Viewpoints | Jan 21,2023

Customs authorities have been directed to consider all motor vehicles imported within three years of their manufacture date as 'new' for the purposes of assessing duty and excise tax.

With the updated definition from the Ministry of Finance, the previous rule requiring a vehicle to be imported within a year of the date of manufacture to be labelled new has been scrapped. However, it requires importers to bring vehicles with mileage not exceeding 4,000Km to benefit from the significantly lower excise tax levied on brand new cars.

This does not apply to three-wheeled vehicles, trailers and similar mechanical vehicles, for which the definition extends to four years.

Legislated in March 2020, the excise tax proclamation significantly reduced the tax imposed on new cars from as high as 100pc to as low as 30pc in the case of vehicles with an engine capacity below 1,300cc. The amendment to the Customs Harmonised System from 2017 has been communicated with relevant authorities through a circular issued last month.

All completely and partially knocked-down vehicles imported to be assembled domestically are also considered new. The amended rule goes on to declare improvements on duty and excise tax rates for minibuses with a seating capacity exceeding 10 passengers.

The government is also encouraging assembly plants by exempting them from excise and duty taxes.

In the amended law, completely knocked down parts of minibuses are fully exempted from excise taxes as well as duty tax. Previously, five percent in excise tax was applicable.

For motor vehicles used for the transport of ten or more passengers including the driver, excise tax on used vehicles exceeding seven years has been reduced from 400pc to 300pc.

The law seems to have achieved the goal, according to Mulay Weldu, head of the tax directorate at the Ministry. The import of old cars declined by 10 fold to 10 million dollars in the second half of last year. Simultaneously, earnings from excise tax increased by 65pc from the 17 billion Br collected in 2019/20.

Car importers in the market state that new vehicles currently dominate the market. While purchasing power in Ethiopia is plunging due to the incessant inflationary pressure and stagnating income, prices of vehicles, which have been dubbed a luxury, has hiked tremendously. The cost of the most sought after automobile in the market, the Toyota Vitz, has doubled in a year's time. A model which would have gone for 400,000 Br a year ago is now being sold for 800,000 Br.

Since the import of old vehicles has been successfully reduced, it would not be fair to impose the same amount of taxation on vehicles that are used for public transportation, according to Mulay.

In a year's time, the cost of minibuses informally referred to as 'dolphin' has increased significantly. Newer models are now being sold for as much as 3.5 million Br while older models, which would have gone for up to 900,000 Br, are now being sold for up to 1.5 million Br.

The Ministry has also recently introduced a directive that allows exemption from excise tax for taxi vehicles imported for the purpose of commercial transportation and to replace old taxicabs.

For Elauto Engineering & Trading Plc, which has been importing taxis for the past two years, the new exemptions are welcome. The company has so far assembled and delivered 470 vehicles. It is also waiting for a shipment of more than 3,300 vehicles to be delivered.

The company has managed to onboard more than 10,000 customers and the price reduction due to the exemption of excise tax has encouraged people, according to Bekele Abebe, managing director of Elauto Engineering.

"The downpayment we collected was not enough to cover our import costs, so it required a huge working capital from our side," Bekele said "Now that tax is lifted off, we can use that amount to cover costs."

The Addis Abeba City Administration kicked off a project last year to replace the old signature blue and white taxis. After the owners meet the threshold for a down payment, Elauto, who has been designated as an assembler for the project, imports knocked-down parts and assembles at three of its manufacturing plants. More than 10,000 taxi owners have registered so far and the company has the capacity to assemble 100 cars a day.

Taxis imported under the City's project for the replacement of old blue and white cabs cost 650,000 Br, in contrast to the 750,000 Br price tag for ordinary deals.

Bekele confirmed that his company has also received a letter detailing the tax reduction for minibuses. Elauto has plans to go into the assembly of transport vehicles with a seating capacity of more than 15 passengers in the short-run.

There is huge demand, especially in cities outside the capital, where the company has 23 branches, according to Bekele. "Officials kept requesting minibuses," he said.

Menelik Solomon, a tax law expert, believes that the amendment will encourage vehicle assembly in the country but cautions the authorities to carry out future amendments in consultation with stakeholders and keeping in mind the demand in the market.

