Sponsored Contents | Oct 24,2023

Aug 27 , 2022

By Austine Sequeira , Andrea Sequeira

The International Monetary Fund (IMF) has released its 2022 World Economic Outlook report. Predictably, it speaks volumes of gloom on the growth front. Major world economies already suffering from the effects of COVID-19 led by high energy and food prices, supply-demand imbalances and rising inflation went into contractionary monetary policies. These policies are now driving global growth downwards. All this happened when the world was waiting for V-shaped recoveries in advanced economies. A classic case of the cure being worse than the disease!

The United States, China, and Europe are the major laggards pulling down the world baseline growth forecast from 6.1pc in 2021 to 3.2pc in 2022 and 2.9pc in 2023. The United States growth forecast is down to one percent due to the reduced household purchasing power and tighter monetary policy, while in China, further lockdowns and the deepening real estate crisis have led to a downward revision of the growth forecast to 4.6pc. Europe is suffering from spillovers from the war in Ukraine and tighter monetary policy and is expected to grow at 1.2pc in 2023.

On the other hand, Sub-Saharan African (SSA) economies have shown an amount of resilience in an upward growth trajectory. Although the growth in the region has weakened during 2022 thus far, it is forecast to grow at 3.8pc percent in 2023. Many SSA-centric economists have predicted that the sharp deceleration of global growth is creating substantial headwinds for the region. This is anticipated given the industry and trade profile of the region. Nevertheless, the SSA statistical data continues to be dominated by big economies such as Nigeria and South Africa.

Now that the developed world has caught up with Africa’s growth prospects in percentage terms, can the African continent match the economic recovery rate of the developed world? Emerging and developing Asia and ASEAN block has consistently clocked an annual GDP growth rate that has been twice that of the United States and Europe - why not Sub-Saharan Africa?

Economic growth is a function of economic output. Incremental economic output depends on structural changes in the economy. In the present context, SSA has surprisingly not booked huge human losses due to COVID-19. Compared to the developed world, stagflation in Sub-Saharan Africa has been due to pandemic-induced losses.

The first and foremost barrier to post-pandemic recovery in almost every Sub-Saharan country today is rising inflation levels – much higher than in the developed world. IMF has reported that the high levels of commodity and food prices have hampered recoveries in almost all sectors leading to erosion of disposable incomes, depressed demand, and deepening poverty.

This, to a large extent, is a homegrown challenge – for years, most SSA countries have held back their economies from globalisation. Global value chains are yet to reach these countries. Low production base and uneven overseas procurement of goods and services have led to a human-made scarcity of goods and services. Developed countries will quickly bounce back, but SSA countries have to move faster to integrate their economies with large global value chains until such time as they raise capital to produce locally and be a vital part of global value chains.

SSA has the potential to be the breadbasket of the world. But it is not difficult to understand why food shortages and inflation should take a particularly severe toll on vulnerable populations. IMF has flagged the surging food and fuel import bills in SSA countries as they have the potential to reverse recent progress in poverty alleviation across the region, especially in the Democratic Republic of Congo and Nigeria, where vulnerable populations are sizable, and in Benin, Comoros, The Gambia and Mozambique, where the dependence on imported food is high. Local logistics and food security program administration need more focus to eliminate shortages and uneven distribution.

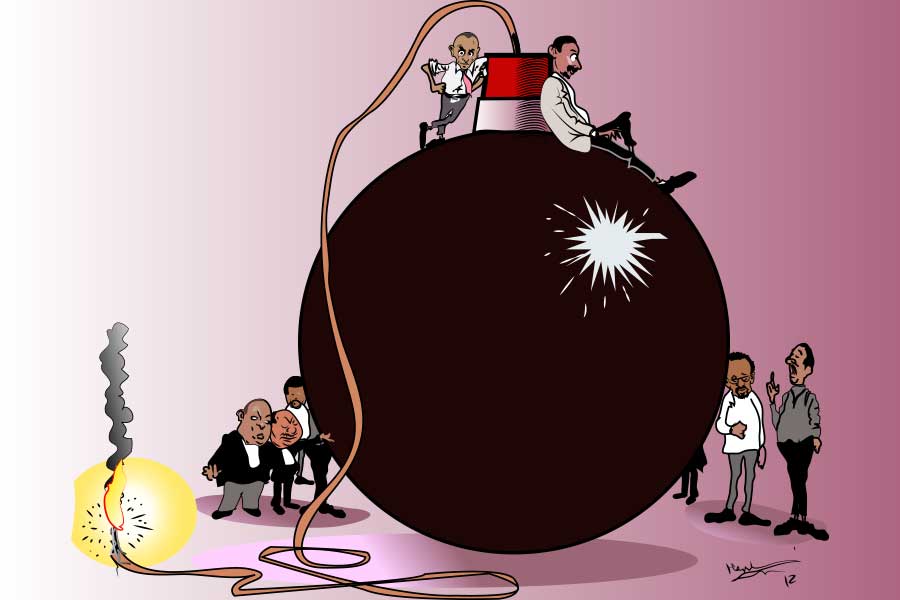

According to IMF, about 45pc of the SSA economies are politically fragile and conflict-affected countries. Insecurity and violence threaten the economic outlook, especially in the lowest-income countries. A quick economic turnaround is, therefore, a distant dream.

Fiscal prudence also holds the key to the post-pandemic challenges. Advanced economies are pursuing accelerated policy tightening, the effects of which are felt in SSA countries already constrained by high levels of public debt and trade imbalances. Managing the risk of systematic insolvency is vital. Nevertheless, GDP growth and public debt are interrelated and dynamic public debt programs that lead to asset creation are critical to economic bounce back.

Currently, the whole world is sailing on the same ship. Still, countries with a balanced demand-supply situation will bounce back faster than expected. SSA leadership must cautiously pursue economic globalisation to catch up with the developed world. Adaptability and decisive decision-making are the need of the hour.

PUBLISHED ON

Aug 27,2022 [ VOL

23 , NO

1165]

Sponsored Contents | Oct 24,2023

Commentaries | May 25,2024

Viewpoints | Aug 20,2022

Sunday with Eden | Apr 03,2021

Editorial | May 28,2022

Editorial | Jun 17,2020

Commentaries | Aug 13,2022

Commentaries | Jul 12,2025

Editorial | Sep 13,2025

Fortune News | Feb 16,2019

Photo Gallery | 177388 Views | May 06,2019

Photo Gallery | 167595 Views | Apr 26,2019

Photo Gallery | 158250 Views | Oct 06,2021

My Opinion | 136984 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...