups in the country over the past decade, contends that the launch of an alternative mobile money operator as holding the potential to significantly augment both the diversity and quality of financial products.

"Competition is always a win for customers," he said.

Nurhassen sees the promise of increased national total deposits with the addition of a new operator in the country but equally recommends enhanced regulatory oversight. He emphasised the importance of enhancing the technical capacities of both the central bank and the Financial Intelligence Services (FIS) with greater financial digitisation.

"There is a proliferation of high-end financial fraud," he told Fortune, underscoring its potential to undermine customer satisfaction.

The digital consultant surmised that the creation of a collaborative association between Ethio telecom and Safaricom Ethiopia as presenting the significant potential to exchange experiences on agent, customer and technology risks.

PUBLISHED ON

Jul 29,2023 [ VOL

24 , NO

1213]

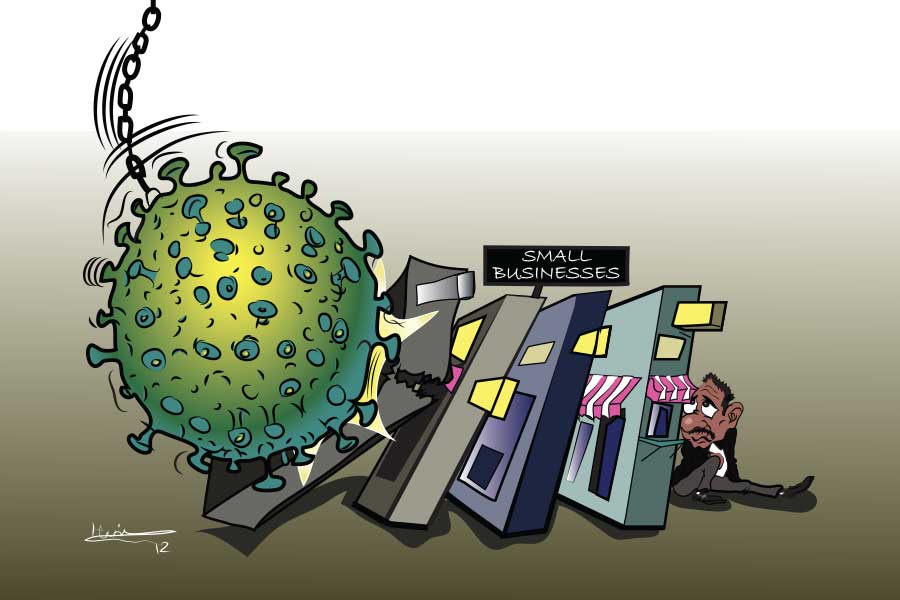

Editorial | Apr 04,2020

Fortune News | Aug 03,2019

Fortune News | Jan 29,2022

Editorial | Oct 28,2023

Radar | Dec 10,2022

Editorial | Aug 26,2023

Covid-19 | May 01,2021

Radar | Aug 01,2020

Radar | Aug 21,2023

Commentaries | Feb 13,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...