Radar | Jan 12,2019

A 26-year-old site engineer, Mizab Ahmed, fumed with anger. Two months ago, he had visited the Autobis Tera area, excited to snag a pair of Beats headphones from his monthly salary of 20,000 Br. He plunked down 2,500 Br, convinced by the packaging that these were the real deal. But his triumph was short-lived. One earpiece went silent.

Mizab claims he was not looking for trouble.

"I only asked him to swap it for another pair," he told Fortune.

But the vendor refused, recalling that inspecting unopened items was not part of the deal. "I was shown another piece that works," Mizab sighed, realizing he had been tricked into buying a counterfeit.

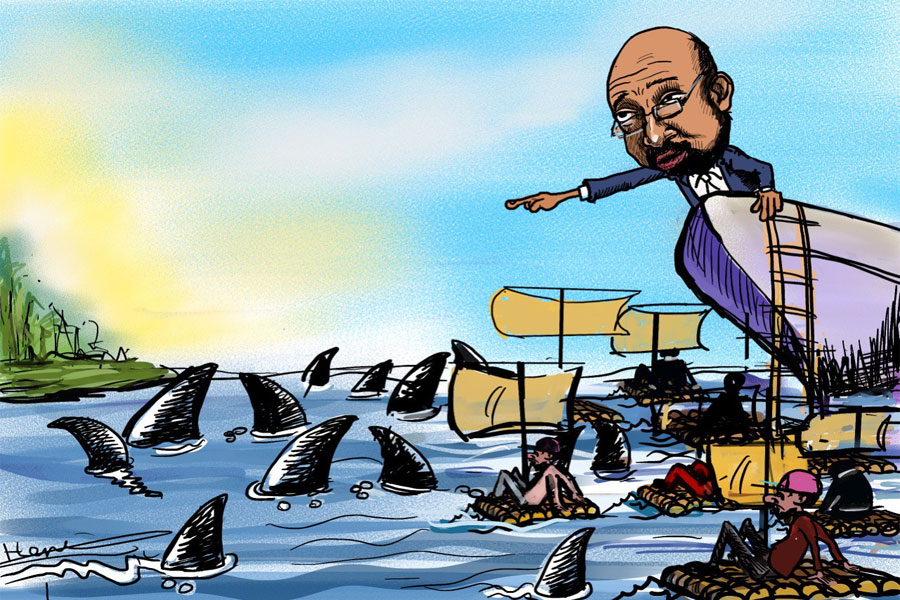

Counterfeit products are surfacing in the local markets. From watered-down clothes and spare parts to fake pharmaceuticals and cosmetics, these knockoffs drag down quality standards and threaten consumer health in some cases. The 1.7 trillion dollar global industry is attributed to avaricious businessmen and high-profile occasions where foreign manufacturers tweak content destined for low-income countries.

A recent report by the Swiss NGO Public Eye exposed a disturbing trend. Nestle, a giant in the baby food market, was caught sending products with vastly different nutritional content to lower-income countries. While their Cerelac and Nido products contained no added sugar in Germany and the UK, Ethiopian babies were getting a whopping five grams per serving.

Ensuring quality in the marketplace is a multi-agency effort overseen by the Ministry of Trade & Regional Integration. Conformity Assessment Enterprise is tasked with inspecting, testing, and certifying products while the Institute of Ethiopian Standards develops and enforces quality benchmarks for new arrivals, sometimes collaborating with the countries of origin. Accreditation Services functions as a reviewer, granting a final stamp of approval and the Calibration Services is supposed to ensure the accuracy of labelled volumes and weights, with hopes of safeguarding consumers from being misled.

Despite efforts by the Ministry and regulatory bodies like the Ethiopian Food & Drug Administration (EFDA), ensuring product quality remains a challenge. The eight-month trade report to Parliament highlights the proliferation of smuggled goods, budget constraints, and a flourishing illegal trade network.

Over the past nine months, the Enterprise has granted quality certification to over 19,000 products and services. This includes inspections on nearly 31 million litres of edible oil and around 900,000Qtl of fertiliser.

According to Tekea Berhane, communications director, testing and inspection procedures are initiated upon requests from regulatory institutions such as the EFDA and the Ministry. He said the Enterprise employs a rigorous testing process across its nine laboratories, encompassing biochemical and electro-mechanical departments.

