Editorial | Jul 20,2024

Ethiopia's energy policy is under review, with federal authorities hoping to make room for the private sector to generate electric power. Officials say the prevailing energy policy introduced in 1994 no longer suffices to meet the country's growing energy demands forecasted to grow by 30pc annually.

Boosting electric power generation capacity is a priority for a country where only half the geography has access to electricity. Though it is home to abundant energy resources, like wind, solar and geothermal, Ethiopia generates most of its electricity from hydropower. Close to 90pc of the 4,500mw generated power comes from hydropower sources, from dams built and operated by the state.

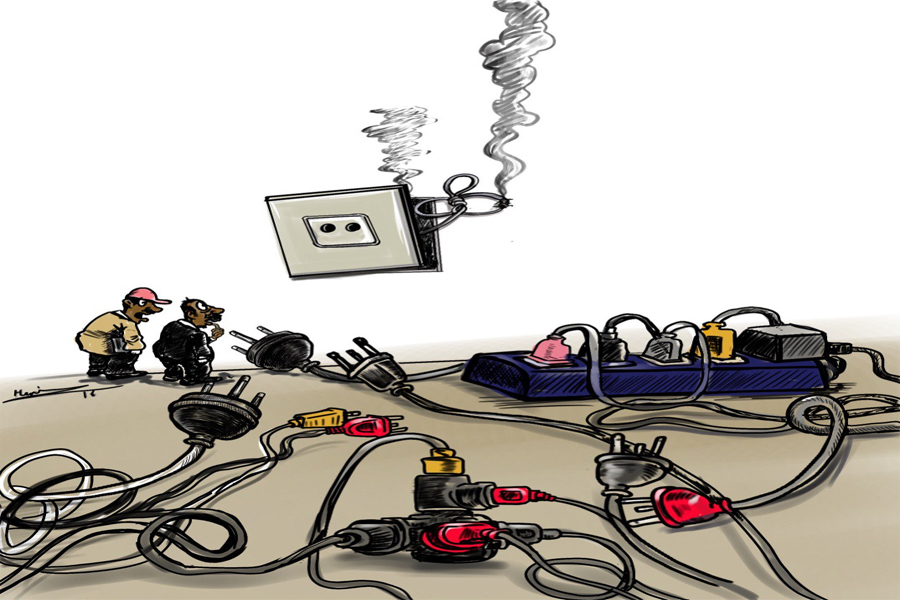

Despite the potential, the country continues to experience shortages and load shedding.

The federal government wants to increase power generation five-fold in a decade, with the private sector accounting for a quarter of this. However, the private sector's involvement in energy production remains almost nonexistent. The exception is Tulu Moye Geothermal Operations Plc, which is developing geothermal power.

Jointly owned by the Paris-based investment firm Meridian SAS and the Icelandic geothermal development company, Reykjavik Geothermal, Tulu Moye's project in the Arsi Zone of Oromia Regional State is scheduled for completion in two years. It will generate 50mw of power, covering 0.012pc of electric power entering the national grid. The company embarked on the project in 2018 with an investment outlay of 800 million dollars.

Experts at the Ministry of Water & Energy sent the draft policy to regional administrations two months ago, according to Sultan Woli, a state minister for Water & Energy.

"The private sector is expected to invest in large-scale projects and small energy technology modalities, like solar energy," said Mesfin Dabi, a senior energy analyst at the Ministry of Water & Energy.

Since 2017, the federal government has pursued a policy shift to attract private capital to the energy sector. Five years ago, Parliament legislated the first law that governs energy production through public-private partnership (PPP) schemes. A directorate under the Ministry of Finance was created to supervise projects under these schemes. A board was also established comprising directors from the National Bank of Ethiopia (NBE), the Ethiopian Electric Power, and Water & Energy and Finance ministries.

“The government has limited capacity to finance energy projects,” said Tilahun Tadesse, director-general of the directorate.

The board has approved eight solar projects over the last four years.

Enel Power, an Italian company, invests in a solar project in Metehara, Oromia Regional State, expected to generate 100mw when completed. According to people close to the matter, it is also in tariff negotiations with the government.

Development organisations are also involved in energy projects.

The Netherlands Development Organisation (SNV) has supported a biogas programme initiated in 2009 with 22 million euros. Hiwote Teshome, energy sector leader at SNV, says the existing energy policy is incoherent and does not consider energy demand.

“The tariff doesn’t consider costs incurred by developers," said Hiwote.

She observed that the government is preoccupied with sheltering end-users from high prices when it sets tariffs. But this excludes the private sector from the game, according to Hiwote.

Tariff negotiations between developers and the government are taking their toll on the viability of the projects, says Tigabu Atalo, an independent power consultant.

“Developers incur costs as the negotiations extend further," he said.

Two solar projects the board had approved before have collapsed due to finance issues. ACWA Power, a Saudi-based energy developer, wanted to develop projects in the Afar and Somali regional states. The Afari-Dicheto and Somali-Gad projects were expected to have generation capacities of 125mw each, with a planned investment of 300 million dollars. ACWA had initially agreed to sell a kilowatt of energy to the government for 0.025 dollars, one of the lowest tariffs in Africa. The company abandoned the projects last year.

The shortage of foreign currency pushed the company away, according to an official at the Ethiopian Petroleum & Energy Authority.

The first batch of projects awarded contracts after ratifying the proclamation has mostly been unsuccessful.

“The policy should fix issues for the upcoming projects," said Tigabu.

Federal officials now show a willingness to explore options that provide guarantees to the private sector to access foreign currency. The Ministry of Water & Energy is studying to revise the existing energy roadmap.

“The study is near completion,” said Sultan.

PUBLISHED ON

Apr 22,2022 [ VOL

23 , NO

1147]

Radar | Oct 15,2022

Radar | Jul 01,2023

Radar | Jun 01,2019

Commentaries | Dec 10,2018

Fortune News | Jun 11,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...