Oct 24 , 2025

A Central Bank directive, delivered to all the commercial banks today, ordered them to collect and submit information on account holders suspected of conducting commercial activities through personal or third-party accounts, a signal that regulatory tolerance for informal financial maneuvering is evaporating fast.

A statement issued by the National Bank of Ethiopia (NBE) has an uncompromising tone.

“The National Bank of Ethiopia will undertake a coordinated action to curb these illicit practices,” the statement declared.

Fikadu Digafe, vice governor, characterised the impending crackdown as a step toward international banking norms. He told Fortune that the practice had enabled widespread tax evasion, with some salaried individuals holding “millions” in their accounts, far outstripping their declared incomes.

“There are people with constant salaries but millions in their account,” Fekadu said, pointing to the common tendency among service providers, including restaurants, to transact through private accounts rather than company accounts. “This entails tax evasion."

The Vice Governor blames such opaque transactions complicate efforts to monitor illegal money flows.

The order, fired a shot at the heart of the country’s cash-driven informal economy, ordering the banks to report the alleged misuse of personal and third-party accounts for business transactions, marks one of the most aggressive attempts by the authorities who claim that they want to stem tax evasion and illicit financial flows.

The alleged practice, the Central Bank warned, not only evades tax oversight but may also serve as a conduit for proceeds of crime and illegal activities.

"A significant number of bank customers, primarily business organisations and individual traders, were using personal or third-party bank accounts instead of the business accounts that had been opened and registered for their official operations,” the statement said.

The banking industry, long accustomed to an enforcement environment, is now under orders to overhaul compliance systems and ramp up due diligence on customer accounts. According to people following the financial sector, the latest warning could drive more businesses into the formal economy, but it also risks pushing some informal traders further into the shadows if they perceive the new regime as overly punitive or bureaucratic.

Viewpoints | Aug 03,2019

Fortune News | Jul 20,2019

Editorial | Oct 08,2022

Fortune News | Feb 26,2022

Radar | Jun 29,2025

Radar | Jul 03,2021

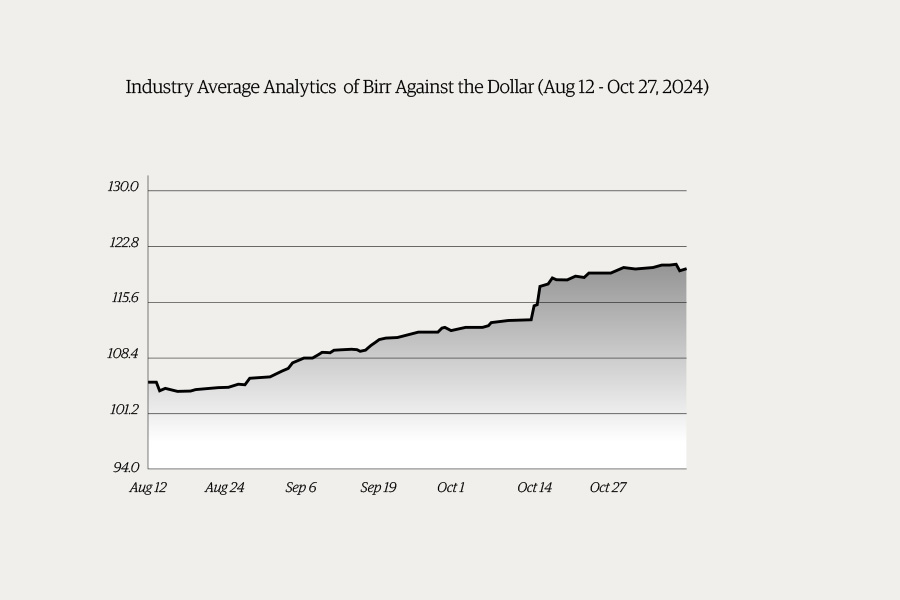

Money Market Watch | Nov 09,2024

Radar | May 14,2022

Viewpoints | May 31,2020

Fortune News | Dec 04,2021

Photo Gallery | 176602 Views | May 06,2019

Photo Gallery | 166813 Views | Apr 26,2019

Photo Gallery | 157353 Views | Oct 06,2021

My Opinion | 136925 Views | Aug 14,2021

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...