"Products subject to mandatory standards can only enter the market after completing our tests," he said.

The Institute maintains a database of over 11,000 standards, with 300 mandatory specific products. It reaches out to new businesses offering products or services and occasionally communicates with origin countries. However, their role is limited to standard-setting and verification; they do not pursue legal action unless false certifications are involved.

Only 372 companies have received official quality certifications from the Enterprise, which is expanding its reach by building a branch office at Lamu Port in Kenya. Meanwhile, there is room for improvement in weeding out low-quality goods. In the first eight months of the year, authorities blocked nearly 880tns of substandard products from entering the country, forcing the closure of around 15 local manufacturers.

According to Mengistu Tefera, technical specification chief at the Institute, they prioritise public health that causes environmental impact, and the prevalence of adulterated goods. He said all legal imports are inspected by Enterprise agents against these established standards.

"Only smuggled goods slip through the cracks," he said.

Standards for imported products are often derived from international organisations like the International Organisation for Standardisation (ISO), while domestic products involve consultations with consumers and producers. However, Mengistu acknowledges the need for continuous improvement in inspection capabilities at import points to adapt to the ever-changing space.

"Without staying technologically updated," he warns, "businesses risk becoming irrelevant."

According to the Organisation of Economic Co-operation & Development (OECD), counterfeits are classified based on risk. While some, like electronics or toys, cause minor inconveniences, others, like fake pharmaceuticals and cosmetics, pose serious health threats. Ethiopia's ranking of 66th out of 193 on the Organised Global Crime Index 2023 indicates the presence of counterfeit products, often entering through increasingly sophisticated smuggling methods.

EFDA is combating this issue, particularly concerning health risks. Recently, they warned health institutions against prescribing a potentially harmful over-the-counter medicine. Fozia Mohammed, head of the inspection desk, said smuggled products bypassing inspections pose the greatest danger.

The issue is complicated by a surge in illegal cosmetic imports. Following restrictions on foreign currency allocation for cosmetics last year, some businesses have resorted to smuggling to meet consumer demand. While EFDA rigorously screens the nearly 2,000 licensed medical importers and wholesalers, cosmetics suppliers face lower entry barriers, allowing some to operate with licenses and then disappear.

Fozia stresses the importance of inspections in preventing hazardous chemicals from entering the country through unregulated channels.

"We can only regulate what comes in through proper channels," she said.

The counterfeit medical industry is a booming black market, with Africa bearing the brunt of its dangers. A World Health Organisation report reveals a staggering statistic: 42pc of the global 200 billion dollar counterfeit market flourishes in Africa.

Dermatologist and researcher Tesfaye Ketema (MD) witnesses this dark side firsthand. He treats a constant stream of young women between the ages of 18 and 35, suffering from burns, itching, and thinning skin – all caused by unregulated beauty products.

"These low-quality fakes often contain irritants that wreak havoc on specific skin types," he said.

The problem extends far beyond major cities. Tesfaye, who previously served in the Somali Regional State, has seen the devastating effects of smuggled cosmetics reaching even remote villages.

"These products enter illegally, then proliferate in local markets," he said. "The damage they cause after just six months of use can be irreversible."

Over the past four years, contraband has become a major market nuisance. Last month, the Customs Commission made a record seizure worth over half a billion Birr in Somali alone. Weekly confiscations of uncertified products flooding in from neighbouring countries have become commonplace, with annual figures exceeding 10 billion Br last year.

Customs plays a crucial role. Zerihun Assefa, the communication director, said every shipment entering the country faces a double inspection with staff verifying tariffs and checking for contraband, while inspectors from quality assurance agencies like the Enterprise assess product quality across all dry port terminals.

"We only allow entry for what they permit," he said.

Depending on the nature of the issue, Zerihun said the goods are either buried or incinerated to prevent them from entering the market and harming consumers.

"We follow the standards set by the relevant quality agencies," he said.

China remains the primary source of imports, with Asian goods making up a significant portion (75pc) of the trade. However, a concerning overlap exists. According to a comprehensive OECD report, China is also the world's leading producer of counterfeit goods, with a particular focus on cosmetics and automotive parts.

