Editorial | Apr 24,2021

Nov 9 , 2019

By YOSEPH MERGU ( FORTUNE STAFF WRITER )

Three years after financial institutions were ordered to auction off shares owned by non-nationals of Ethiopian origin, parliament passed an amendment to allow Ethiopian diaspora to invest in the insurance sector.

The amendment was passed on October 5, 2019, after parliament deliberated on the matter.

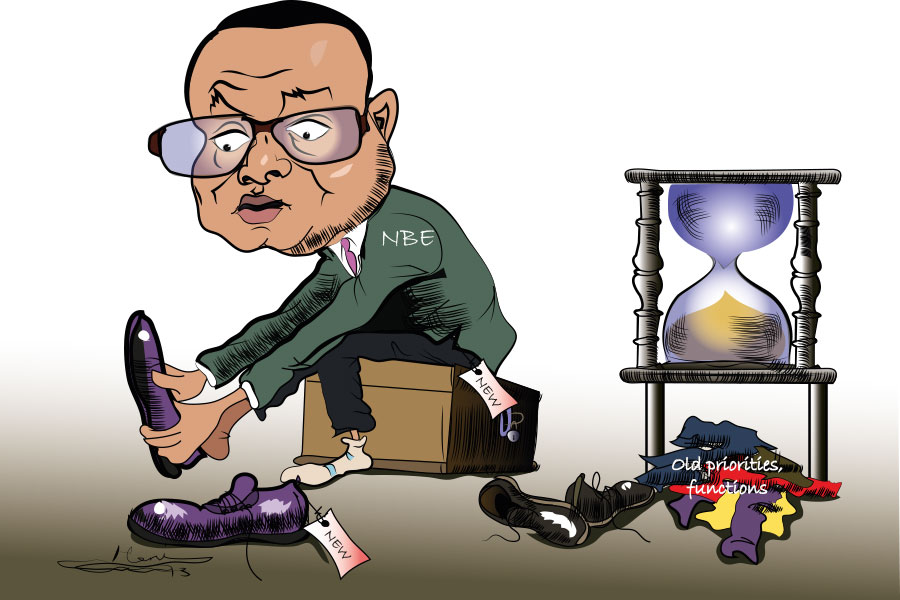

The current growth and expansion of the financial sector and the improved capacity of the National Bank of Ethiopia (NBE) to regulate the sector were forwarded as reasons enough to lift the ban on non-nationals of Ethiopian origin. The importance of the participation of the Ethiopian diaspora in investing their resources into the economy was also cited as grounds for the amendment.

“The need for the amendment of the proclamation was to consider Ethiopian born foreign citizens in the wide range of reform frameworks,” read the statement from the Prime Minister’s Office.

The draft of the amendment was sent to the Budget & Finance Affairs Standing Committee on October 10, 2019, for further debate. After holding a meeting on the amendment two weeks later, it held a discussion with members of the National Bank of Ethiopia later that month.

Parliament voted to unanimously pass the amendment to the insurance business proclamation that was put into force back in 2012.

Non-nationals of Ethiopian origin were booted from the financial sector in 2016, following a November directive from the National Bank. All banks and insurers were forced to notify non-Ethiopian shareholders to return their shares. The non-nationals were estimated to have held an aggregate amount of 40 million Br.

The shares were auctioned beginning in 2017 by the financial institutions, and the profits made by the banks and insurers were turned over to the National Bank despite the outcry of industry outsiders. The central bank’s decision was taken to enforce the 2008 banking business proclamation.

The decision led to court proceedings, namely by Sophia Bekele, a non-national Ethiopian native, who sued the central bank for forcing her to sell shares in United Bank and United Insurance Bank that she inherited from her father.

Ethiopia’s insurance sector has grown significantly since the 1990s. Currently, the nation has 17 insurers that had 532 branches at the end of last year, over 80pc of which were located in Addis Abeba.

Insurance companies increased their total capital by over a quarter in the 2017/18 fiscal year to 5.5 billion Br. The share of private insurance companies was 72.1 percent, while that of the lone state insurer, Ethiopian Insurance Corporation, makes up the rest.

Tewodros Meheret, a lawyer and a lecturer at Addis Abeba University's College of Law & Governance Studies, believes that non-nationals of Ethiopian origin should not have been prohibited from investing in the sector to begin with.

“Allowing them to invest in the sector will increase the capital of the banks and insurance sector and increase the flow of forex,” he said. “It also transfers know-how to the country.”

PUBLISHED ON

Nov 09,2019 [ VOL

20 , NO

1019]

Fortune News | Feb 01,2020

Fortune News | Jan 25,2020

Films Review | Jun 20,2020

Radar | Jun 03,2023

Radar | Dec 15,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...