Fortune News | Aug 20,2022

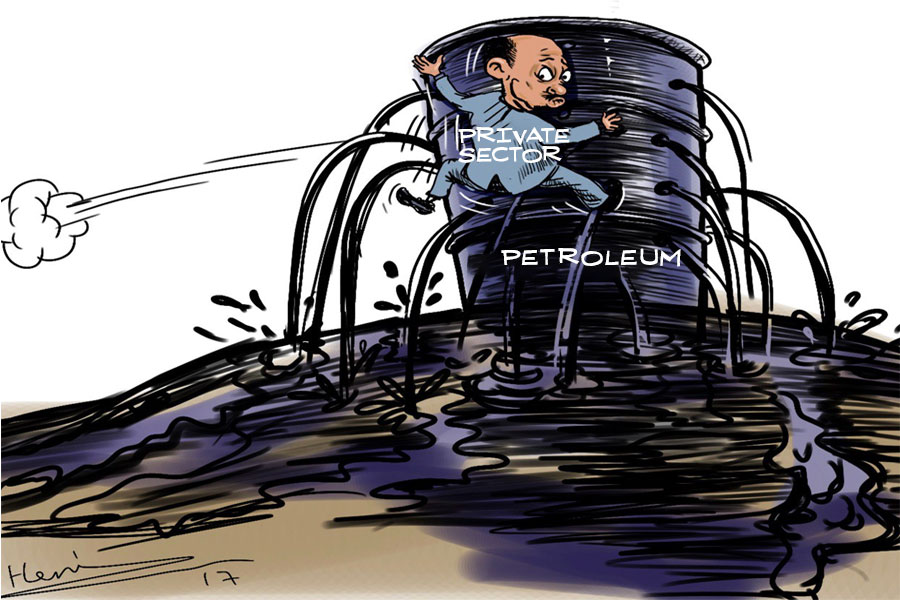

The Ethiopian Petroleum Dealer's Association has filed an urgent plea over the impending, cash-based payment modality for oil companies operating in the country. The Association requested an audience with the ministries of Trade & Industry and Mines & Petroleum among others, claiming that its members do not have the financial capability to operate under the new payment plan, effective next month.

The latest modality, first announced in September 2019, repeals the credit system availed by the Ethiopian Petroleum Supply Enterprise to oil companies in the country. The official notice forwarded from the Enterprise notified all 30 operational oil companies that it will shortly stop availing its credit-based payment system as it had created complications in debt collection due to the rising number of operators. However, oil and petroleum dealers in the country are voicing their concerns as the companies, in turn, have started demanding full payment from the distributors.

The Association, which has over 100 active distributors under its umbrella, had previously lodged a series of inquiries on the new modality, which was scheduled to take effect in stages after an initial six-month notice period.

With just a month remaining for full implementation and no visible solutions posited for loans, members of the Association are distressed it will force them out of the business, according to Ephrem Tesfaye, board member and facilitator at the Association.

"When the law first came into effect, we were not sure this would trickle down to us as it pertains to the companies," he said. "That was why we initiated a discussion with the relevant government bodies."

However, the Association's requests fell on deaf ears, according to Ephrem.

The concerns of the Association stem mainly from the lack of immovable collateral for loan requests needed to make the full upfront payments. Previously, oil companies had availed a loan repayment schedule that lasted from three to 15 days to the distributors, which number more than 800 countrywide.

"Those that may not be able to secure these loans will have to leave the business," said Ephrem. "This might create needless disruptions in oil provision in the country."

The Ethiopian Petroleum Supply Enterprise, on its part, has stated that any costs incurred in the implementation of the modality, in interest on bank loans or otherwise, will be reimbursed.

The cash-based payment plan for petroleum companies in the country is expected to compensate for all costs related to its implementation, according to Tadesse Hailemariam, CEO of the Enterprise.

"All expenses incurred by the companies associated with the new modality will be compensated," he said. "The expenses will not be transferred to the companies."

The CEO explained that this may be through the efforts of the government or through other methods such as raising the price of petroleum. In parallel to this, costs that will be incurred by the distributors will need to be covered by the companies, according to Tadesse.

"This is part of the conditions that the companies have to fulfill to have their costs covered," he said.

Tadesse Tilahun, CEO of the National Oil Company and president of the Ethiopian Oil Companies Association, declined to comment on the issue, stating that the matter is still under deliberation with the relevant government bodies.

The effects of the change in modality might have wider implications that will affect more than just the dealers, according to Ibrahim Dawd, an expert in banking with more than 12 years of consulting experience.

"If their justifications for changing this modality is defaulting companies, then it would be better to have specific changes in regard to that," he said. "This will undoubtedly bring challenges to a sector that requires substantial working capital."

The expert suggested that the changes may need a revision, as even interest rates at banks will not be commensurate with the marginal profits available in the sector.

"If the government wants financially strong players in the sector, then it can resort to other means like adjusting entry barriers," said Ibrahim.

PUBLISHED ON

Feb 06,2021 [ VOL

21 , NO

1084]

Fortune News | Aug 20,2022

Fortune News | May 11,2019

Radar | Jan 14,2023

Fortune News | May 11,2025

Editorial | Dec 07,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...