Ethiopian Maritime Authority is launching a major overhaul of the logistics sector in a bid to streamline operations and attract foreign investment. A recent study conducted by a UK consulting firm exposed critical bottlenecks hindering the sector's growth. Outdated regulations, a lack of transparency, and limited opportunities for foreign investors were identified as the main culprits.

One of the participants in the study, Yared Shiferaw, has operated in the sector for over 30 years. He observes that a restriction to foreign investors' stake capped at 49pc is seen as unattractive for investment. He said outdated freight forwarding regulation has also resulted in firms operating without clear liabilities.

"Policymakers have to scrutinise the regulatory gaps," he said.

Under the Authority, the Logistics Transformation Office hired Triple-Line and local consultants to conduct a six-month study. According to Temesgen Yihune, deputy director, the study is part of a national strategy to identify gaps and enhance the logistics sector's performance. The recommendations have gone through public consultation and are being reviewed by the Authority before being approved by the National Logistics Council, led by Alemu Sime (PhD), minister of Transport & Logistics.

"Improving transit time, cost and infrastructure is vital," said Temesgen.

Out of 330 freight forwarders in Ethiopia, only 95 are members of the Ethiopian Freight Forwarders Association (EFFSAA). The study suggests stricter regulations for market entry and adopting international standard trading conditions. According to Dawit Woubishet, president of the Association, the relaxed requirements to join the sector under the guise of ease of doing business have made proper monitoring difficult.

While holding a monopoly for the past decades, the study suggests that Ethiopian Shipping and Logistics (ESL) has not invested adequately to grow its services or deliver cost-effective services to customers. The state-owned ESL operates 10 vessels, and 572 fleets which cater to nearly 90pc of the country's logistics demand. The company amassed over 34 billion Br in revenues in the past nine months and netted over four billion Br.

Berisso Amalo (PhD), CEO, said multiple expansions have occurred by increasing the number of cargo, fleets, and vessels. He said external challenges at Djibouti ports with service delays, port clogs and disrupted roads are dealt with through negotiations.

Djibouti ports handle over 400 million tons of freight goods annually, serving as the primary entry point for Ethiopia. However, issues such as pre-clearance and transit delays persist. Ethiopia's efforts to open the logistics sector to private multimodal participation face restrictions due to a 20-year-old agreement with Djibouti, which requires revision.

Constant regulatory reforms are necessary for the sector, according to Elizabeth Getahun, former president of the Ethiopian Freight Forwarders & Shipping Agents Association and CEO of Pan Afric Global. The company is among the three logistics companies recently granted permission to become one of the first privately owned multimodal logistics operators. Elizabeth said operators still have not received permission.

"Proper framework is still missing," she said.

With the bilateral agreement on transit, transportation, operation modes, documentation clearances and tariffs set to be revised in a couple of months, industry insiders are anticipating positive changes.

Henock Tesfaye, general manager of Ocean Logistics, identifies domestic security concerns, absent insurance coverages, foreign currency shortages and clearance payments in Djibouti, and unpredicted revision of tariffs at Djibouti ports, as difficulties. His company has around 10 permanent customers, mainly shipping raw materials for state-owned projects and factories. Henock said freight forwarders make unintended payments, and face delays in the transit of cargo, resulting in inflated demurrage expenses and occasional abandonment of the goods.

"There is a major backlog," he said.

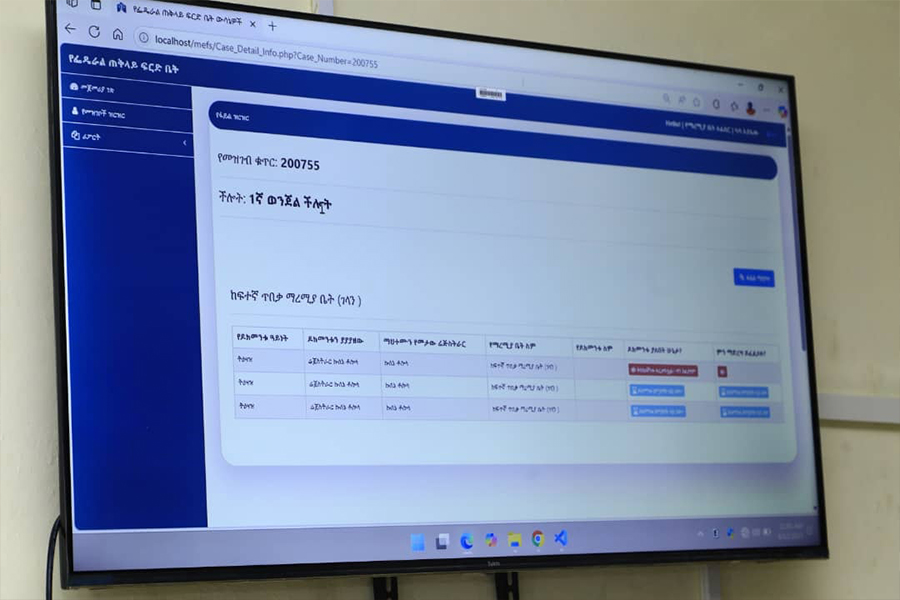

Another area slated for improvement is cargo tracking. The absence of a comprehensive tracking system creates information gaps and hinders efficient logistics management. The study recommends the government implement a digital "Port Community System."

Ethiopia's logistics performance ranks 141st among 160 countries. According to Shiferaw Mitiku, lecturer of logistics and supply chain at Addis Abeba University, tracking and tracing performance has ranked the least due to the poor quality of the fleet and management.

He believes diplomatic agreements have to be based on mutual benefits while suggesting expanding investment in dry port expansions and modernising transport and logistics services to improve efficiency and reliability.

"Institutional capacity needs to be enhanced," he said.

PUBLISHED ON

Jun 22,2024 [ VOL

25 , NO

1260]

Fortune News | Apr 22,2022

Fortune News | Jul 19,2025

Verbatim | Apr 22,2022

My Opinion | Feb 23,2019

Fortune News | Jan 02,2021

Viewpoints | Oct 21,2023

Radar | Jan 07,2023

Radar |

My Opinion | Nov 27,2018

Commentaries | Dec 14,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...