Radar | Dec 25,2021

Feb 29 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Its earnings per share (EPS) decreased by 54 Br to 443 Br due to stagnating profit and a rise in paid-up capital. Despite the decline, NICE's EPS is still reasonable.

Its earnings per share (EPS) decreased by 54 Br to 443 Br due to stagnating profit and a rise in paid-up capital. Despite the decline, NICE's EPS is still reasonable. The profit of National Insurance Company (NICE), the country's first private insurance firm, stagnated in the last fiscal year, registering only a single percent increase.

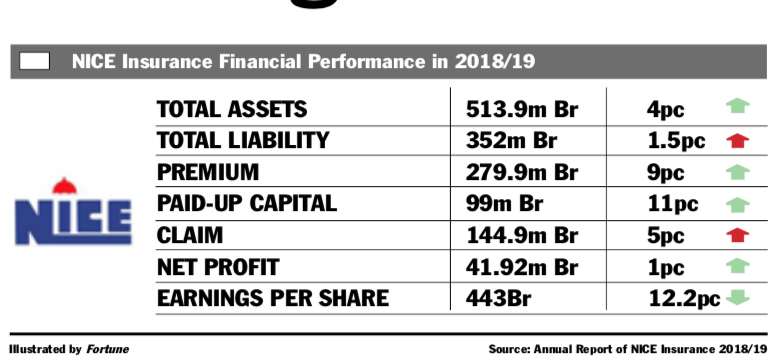

During the fiscal year, the company's profit grew to 41.9 million Br. Its earnings per share (EPS) decreased by 54 Br to 443 Br due to stagnating profit and a rise in paid-up capital. Despite the decline, NICE's EPS is still reasonable.

Many factors contributed to the insurance firm's stagnant performance. Modest growth in underwriting surplus and interest income coupled with a modest increase in claims, as well as soaring salaries and administration expenses, were among the causes.

Tesfaye Debella, CEO of the company, identified cutthroat competition, the high price of spare parts and escalating house rent as among the challenges facing the industry.

In the reported year, the gross written premium of NICE increased by nine percent to 279.9 million Br. Out of this, 91.3pc was retained, the same as the preceding fiscal year. Over the past three years, NICE has reported a high retention rate, which is far above private insurers' average of 79pc.

Out of the total written gross premium, the lion's share, 46pc, went to motor policy accounting. General accident, marine, fire and bond policies constituted the remaining share.

NICE earned 5.8 million Br in commission from reinsurers, 49pc higher than the preceding fiscal year. The commission NICE paid to agents also increased by 14pc to 15.7 million Br.

Even though the written premium grew, claims paid and provided for increased only slightly by five percent to 144.9 million Br.

“This shows that claims were well controlled,” concluded Abdulmenan Mohammed, a financial analyst with close to two decades of experience. "The practice should be maintained."

The investment activities of NICE showed modest growth in the last fiscal year. Interest income increased by five percent to 25.3 million Br, and dividend income went up by 14pc to 10.6 million Br.

An income spike accompanied the surge in expenses. NICE’s operating cost increased considerably. Salaries and benefits went up by 22pc to 45.3 million Br, and other operating expenses increased by 25pc to 36.5 million Br.

Rising salaries, advertisement and utility expenses caused the spike in operation expenses, according to the CEO.

Last year the company opened five additional branches, raising the total number of branches to 40. Its workforce has also reached 126 employees.

The growth in expenses undermined the modest increase in total income, according to Abdulmenan, who recommends that management set up a system to control costs.

In the reported year, total assets of NICE showed a small growth of four percent to 513.9 million Br. This must have been due to slow growth in the insurance business, according to the expert.

NICE’s total assets were below that of its largest peer firm, United Insurance, whose assets spiked by 14pc last year to 1.5 billion Br.

Out of NICE’s total assets, 59.6pc was kept in interest-earning deposits and shares, six percent lower than the preceding year.

"This must have been mainly due to an increased liquidity level," according to Abdulmenan.

The liquidity analysis of NICE shows that its level has improved in value terms. Cash and bank balances increased by 12pc to 39.2 million Br. Cash and bank balances to total assets slightly increased by 0.6 percentage points to 7.6pc.

The paid-up capital of NICE increased by 11pc to 99 million Br, and it has capital and non-distributable reserves of 123.8 million Br. The paid-up capital and the non-distributable reserves of the firm accounted for 24pc of its total assets.

This indicates that NICE is a well-capitalised insurance company, according to Abdulmenan.

Teodros Bogale, a shareholder of NICE for more than a decade, appreciates the firm’s activity in explaining the challenges of the year to the industry.

"The company tried to generate profit by properly investing the cash at hand," said Teodros.

Alemu Reba, a chairperson of the board of directors of the company, says that during the year the board of directors focused on system development and strategic issues to enhance the efficiency and effectiveness of the company’s operations as well as customer service related activities.

"Raising the company’s capital, finalising the architectural design of the headquarters, retouching the company’s strategic plan and organisational structure, and deploying a new IT system will be the focus of the board in this fiscal year," he said.

PUBLISHED ON

Feb 29,2020 [ VOL

20 , NO

1035]

Fortune News | Nov 04,2023

Verbatim | Oct 11,2025

Fortune News | Dec 14,2019

Money Market Watch | Apr 13,2025

Radar | Jan 26,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...