Commentaries | Oct 22,2022

Mar 26 , 2022.

There has rarely been a time when the National Bank of Ethiopia (NBE) is in the spotlight, at least for those that pay close attention to the macroeconomy, as it is lately. The prices of goods and services are escalating daily, the cost of living rising alarmingly and unemployment biting. The central bank and those entrusted with its leadership are in the spotlight for failing the crucial fight over stagflationary pressure created by a convergence of a supply shock and a rise in the money supply. The latter is the self-induced pain by macroeconomic policymakers.

Yinager Dessie (PhD) has been active in the driver’s seat for the past four years. Or inactive, so to say. He is among the 42 of the 45 executive members of the Prosperity Party of the Amhara Regional branch who did not make it when the party reelected its leaders two weeks ago. He even failed to make it into the council of the incumbent party, signalling that Yinager's days at the central bank are numbered.

Yinager's time with the central bank has been the worst on too many occasions and fronts. There may have been some positives. Recently, it allowed half of the shipping costs payable to the state-owned Ethiopian Shipping & Logistics Services Enterprise (ESLSE) to be covered in Birr. This should give some breathing room to players in the import sector struggling to source inputs and transport goods for lack of foreign currency.

But even this effort is an attempt to bandage another directive that has harmed commercial banks, exporters and importers. Last January, the central bank punished exporters by expanding the amount of currency to be surrendered to the central bank to 70pc, the rest shared between banks and foreign account holders. The cries of crucial players in the external sector, who fetch the country hundreds of millions of dollars in exports, such as floriculture businesses, have yet to change the mind of top officials on the macroeconomic front.

It may sound unreasonable and unfair to put all the blame squarely on the Governor. The macroeconomic team where he served as a member and chaired by the Prime Minister should be held responsible.

However, exasperating all of this has been how the central bank communicates with the industry. At least, in its latest decision, a formal letter was sent to the state shipping company. It was not a text message sent from Yinager, or one of his deputies, mobile account to Roba Megersa, head of the shipping company, as if it was a personal business between two gentle souls. It is a significant policy alteration that affects the national economy. Thus, it needs to be communicated in a formal procedure that is traceable and available as a record for scrutiny.

Surprisingly, the central bank does not see its engagement with financial institutions in such a formal light. It has gotten a taste for a highly fickle communications medium when it passes down new rules: text messages. This has happened on at least two occasions. The first was when it suspended collateral lending, which lasted for a quarter of a year.

How was the freezing of flows from financial institutions that power the economy effected?

The central bank saw no need to serve commercial banks with any formal and legally binding letters except to text message bank presidents about the suspension. The most charitable explanation of why formal procedures would be chucked out in favour of arbitrary orders, even when the central bank had the power to issue a circular or a directive, is that it was a matter of urgency. The Birr was sliding against the dollar at a much faster rate than usual in the parallel market, indicating perhaps capital flight. It could be argued that the Governor and his team needed to plug up part of the financial sector, its credit system, in a hurry.

But the order to suspend loans was never followed by any formal circular or directive. Outside of reports on the matter, there are no traces of this happening in the central bank’s archive of circulars and directives. This should be unacceptable. Unfortunately, it did not stop there.

The lowering of forex retention rules was also communicated in the same manner. No one could argue this needed to be done in a hurry that the matter could not wait for letters to be formally sent to banks and the directive to be amended prior. Here again, the order to redistribute hundreds of millions of dollars to the central bank was communicated in casual text messages from central bank officials to bank executives as if it was a personal matter between two old pals.

This is truly a bizarre behaviour from the most critical institution in macroeconomic policymaking. It also raises a crucial question: do the banks even have to comply? No law or directive holds them beholden, simply because the central bank has elected not to communicate orders using a directive, a legal instrument. What would they be held accountable to? Imagine the Finance Ministry texting heads of tax bureaus to raise value-added tax (VAT) to 20pc without any change of laws. Would that be acceptable?

