Editorial | Jun 29,2024

Nib Bank's newly appointed Board of Directors rejected Bank President Genene Ruga's resignation last week. His resignation letter submitted on February 10 received a peculiar response five days later, from the Board Chairman Shisema Shewaneka. He hinted at potential legal consequences for Genene, stemming from activities during his tenure that may surface with ongoing investigations by the central bank.

"It's within our mandate," said Shisema.

With three decades of financial background up his sleeves, Genene entered through the doors of Nib Bank in 2014. Armed with a background in agricultural economics and business administration, he commenced his journey as a junior loan officer at the Development Bank of Ethiopia (DBE). His trajectory led him to the vice presidency before assuming leadership at Nib Bank in 2019.

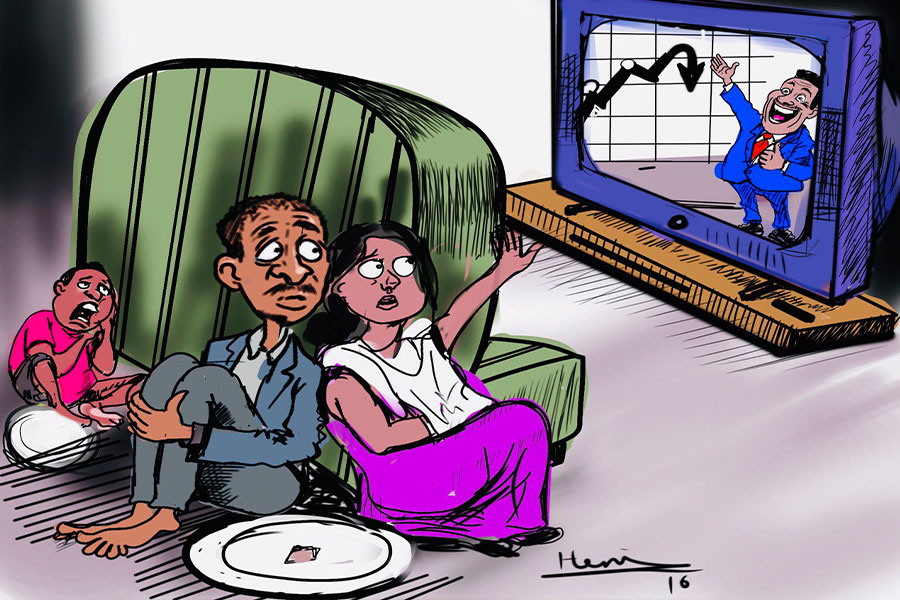

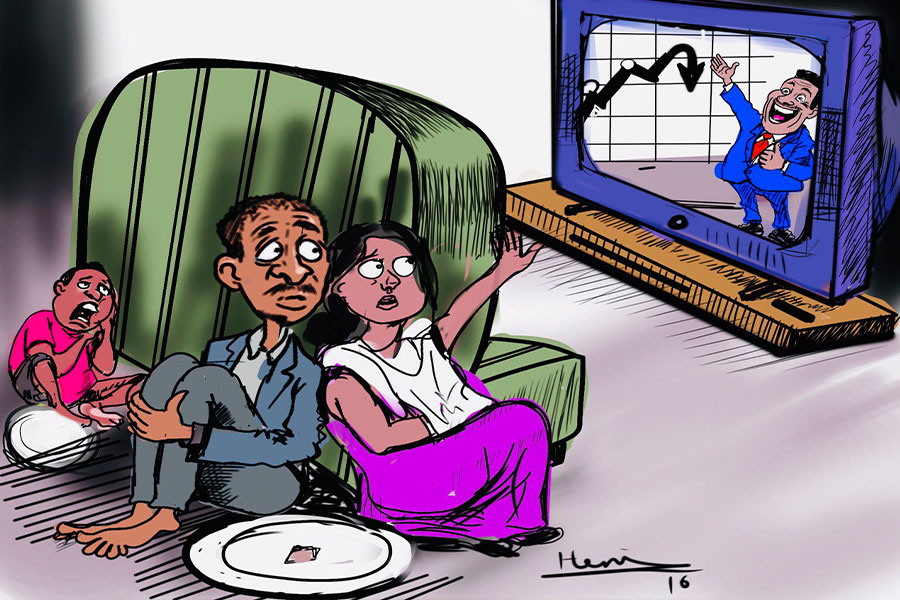

Through his leadership, Nib Bank experienced a surge in financial performance. Its gross profit leapt to two billion Birr in 2021/22, from 645 million Br the previous year, while deposits swelled to 59.4 billion Br from 16.4 billion Br. Loans and advances saw an increase of more than fivefold, reaching 54 billion, and the Bank's total assets grew from 21 billion Br to an impressive 77 billion Br.

However, corporate governance issues and liquidity management issues have also become a point of contention. Nib Bank could not roll out an effective liquidity management system while failing to comply with the Ethiopian Automated Transfer System Rule levied by the regulator. The liquidity ratio and the Bank's reliance on 2.5 billion Br borrowing from the central bank to respond to cash shortages brought to the surface the need for refined liquidity management practices to ensure stability and responsiveness to market demands.

Nib Bank underwent a transformative phase with the formation of a new Board of Directors under the auspices of the National Bank of Ethiopia (NBE) three weeks ago. The shift was triggered by escalating tensions marked by concerns over corporate governance and shareholder complaints. Central Bank's intervention paved the way for significant changes at the general assembly, culminating in the election of a new board of directors.

Chairman Shisema promptly prioritised management changes, setting the stage for a strategic shift to address governance issues flagged by the regulator. While Genene's departure pleased some former colleagues, the central bank imposed a six-year ban on 11 former board members for failure to fulfil responsibility imparted by shareholders, intensifying the challenges surrounding their exit.

