Radar |

Oct 3 , 2020

By BEMENET WONDEWOSSEN

The Development Bank of Ethiopia (DBE), which stopped receiving funds from the central bank as of this year, has mobilised the highest value of resources yet amounting to 305 million dollars. The funds, mobilised from six institutions, will be used for a project to promote a line of credit and financial services in the rural areas of the country.

The state policy bank has been receiving finances from the National Bank of Ethiopia (NBE) for the past decade from resources mobilised through the recently repealed NBE bill directive, where 27pc of the gross loans and advances of all private commercial banks were redirected to DBE. As of this year, DBE will use alternative sources including development partners, selling bonds and time deposits.

During the first round of fund sourcing, the four international co-financiers, one guarantor, and three local funders mobilised the funds for the third round of the Rural Financial Intermediation project that was launched 17 years ago. The six-year plan, which targets 6.6 million people, will be achieved through 11,000 rural savings and credit cooperatives and unions, as well as 38 microfinance institutions (MFIs).

Close to 40 million dollars will be financed by the International Fund for Agricultural Development. The European Investment Bank has committed to giving a loan of 112 million dollars with parts of the contribution to be funneled toward developing leasing products for rural areas of the country. The European Union and Alliance for Green Revolution in Africa committed 19.4 million dollars and 1.5 million dollars, respectively.

As for the local source of funds, the Ministry of Finance is set to commit close to 50 million dollars, and the Ethiopian Insurance Corporation also agreed to chip in for the project, which will be managed through the Programme Coordination & Management Unit at DBE governed by the Programme Steering Committee.

“We haven’t decided on the amount yet,” said Netsanet Lemessa, CEO of Ethiopian Insurance Corporation, which plans to work with the microfinance institutions to provide insurance coverage for their work under this Programme. "This is part of our corporate social responsibility to promote financial service in the rural region."

With the new structural change in the resource mobilisation for the Bank, this is going to be instrumental, according to Natnael Hailu, acting director of strategy, change and communications at the DBE.

The Programme is expected to unlock access to financial services to 13.6 million savers by 2025, and the MFIs sector will serve 10.3 million clients and credit cooperatives alongside their unions to cover 3.3 million customers.

“There is going to be much focus on helping women and the youth through this Programme,” said Natnael.

The seven-year Rural Financial Intermediation project was conceived in 2003 with a total project cost of 88.7 million dollars. The second round was launched in 2011 with a total project cost of 248 million dollars and delivered financial services for between 3.3 million to 6.9 million households before it was wrapped up last year.

The nation has much fewer conventional banks operating in the rural region, according to Sintayehu Demissie, a lecturer at Addis Abeba University School of Business & Economics.

“Insurance in the country focuses more on the manufacturing and urban-related risks rather than expanding their reach to the rural region,” he added. “But there are some risks that require attention, especially the microfinance institutions that put out high-interest rates for two reasons."

Since the loans they give out are small and their expenses to run offices are high compared to what they earn, they increase their rates, according to the expert.

“Most of the loans given out by microfinance institutions are without collateral. If they default, then it means that the microfinance institution has to cover that loss,” he added.

PUBLISHED ON

Oct 03,2020 [ VOL

21 , NO

1066]

Radar |

Fortune News | Jun 07,2020

Fortune News | Feb 04,2023

Radar | Jun 05,2021

My Opinion | May 11,2024

News Analysis | Nov 09,2024

Radar | Aug 05,2023

My Opinion | Dec 25,2021

Radar | Oct 30,2021

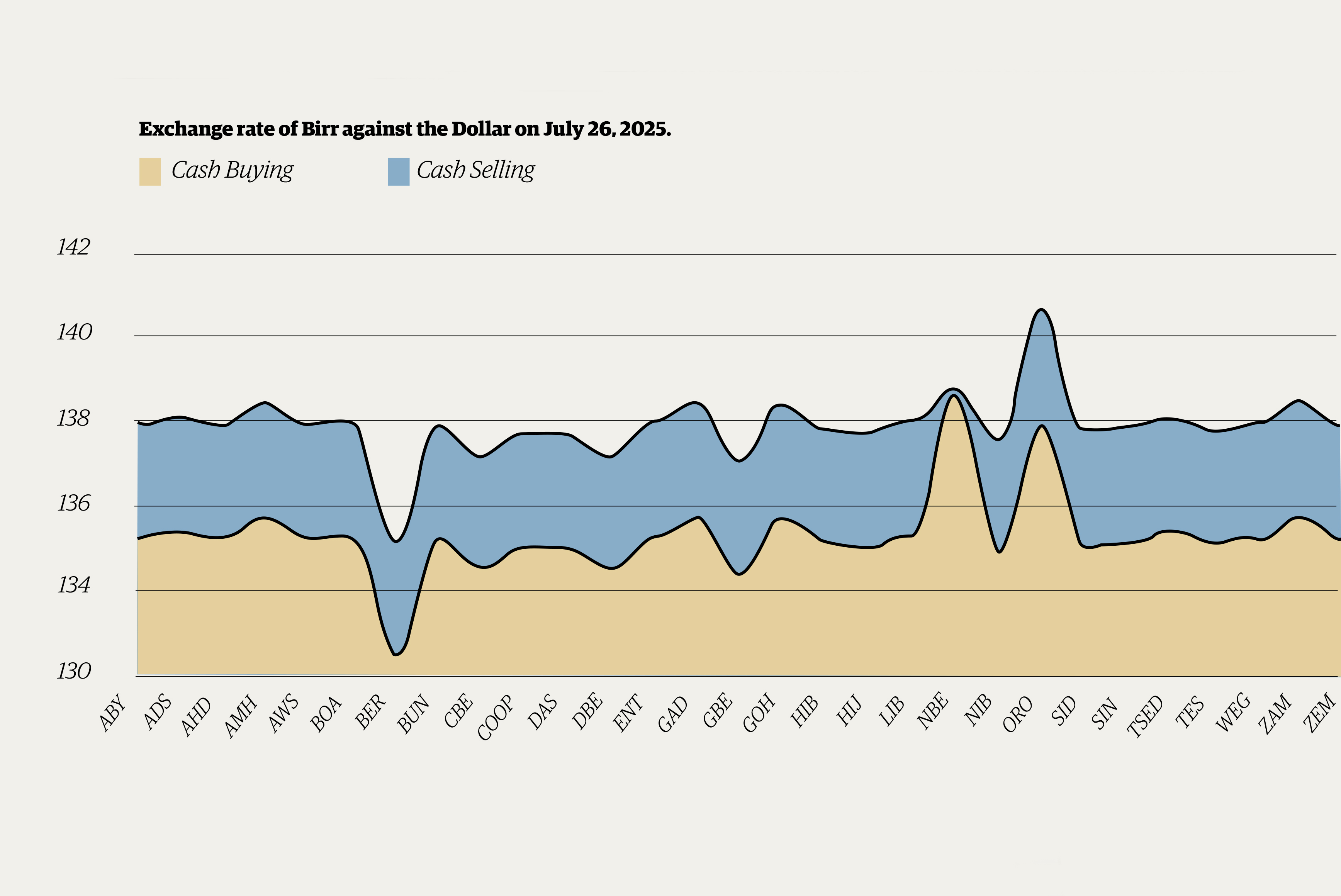

Money Market Watch | Jul 27,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...