Exclusive Interviews | Apr 19,2025

Dec 21 , 2019

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

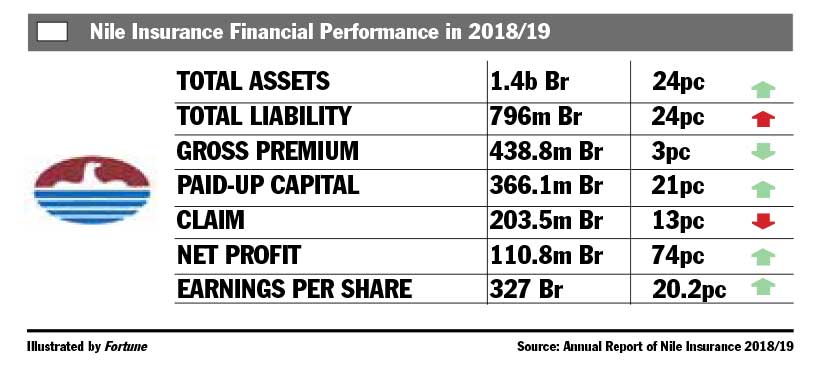

Earnings per share (EPS) also went up by 55 Br to 327 Br. Still, last year's EPS is lower than the 546 Br/share recorded three years ago.

Earnings per share (EPS) also went up by 55 Br to 327 Br. Still, last year's EPS is lower than the 546 Br/share recorded three years ago. Nile Insurance sprang back from a slow performance last year to achieve a 74pc increase in profit by netting 110.8 million Br.

Earnings per share (EPS) also went up by 55 Br to 327 Br. Still, last year's EPS is lower than the 546 Br/share recorded three years ago. Two years ago, the profit and EPS of the company plunged by more than half due to massive expense claims.

Nigus Anteneh, CEO of Nile, attributes underwriting measures in general insurance premiums, claims management and accounting life premiums as reasons for improved performance of the company in the past fiscal year.

"Life insurance was not accounted for in the earlier performance report," said Nigus.

Two years ago, Nile Insurance transferred 22.5 million Br to the life insurance fund, causing the income decline. Nile used to report life insurance premiums every three years, since it was not able to get a local firm to carry out an actuarial performance appraisal.

The firm is now required to report life insurance every year, according to Mekdes Aklilu, chairperson of Nile's board of directors.

"We used to hire foreign firms for the work," Mekdes said. "However, after the implementation of IFRS, we're conducting the assessment every year as part of the overall performance report."

In the last fiscal year, the value transferred to life funds plummeted to 1.5 million Br from 22.5 million Br in the previous year.

As a strong performance, Nile managed to increase its retention rate, reduce its claims, and significantly reduce the money transferred to the life fund.

However, the gross written premium dropped by three percent to 438.8 million Br, and out of this 82pc was retained, two percent higher than the preceding year. The company received 27.7 million Br as commissions, a 22pc increase.

Abdulmenan Mohammed, a financial statement analyst with close to two decades of experience in the area, attributed the stiff competition in the industry as a reason for the reduction in gross written premium.

"The management should be concerned about it,” Abdulmenan cautioned.

Along with fierce competition in the industry, underwriting measures contributed to the reduction in gross written premium, according to Nigus.

"Last year, Nile used a selective approach to exclude high-risk premiums," Nigus explained.

The management excluded high-risk motor premiums, particularly Sino and Isuzu trucks, minibuses, and automobiles such as the Toyota Vitz, which were found in the high-risk category among the motor insurance premiums, according to the CEO.

Claims paid last year also depicted a 13pc decline and reached 203.5 million Br.

"Nile should continue controlling its risks," Abdulmenan suggested.

Nile’s investment activities last fiscal year were not as successful as the previous year. Income from interest and dividends fell slightly by six and nine percent to 47.8 million and 20.8 million Br, respectively.

Nile's total assets have increased by 24pc to 1.4 billion Br. Out of this, 24pc was invested in interest-earning time deposits and 14pc in shares. The investment in interest-bearing accounts went down from 53pc, mainly due to huge investment in fixed assets.

Reduction in time deposits made to increase investment in fixed assets must have caused the marked decline in interest income, according to Abdulmenan.

Nigus agrees on this point, mentioning the 87 million Br payment the firm settled to Rama Construction, which is engaged with the finishing work of the firm's headquarters building in the Financial District of the capital.

“As Nile has considerable receivables," Abdulmenan said, "it should improve its investment activities."

The expense of the company also showed a marked growth of 23pc in salaries and other operating costs to 108.8 million Br, which the expert noted as concerning.

“The management of Nile should keep an eye on expenses,” Abdulmenan said.

The board chairperson argues the expansion in expenses for salaries and benefits is justifiable in terms of staff retention and inflationary pressure in the economy.

The liquidity level of Nile increased considerably in terms of value. The 42pc surge in cash and bank balances reached 40.5 million Br. The ratio of cash and bank balances to total assets remained the same at three percent, whereas, the cash and bank balances to current liabilities showed a slight increase by one percentage point to six percent.

“The liquidity level at Nile is small," said Abdulmenan. "The management should take extra caution against a further reduction."

Nile registered a 21pc increase in its paid-up capital to raise it to 366.1 million Br, with its total capital and non-distributable reserves reaching 427.7 million Br, accounting for 30.9pc of its total assets.

"This shows that Nile has strong capital, so it should use its capital to earn more income," recommended Abdulmenan.

PUBLISHED ON

Dec 21,2019 [ VOL

20 , NO

1025]

Exclusive Interviews | Apr 19,2025

Radar | May 06,2023

Viewpoints | Mar 11,2023

News Analysis | Apr 13,2024

News Analysis | Jan 05,2020

Editorial | Jun 29,2019

My Opinion | Aug 01,2020

Commentaries | Jun 07,2020

Fortune News | Apr 19,2025

Fortune News | Apr 06,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...