A couple of board directors protested the central bank's decision in a letter last month, seeking separate treatment. Amare Lemma argues he was one of the three subcommittees with Alemu Denekew and Kifle Sebgaze, that conducted an assessment report on Causes of High Staff Attrition and Proposed Remedial Measures in 2022.

Nib Bank has grown its staff numbers to 7,661. The report aimed to address resignations and terminations that risked the Bank's future integrity, as a significant number of staff departed starting from June 2021.

The result highlighted concerns such as high staff attrition, centralised management and disrespectful handling of resignations. It also recommended "immediate action" against Genene and certain senior management members, urging gradual replacements within six months if progress was not achieved.

The former Board led by Woldetsenay Woldegiorgis was divided into two factions upon the findings, according to Amare: three members calling for the immediate resignation of Genene and eight agreeing to an extension of a quarter.

"I just want to restore my reputation," he said.

Former employees, shedding light on the work environment, spoke of dictatorial tendencies. A former employee who resigned from the Bank after 14 years of service and climbing to the ranks of district manager claims to have gotten into a serious dispute with management for attempting to protect the livelihood of seven branch managers over what he believed were unjustifiable grounds for termination.

"I was demoted to division management for my defiance," he told Fortune. "So I resigned."

In the face of high discontent, Genene remains upbeat about steering the bank towards greater achievements. The workforce doubled in size, and the Bank's paid-up capital expanded from 1.8 billion Br to six billion Birr. This period of expansion also saw the completion of the Bank's headquarters and the acquisition of three new buildings, enhancing its physical assets.

"I did what I could in the face of numerous challenges," Genene told Fortune.

PUBLISHED ON

Feb 17,2024 [ VOL

24 , NO

1242]

Editorial | Jun 29,2024

Radar |

Radar | Aug 22,2020

Fortune News | Nov 27,2018

Fortune News | Sep 10,2021

Fortune News | Sep 27,2020

Commentaries | Apr 30,2022

Election 2021 coverage | Feb 27,2021

Fortune News | Mar 12,2022

Radar | Feb 15,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...