Viewpoints | Apr 13,2019

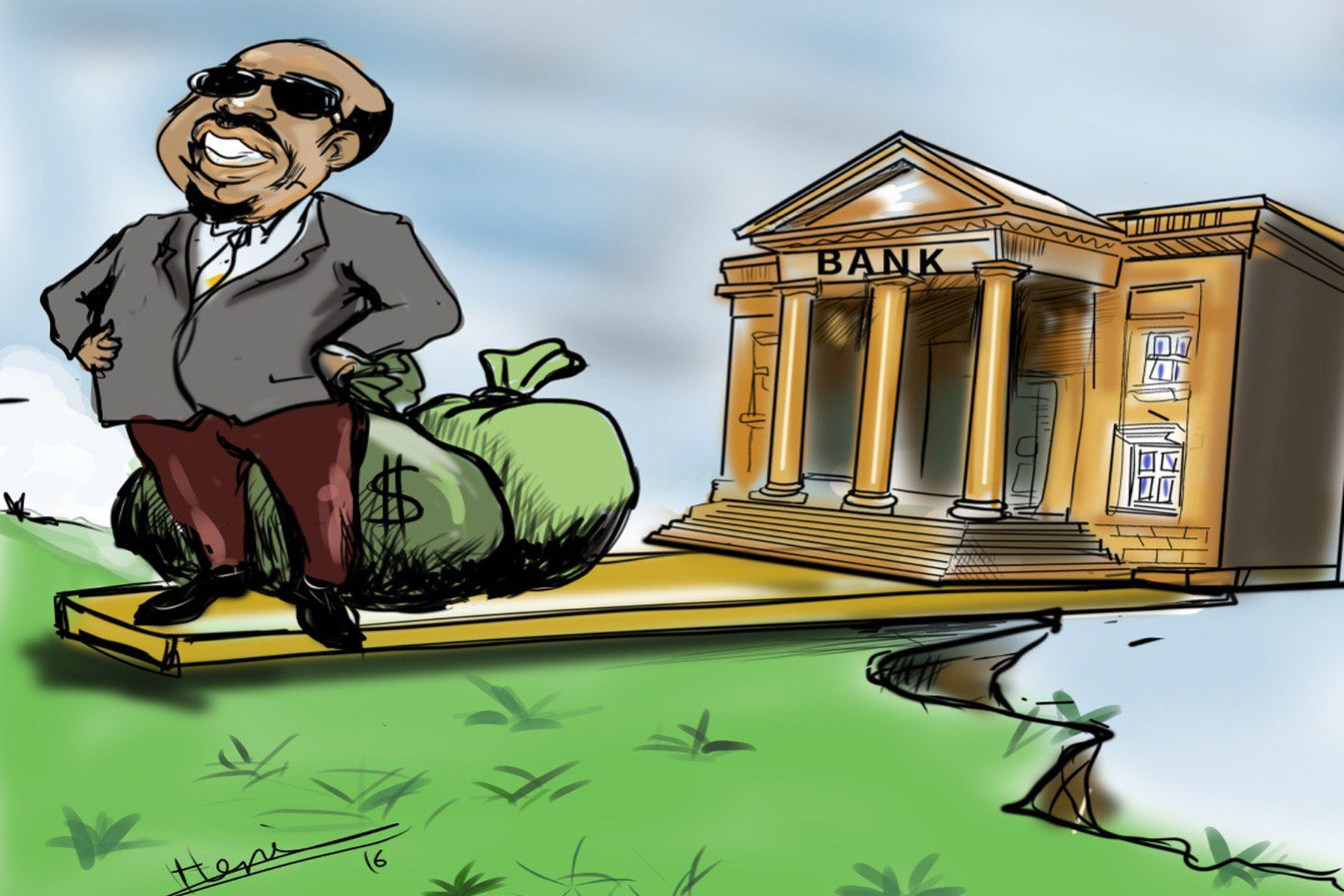

Brook Taye (PhD), the director general of the newly established Ethiopian Capital Market Authority (ECMA), has issued a stern warning to commercial banks involved in the "securities brokerage business" without a proper license. In a letter dispatched last week, he told bank executives to halt such activities unless they adhere to a new regulatory framework, signalling a posture of tightening financial regulations to safeguard the public.