PUBLISHED ON

Jul 24,2021 [ VOL

22 , NO

1108]

Viewpoints | Jan 21,2023

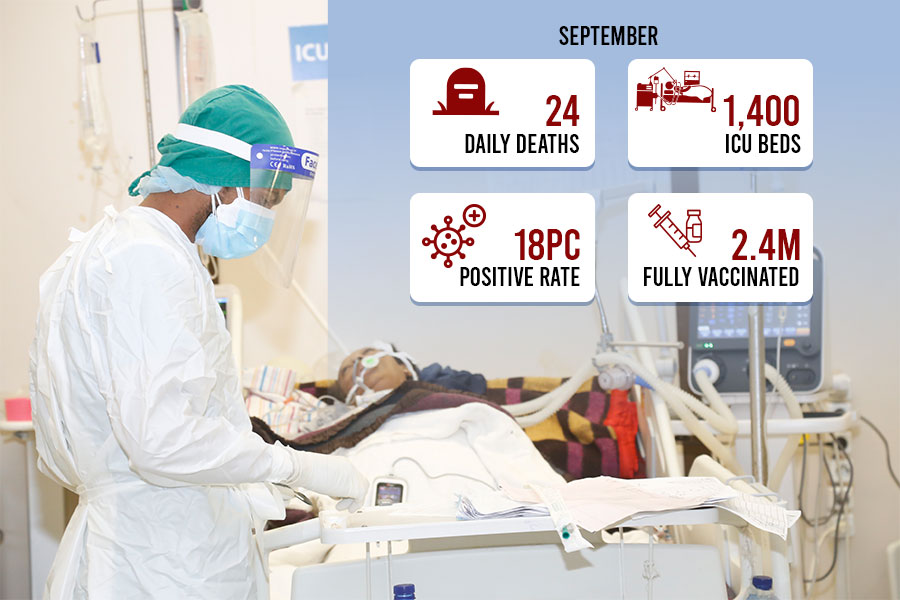

Fortune News | Sep 18,2021

Fortune News | Oct 12,2019

Radar | Sep 14,2024

Fortune News | Dec 05,2018

Fortune News | Feb 25,2023

Fortune News | Jan 16,2021

Fortune News | Feb 29,2020

Radar | Dec 16,2023

Radar | Jun 12,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

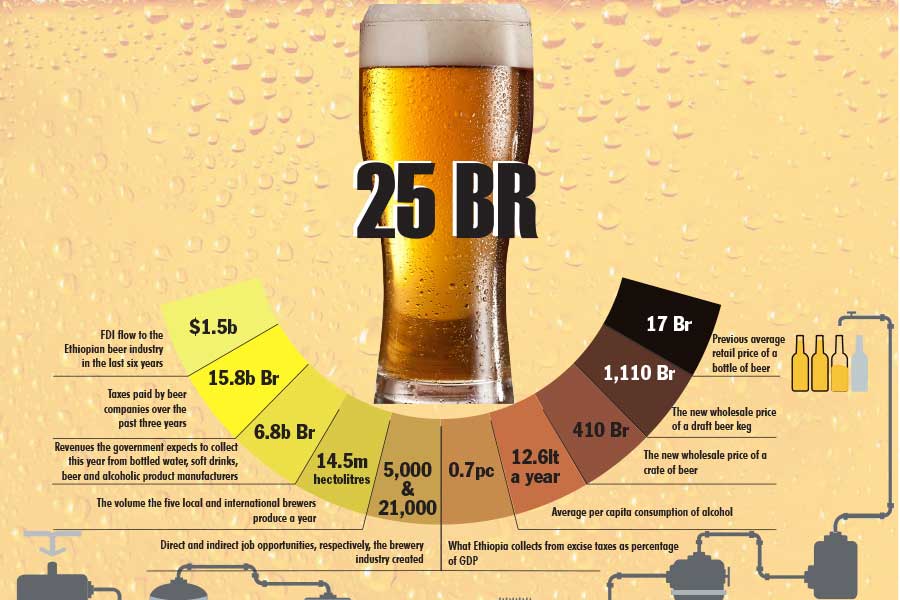

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...