Jul 8 , 2023

By MUNIR SHEMSU ( FORTUNE STAFF WRITER )

Finance experts from across the world converged in the capital to discuss prospects and pitfalls as Ethiopia births capital markets where lively discussions and lectures ensued on the different types of markets such as debt and equity while the development of sound policy-making.

A pair of regulations on employment administration and compensation funds along with 10 draft directives were revealed as looming legal instruments for the pre-nascent financial markets.

Enhanced control over the manner of offering shares to the public is to be set with a directive by the Authority, currently awaiting approval from the board.

During the capacity-building workshop for the Ethiopian Securities Exchange (ESX), the impending strict control on public offerings entailing up to a 15-year sentence for misleading advertisements on returns of shares was revealed.

An essential disclosure document with accurate information on the nature of the investment offer is required while exemptions from the submission of a prospectus for government securities and a few other instances like court-ordered sales are given, according to Solomon Bekele, senior legal advisor at the Authority.

"Exemptions for a prospectus are not extended to state-owned enterprises," Solomon told Fortune. "Shares will be offered to the public only after approval by the Authority."

He noted the proliferation of advertisements promising ludicrous returns over the last year as companies realize the impending regulatory noose that is looming in the halls of the Authority. Solomon indicated that despite the companies slipping through at the initial offering phase, they are still within reach with the investigative mandate of the Authority.

"We will get re-introduced as they fulfil their ongoing public disclosure requirement," he told Fortune.

Once the capital markets are up and running, public share companies in the country will be required to submit audited periodical reports on their financial and managerial status to the Authority.

The two-day event at Radisson Blu Hotel on Tito Street was primarily organised by the United Nations Economic Commission for Africa (UNECA) with sponsorship from the Bill and Melinda Gates Foundation.

Participants hailed from the National Bank of Ethiopia (NBE), the Ethiopian Capital Market Authority (ECMA), the Ethiopian Securities Exchange (ESX), Financial Sector Deepening Africa (FSD Africa), African Export-Import Bank (Afreximbank), the International Growth Centre, NCBA Investment Bank, Old Mutual Investment Group, and the Pension Benefit Guaranty Corporation (PBGC).

The discussions followed pre-recorded opening remarks by Antonio Pedro, acting executive secretary for the UNECA and Brook Taye (PhD), director general of the ECMA.

Evan Inglis, chief policy actuary at the Pension Benefit Guaranty Corporation, which protects the retirement incomes of over 33 million American workers, gave a presentation on fixed-income markets commonly called bond markets, usually trade securities like government bonds, corporate bonds, and treasury bills, in which he emphasized the importance of interest rates and bond yields.

"A 10-year bond yields give a lot of information on a country's economic standing," he said.

Evan emphasised that a rise or decline in interest rates significantly determines the demand for securities in the market.

He believes that the role of central banks in financial markets can serve as both a negative and positive force. He said the central bank is an external force that too often distorts capital markets as he reflected on his experience in the US.

"Reliance on market forces opposed to centralised decision-making is beneficial in the long run," he told Fortune.

Evan recommends adding investment in bond markets to one's portfolio to balance out risks arising from equity markets.

Active input from the National Bank of Ethiopia during the inception of the capital market has been deemed vital by experts in the panel.

"This market can't work without the central bank," said Michael Habte, senior project manager at the ESX during the first-day workshop.

The Exchange is working to host two market segments: Main Markets worth above a billion Birr and Small & Medium Enterprise markets.

Tilahun Kassahun (PhD), fellow project manager at the Exchange, revealed that the 20 trillion Br the country needs over the next decade to successfully develop infrastructure requires vibrant capital markets for financing.

He assured the availability of financial supply revealing that two pension funds (Public Servants Social Security Agency and Private Employees Social Security Agency) in the country manage more than 300 billion Br.

"They can buy a bank each year with only 10pc of their funds," he said.

Experiences from the nearly 70-year-old Nairobi Securities Exchange were highlighted through senior management from NCBA Investment Bank, which facilitates wealth management, equities trading and a host of other services in the continent's fourth-largest financial market.

Paul Gicheru, Chief Investment Officer at NCBA highlighted the importance of having a diversity of investors for capital markets to thrive while stressing the role of custodians for fostering reliability.

"A fund manager is in a position of trust," he said.

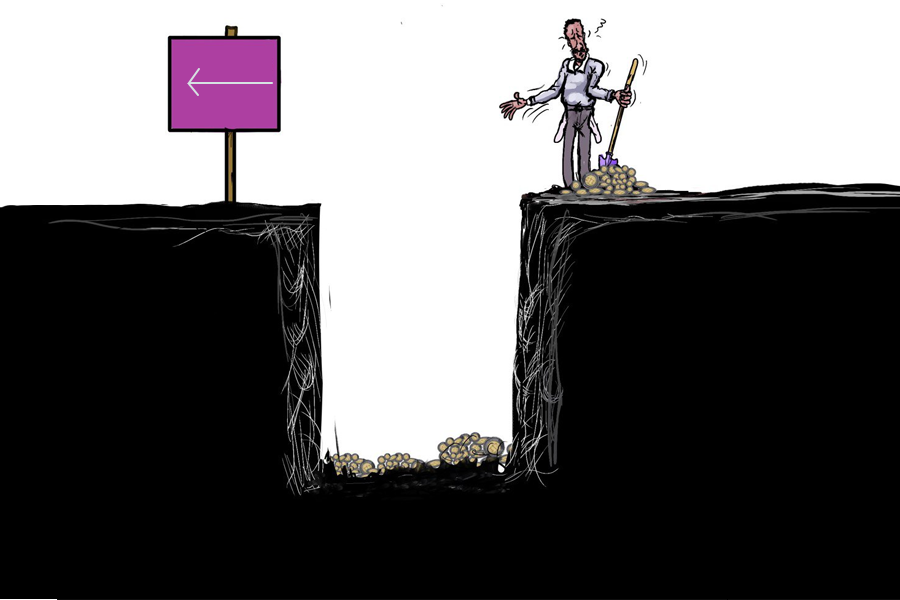

The theriac image increasingly being painted by the impending capital markets came down to earth as a comprehensive and grounded presentation on the imposing conditions of the economy was put forth by Tewodros Mekonen (PhD), a macroeconomist out of the International Growth Centre, London School of Economics based research facility.

He reasoned that high external debt, galloping inflation, unsustainable balance of payments, severe forex shortages and financial repression are realities of the Ethiopian economy with which the impending capital market will have to contend with.

The State-owned Commercial Bank of Ethiopia (CBE), which channels around 60pc of the country's funds while loaning out a mere one-fifth of the amount to the private sector, moves too much money into the public sector, according to the macroeconomist.

Tewodros stressed the importance of having stable commodity prices, which are hindered by an agricultural sector that consumes 70pc of its own production. He pointed to the creation of strong institutions, removal of financial repression and mitigation of inflation rates to grease the clanky economic machinery of the country.

The macroeconomist cited the looming creation of a capital market as the sole positive policy development amidst a host of policy reversals in a negative direction.

"The inflation is to be expected," he reasoned referencing the nearly 200 billion Br the government borrowed from the central bank over the past two years.

PUBLISHED ON

Jul 08,2023 [ VOL

24 , NO

1210]

Fortune News | Nov 09,2024

Viewpoints | Sep 01,2024

Editorial | Mar 18,2023

Radar | Jan 01,2024

Commentaries | Dec 29,2018

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...