One consumer with a purchase that backfired is Biruk Bizyayehu, a driver juggling multiple taxi-hailing apps. When the weather turned cloudy, Biruk reached for his usual windscreen washer fluid. Instead of clearing the haze, his windshield became an opaque mess. The culprit was a cheap, counterfeit alternative for his Toyota Vitz, bought from a street vendor for nearly 4,000 Br less than the original.

"The price was too good to resist," Biruk admits, with a touch of regret in his voice.

His story exemplifies a growing trend – the rise of purely online interactions in the post-COVID world. This shift, as highlighted by the OECD report, exposes consumers to an increased risk of receiving defective products, often with the burden falling entirely on the final buyer.

The line between quality standards and consumer behaviour seems to be blurred for businessmen like Shafi Nur, who bridge the gap between consumers and Chinese suppliers. He offers a different perspective.

Shafi argues that consumer demand heavily influences the quality and authenticity of imported goods. He said Chinese wholesale markets offer a spectrum of product quality. However, high-end options target Western consumers, while lower-priced, used, imitated products cater to other markets. He attributes this to a combination of factors: budget constraints and a perception among some consumers that value for money translates to lower prices, even at the expense of quality.

"Many local businesses gravitate towards the cheaper options," Shafi said.

Officials at the Ministry of Trade & Regional Integration acknowledge the challenges in ensuring quality compliance, consumer awareness and private sector engagement.

Hana Bizuwork, head of quality facilitation, observes coordinated effort among agencies has room for improvement. Hana said a five-billion-Birr project is underway to establish a centralised facility housing these organisations. She also bets on another 50 million dollar World Bank project aimed at bridging the technical skills gap. in fostering a culture of quality.

"But at the end of the day, consumers need to be discerning when making purchases," Hana told Fortune.

However, local manufacturers face an uphill battle. With the market saturated with counterfeits, smuggled goods, and used items, they often feel ignored in the pursuit of quality standards.

The Ethiopian Textile & Garment Manufacturers Association raises concerns about the impact of counterfeits on quality. Agazi Gebreysus, the association's secretary general, highlights the lack of incentive for manufacturers to prioritise quality assurance when competing with a market flooded with cheap imitations. Agazi said a nuanced view of quality improves through ongoing investments in technical skills, but only alongside a responsive consumer base. He identifies the country's heavy reliance on imports as a factor contributing to lower quality standards.

"Many consumers are drawn to the affordability of smuggled goods," Agazi said.

He argues that a significant shift in consumer behaviour is necessary to achieve national progress in product quality. He believes consumers often prioritise flashy packaging over genuine quality.

"If our products can meet stringent export standards," Agazi said, "they are surely good enough for the domestic market."

For economist Arega Shumete (PhD), a complex interplay of factors hinders quality standards. He argues that weak regulatory enforcement, a lack of consumer awareness, and limited competition create an environment where businesses have little incentive to prioritise quality.

"High demand for products often outstrips local supply," said Arega. "It makes the sale of counterfeits highly profitable."

He believes that while readily available imports are not solely to blame, consumers' willingness to purchase low-cost goods, sometimes at the expense of quality, contributes to the problem. Arega highlights the historical challenges of corruption within regulatory bodies, which may have fostered a culture of leniency towards businesses that cut corners. This systemic disregard, he argues, allows counterfeit and potentially hazardous products to enter the market.

"Tampering with expiration dates is a concerning example," he said.

However, Arega remains optimistic. He sees potential for improvement through technological advancements like better product tracking systems, a more robust regulatory framework with empowered inspectors, and a shift in consumer behaviour towards demanding quality: "If we manage to build a culture of quality where consumers hold businesses accountable."

Ethiopia's battle against counterfeit goods is far from over. While regulatory agencies need to make a coordinated effort, the fight requires consumers to become more discerning, pushing manufacturers and businessmen to prioritise quality. The government needs to invest in robust inspection systems and consumer awareness campaigns.

PUBLISHED ON

Jun 01,2024 [ VOL

25 , NO

1257]

Radar | Jan 12,2019

Editorial | Apr 22,2023

Fortune News | May 08,2021

My Opinion | Feb 10,2024

Commentaries | Aug 24,2019

Verbatim | Jan 07,2024

Fortune News | Jan 07,2022

View From Arada | Apr 20,2019

Featured | Oct 25,2020

Radar | Jun 26,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...