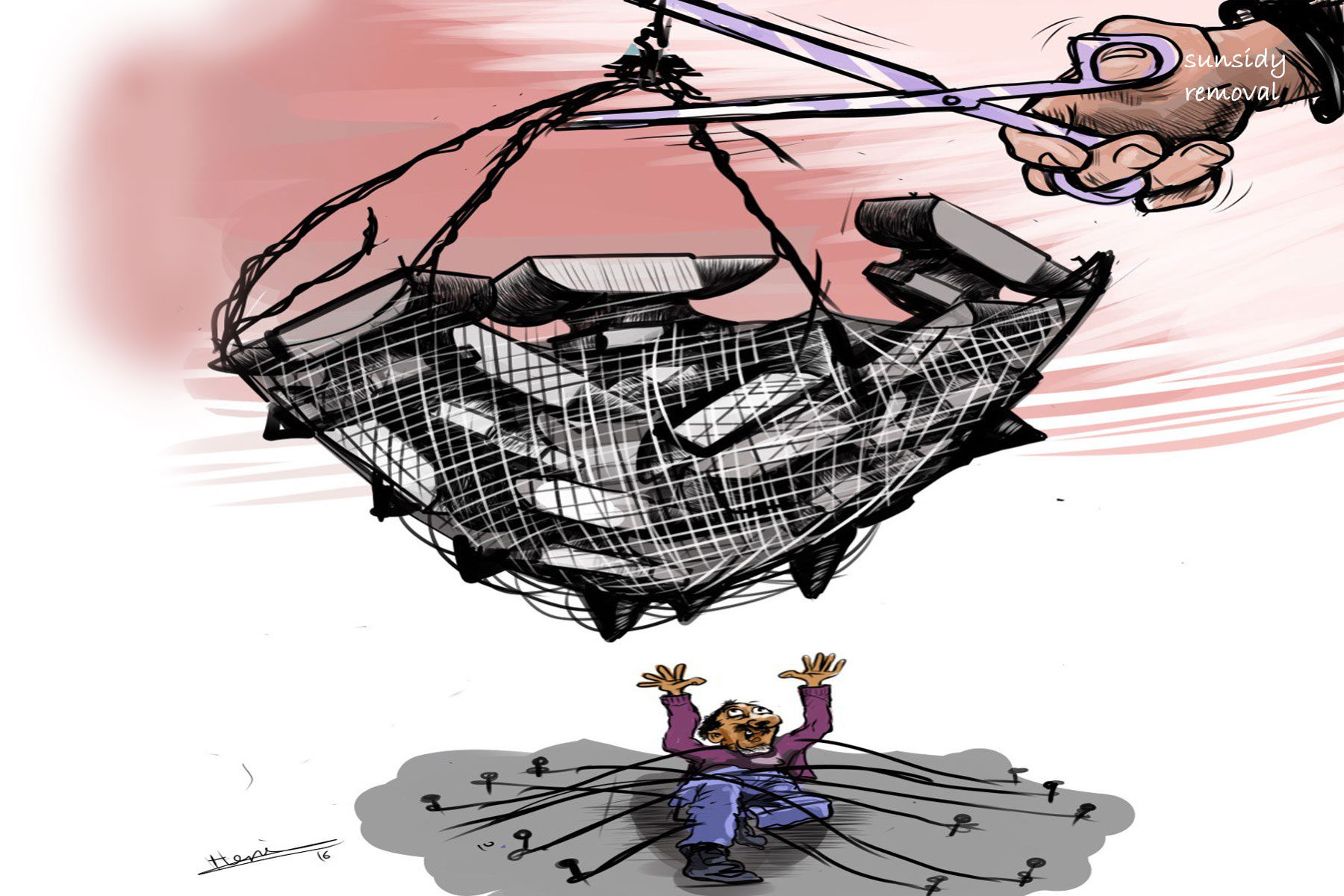

The federal crackdown targets commercial banks selling shares on behalf of companies without the requisite prospectus approved by the Authority. The enforcement action comes as banks face liquidity crunches, making the sale of shares an increasingly appealing method of attracting long-term deposits. The Director's warning proved his government's resolve to impose legal consequences on those banks that continue as vehicles for share transactions without authorisation.

