Exclusive Interviews | Jan 27,2024

The National ID Program, a.k.a Fayda, has met citizens with the kind of contention that bruises optimism. Many thought it would lighten the load of everyday transactions, but found themselves wrestling with unscannable QR codes and federal and regional institutions reluctant to accept ID cards. Stories are emerging, emblems of deeper systemic issues, from rejections at banks to sluggish enrollment times that turn a supposedly streamlined future into a stubborn present. The digital identity scheme seeks to unify a fragmented system of Wereda IDs and various local credentials to simplify governance and fight fraud. It arrives at a time of rapid rural-to-urban migration and escalating vulnerabilities in a paper-based system that cannot keep pace with the relentless churn of identity verification. Yet, the benefits promised are often locked behind technical misfires and institutional inertia.

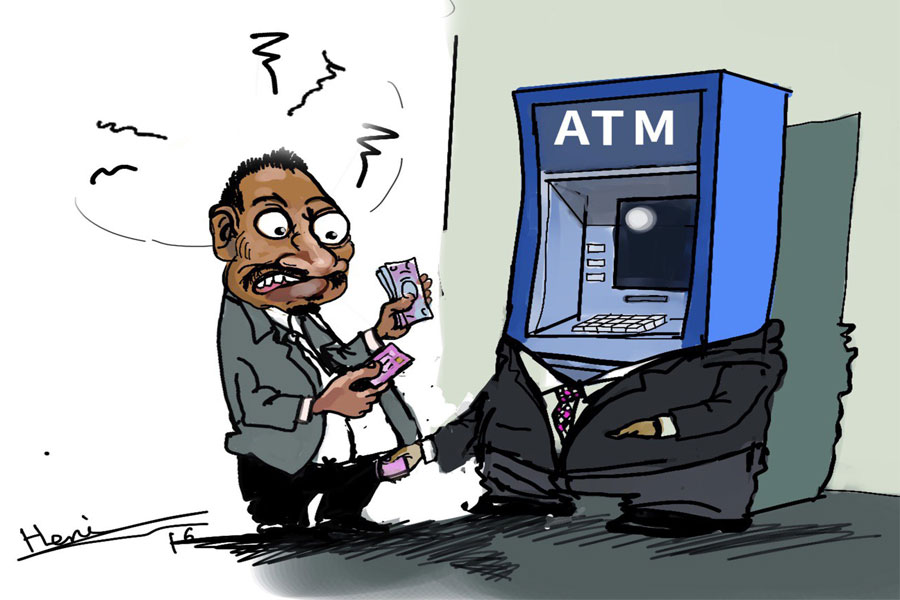

While some institutions, like the Document Authentication & Registration Service (DARA), are pleased to rely on Fayda IDs to prevent fraudulent property sales, others lag behind. The Addis Abeba Driver & Vehicle Licensing & Control Authority requires both the new digital credentials and old Wereda IDs, leaving citizens caught in a tangle of outdated red tape. In this ambivalent atmosphere, Fayda’s early adopters are relieved and unsettled, unsure when — or if — the rest of the country’s offices would fully embrace it. Financial institutions have recognised the importance of implementing the ID system and are racing to safeguard against a relentless rise in bank fraud. With directives from the National Bank of Ethiopia (NBE), major banks have invested in thousands of registration kits, hoping to channel the benefits of digital identification into more secure, transparent accounts. Yet, the rollout remains slow, impeded by import delays and misgivings among customers clinging to familiar forms of identification.

Ethio telecom’s nationwide push to print and distribute millions of these new IDs alludes to a future in which Fayda could reach nearly every corner of the country. The program’s champions envision its eventual acceptance not only warding off forgeries and theft but also boosting the economy. Prime Minister Abiy Ahmed (PhD) believes it could expand GDP by seven percent, forging trust between citizens and service providers and cajoling the informal market into the open. However, the system’s architects face the daunting task of sustaining momentum in the face of scepticism, confusion, and inconsistent acceptance. As the program expands, the pressure mounts to invest in training, awareness campaigns, and incentives to ensure the digital IDs unlock their intended benefits. Without urgent coordination and clearer directives, the promise of a single, secure identity could remain just that, another grand vision waiting to take hold.

You can read the full story here

PUBLISHED ON

Dec 08,2024 [ VOL

25 , NO

1284]

Exclusive Interviews | Jan 27,2024

Radar | Oct 12,2024

Commentaries | Sep 21, 2024

Fortune News | Sep 16,2023

Radar | Jan 15,2022

Featured | Apr 30,2021

Editorial | Oct 28,2023

Radar | Apr 08,2023

Commentaries | Feb 26,2022

Fortune News | Sep 28,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...