The central bank is embracing a price-based monetary policy, a departure from its traditional approach, as part of a comprehensive three-year strategy outlined by the National Bank of Ethiopia (NBE). The shift, spearheaded by Governor Mamo Mihretu, and his advisors, is seen as an essential step towards addressing the country’s long-standing macroeconomic constraints.

The strategy, unveiled last week, aspires to achieve robust macroeconomic stability through a series of quantitative goals, including beefing up the foreign currency reserves to cover two and a half months of imports by 2026. The plan also targets a significant reduction in inflation, bringing it down to eight percent. It seeks to expand the role and value of digital payments and financial services, with an ambitious goal to increase them more than fourfold to 17 trillion Br.

Central to this strategy is the establishment of a market-based monetary system. The central bank is set to reactivate a monetary policy committee that will spearhead this transition. The committee is expected to guide the economy towards a system where monetary policy decisions are influenced by market dynamics, rather than ideologically driven and government-directed path. Price stability is presumed to be the top priority. Eventually, reconsidering current policies on capital accounts and current accounts based on studies is also part of the strategy.

Fikadu Digafe, the central bank's vice governor, described the shift as a move towards a "more modern system." He believes the price-based monetary system is in line with global central banking trends, where using interest rates as a nominal anchor to steer the economy is the rule. According to Fikadu, this approach allows for enhanced liquidity management, which is crucial for a growing economy like Ethiopia.

"It's an essential instrument in liquidity management," he told Fortune.

A critical instrument in the new strategy is open market operations, a tool for managing liquidity in the economy by allowing the movement of finance based on demand and supply. The central bank's recent agreement with the US-based technology firm, Motran, is instrumental. Motran will supply a Central Securities Depository (CSD), a system essential for implementing open market operations. Supported by a 2.5 million dollar fund from the World Bank, the company's earlier involvement includes supplying the CORE banking system twelve years ago.

One of the central bank’s key initiatives is to transform the size, shape, and scope of the financial sector. This transformation includes expanding access to financial services, digitisation, and encouraging foreign investors and capital markets participation. The strategy emphasises the need for a 'clean and adequate' currency supply, ensuring financial institutions access sufficient high-quality bills. The approach is expected to streamline currency management across the banking sector.

The shift in policy is also expected to have implications for the nascent capital markets. Interest rates are anticipated to play a more significant role in market dynamics, with the central bank retaining a mandate over inter-banking operations. Brook Taye (PhD), the director general of the Capital Market Authority, noted that market-based principles in security markets facilitate a transparent price discovery process, which is indispensable for a thriving capital market.

"The price discovery process can help," Brook told Fortune.

Zemen Bank recently became an inaugural investor in the Ethiopian Security Exchange (ESX) with a five percent stake. Its President, Dereje Zenebe, welcomes the central bank's move, noting that the lack of modern financial instruments has previously impacted liquidity.

"A predictable and reliable financial sector, driven by market forces, can make inflation a healthy phenomenon," he told Fortune. "Banks create money when they lend it, after all."

Dereje views the highly anticipated entry of foreign banks in the domestic market as a positive step towards introducing healthy competition and increasing capital and liquidity in the industry. However, he cautioned against seeing this as a final solution to the financial sector's problems. According to him, the foreign currency crunch is a significant issue, with demand far outstripping supply.

"Everything comes down to demand and supply," Dereje said.

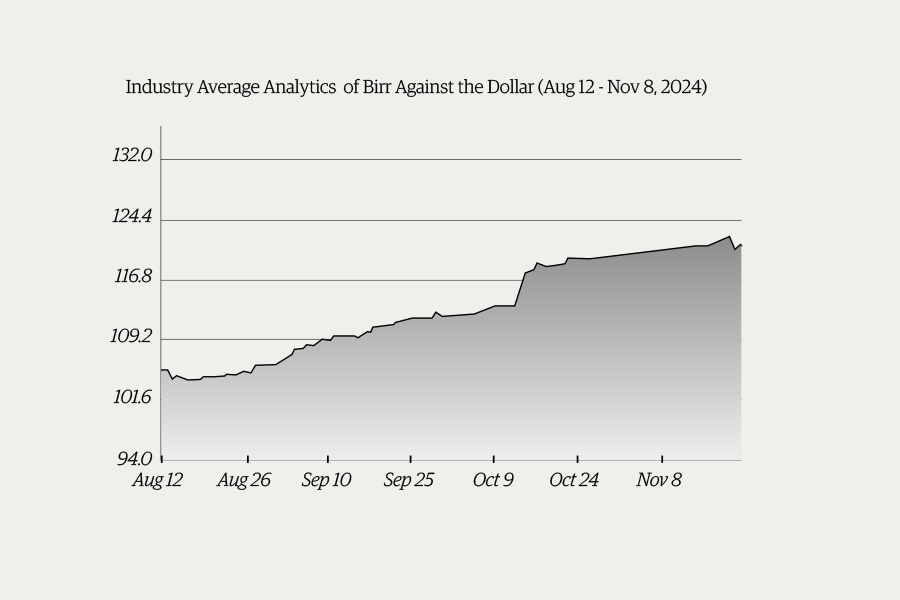

The imbalance has manifested in the foreign exchange interbank market, which saw a 3.3pc decline in the fourth quarter of 2022/23.

The central bank’s definition of external stability includes maintaining an exchange rate that avoids significant or prolonged discrepancies in the parallel market. The dollar rate in the parallel market is more than double the official rate. In the last quarter of 2023, the number of treasury bills sold by the central bank rose by 20.9pc to 149.2 billion Br, while the outstanding bills increased by 6.7pc, reaching 338.5 billion Br.

Efforts to steer Ethiopia's financial industry towards market-based principles are not new, dating back nearly a quarter-century. However, previous attempts faltered due to a lack of institutional follow-up and a shift in economic policies with changes in governments.

Eshetu Fantaye, a veteran banker, advocates for an independent open-market operations committee. He sees the need for a strategic position that distances the committee from government objectives as crucial for taming inflation. Success, according to Eshetu, hinges on shedding insular perspectives, embracing long-term commitments, and embodying institutional autonomy, knowledge, and goodwill.

While aspirations for an interbank market resurge, he acknowledged the historical constraints of both local and foreign currencies. Eshetu considers the central bank’s forex reserve target conservative, yet rooted in a thorough analysis of economic trends.

"It likely arises from inspection of trends in the balance of payments, external debt pressures and assessments of the current and capital accounts," he said.

PUBLISHED ON

Jan 27,2024 [ VOL

24 , NO

1239]

Fortune News | Apr 27,2025

Viewpoints | Dec 31,2022

Fortune News | Jul 30,2022

Money Market Watch | Nov 24,2024

Fortune News | Oct 05,2019

Fortune News | Jul 30,2022

Fortune News | Sep 30,2023

Editorial | Dec 07,2024

Commentaries | Feb 13,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...