Such a mode of communications and procedural laxity says a great deal about how the central bank’s relationship with financial institutions has transformed from regulation to policing. It is nothing less than ruling by fiat, where necessary institutional and industry-wide processes and stakeholders are bypassed. It shows that the central bank sees financial institutions as entities it needs to keep in line instead of helping thrive for shared objectives. The central bank does not see them as partners to achieve common policy goals but subservient entities to be handled on a tight leash.

It is bad enough that the central bank is as all-powerful as it is in monetary policymaking. It fixes savings interest rates and manages the exchange rate of the Birr, powers long ago surrendered by more open economies to markets. Over the past three years, it allowed the Birr to depreciate by 78pc without an end in sight or anyone pressing it on why it is doing this or to what end. A closed institution that decides the economy's fate behind closed doors, to pass orders on text messages without so much as a directive or a circular seems a crude way of highlighting that its powers are neither questioned nor challenged.

More importantly, it concentrates power in the hands of bureaucrats and dilutes the institution's power by removing its importance as a medium of communication. It creates a situation where commercial banks can bypass proper institutional procedures and influence executives directly without leaving a fingerprint that could be used as a record. Accountability in the foreseeable future is lost.

Coming from an institution that already does not exercise autonomy and rules the financial sector with an iron fist, this is bad enough. It will be a tragedy for its powers to be personalised to the point that formal written rules and laws pale in the face of Yinager’s, and his deputies, text messages. It will further discredit the central bank when its services are direly needed. This will remain the unceremonious legacy of Governor Yinager.

PUBLISHED ON

Mar 26,2022 [ VOL

22 , NO

1143]

Commentaries | Oct 22,2022

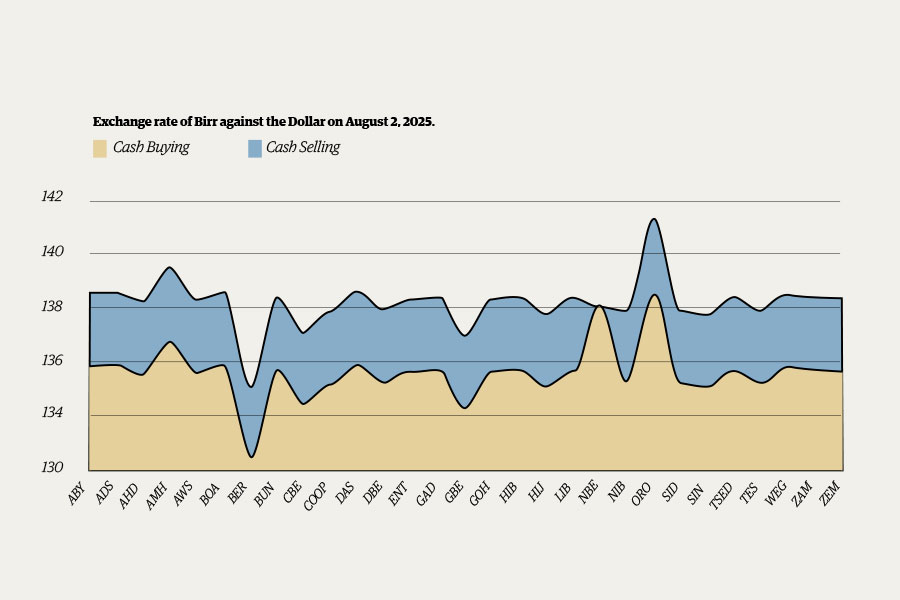

Money Market Watch | Aug 03,2025

Fortune News | May 15,2021

Fortune News | Jan 05,2020

Sunday with Eden | Dec 21,2019

Viewpoints | Mar 09,2024

Featured | Mar 26,2022

Fortune News | Mar 11,2019

Sunday with Eden | Jul 10,2020

My Opinion | Mar 16,2024

Photo Gallery | 174831 Views | May 06,2019

Photo Gallery | 165052 Views | Apr 26,2019

Photo Gallery | 155308 Views | Oct 06,2021

My Opinion | 136731 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

Oct 18 , 2025 . By BEZAWIT HULUAGER

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...