Solomon Bekele, a senior advisor at the Authority, believes prospectuses are vital in ensuring transparency and accountability in public share sales, stressing their importance in the regulatory framework.

According to the officials, the regulatory body's latest mandate that a vetted prospectus accompany all public share offerings is part of a broader push to fortify the financial sector's infrastructure and ensure compliance with an updated commercial code. They defend the regulation for aiming to boost transparency and accountability by compelling companies to comprehensively disclose their financial condition, business operations, and potential risks to investors.

"Their intention doesn't matter," Estifanos Melkamu, a senior legal advisor at the Authority, told Fortune. "Our focus is on ensuring proper licensing and investor protection."

He disclosed that some companies have exploited banks' extensive networks to sidestep formal registration processes and sell shares directly to the public. The Authority has also mandated that all advertisements for the sale of public shares receive prior approval, centralising the oversight of capital market activities. Brook disclosed that the Authority has prohibited advertisements with unapproved share sales to the public to illustrate the changing tides of the financial sector.

"Failure to comply could result in legal consequences," Solomon said.

The impact of these regulations is already being felt across the financial sector.

Deloitte, one of the four biggest international audit firms, became the first recipient of a capital market service provider license under the new regime. Another 14 types of licenses are under review for qualified applicants, pending approval.

For nearly the past three decades, commercial banks have facilitated public share offerings, enabling share companies to capitalise on the banks' nationwide branch access. This relationship helped companies raise capital efficiently and provided banks with a significant boost in deposits. However, with the Authority now requiring a securities broker license for such activities — a license that demands a minimum capital of six million Birr — commercial banks will be forced to reevaluate their strategies.

Tadesse Hatiya, founding president of Sidama Bank, acknowledged the benefits derived from share sales.

"There're no more free lunches," he said, indicating that the era of easy gains through share sales without stringent regulatory adherence is over.

Amid these regulatory changes, some banks under formation are considering alternative capital-raising strategies, facing dire circumstances under the new regulatory environment.

After a two-year hiatus and facing challenges such as the conflict in the north and the central bank's upgraded capital requirements, Geez Bank, under formation, is exploring different options for share sales. With a paid-up capital of around 610 million Br, its promoters are short of the central bank’s five billion Birr minimum threshold set for 2026. One of the promoters, Thomas Haile disclosed that directors have reached out to Prime Minister Abiy Ahmed (PhD), seeking loan waivers and other concessions to aid recovery efforts.

The possibility of mergers is also on the table for some institutions to meet regulatory and capital requirements.

"We might have to merge if the central bank doesn’t make extraordinary considerations," Thomas said.

Banking industry veterans see the new licensing requirement as a dual-edged sword. While it imposes additional burdens during demanding economic times, it also allows banks to diversify their revenue streams through brokerage services. It could enhance banks' competitiveness by broadening their service offerings to include investment opportunities, potentially increasing customer loyalty and generating additional revenue through commissions and advisory fees.

"This can be a revenue source for banks," said Eshetu Fantaye, a banking industry veteran, seeing the oversight as a one-stop shop for customers’ banking and investment needs.

Eshetu believes the ability to offer brokerage services could allow banks to diversify their revenue streams, enhancing their competitiveness in the financial services industry. Nevertheless, he cautioned that banks need to manage risks prudently, including those associated with regulatory compliance, market fluctuations, and potential conflicts of interest in managing brokerage services.

"Astute management is important," he said.

PUBLISHED ON

May 04,2024 [ VOL

25 , NO

1253]

Viewpoints | Apr 13,2019

Commentaries | Oct 07,2023

Viewpoints | Mar 16,2024

Commentaries | Jul 13,2020

Editorial | Jan 19,2024

Letter To Editor | Mar 02,2019

Verbatim | Apr 30,2021

Commentaries | Jun 10,2023

Viewpoints | Dec 02,2023

Sunday with Eden | Apr 02,2022

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

May 11 , 2024

The ruling Prosperity Party - the Prosperitians - has its leaders turned to the Publi...

May 2 , 2024

For successive generations of Ethiopia's tax authorities, the chore of tax collection...

Apr 27 , 2024

The Prosperity Party (PP) - Prosperitians - is charting a course through treacherous...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...