Commentaries | Jul 30,2022

Prime Minister Abiy Ahmed (PhD) had a darting tour of Europe last week, where he visited three countries in two days. In Paris, he met his counterpart, Emmanuel Macron, whose country co-chairs with China a creditors' committee negotiating Ethiopia's external debt. Two of his senior officials, Mamo Mihretu, governor of the central bank, and Eyob Tekalign (PhD), state minister for Finance, were in Paris meeting French officials to shore up support to move forward with debt restructuring.

Ethiopia is one of three African countries - Chad and Zambia included - urging its creditors for debt restructuring under the G20 framework agreement, a.k.a Debt Service Suspension Initiative (DSSI). It was launched in response to the COVID-19 pandemic, providing debt relief to the world's poorest and most vulnerable countries. Ethiopia's annual debt service of over two billion dollars was suspended before December 2021. Although extended for another six months, the initiative expired in June 2022.

Ethiopia owes its creditors 26.8 billion dollars up until September last year, which dropped by over one billion dollars from June of the same year, owing it to an appreciated value of the Dollar. It is a trend that continues to help the country save from currency fluctuations of the Dollar against other currencies. Since September, external debt stock has declined by 2.6 billion dollars, about nine percent, compared to June 2021. Official creditors (bilateral and multilateral) claim 81pc of the external debt, while private creditors have the balance, with Euro bondholders taking 3.72pc of the share.

However, private creditors were seen as unenthusiastic about the complex and ongoing debt restructuring process, which Ethiopian authorities see as critical for economic stability and growth. They have a lot of miles to travel before they see meaningful responses.

PUBLISHED ON

Feb 11,2023 [ VOL

23 , NO

1189]

Commentaries | Jul 30,2022

In-Picture | Nov 16,2024

Sunday with Eden | Sep 10,2022

Fortune News | Aug 12,2023

Radar | Oct 19,2024

Agenda | Dec 24,2022

Advertorials | Dec 06,2023

Fortune News | Oct 06,2024

Radar | Sep 29,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

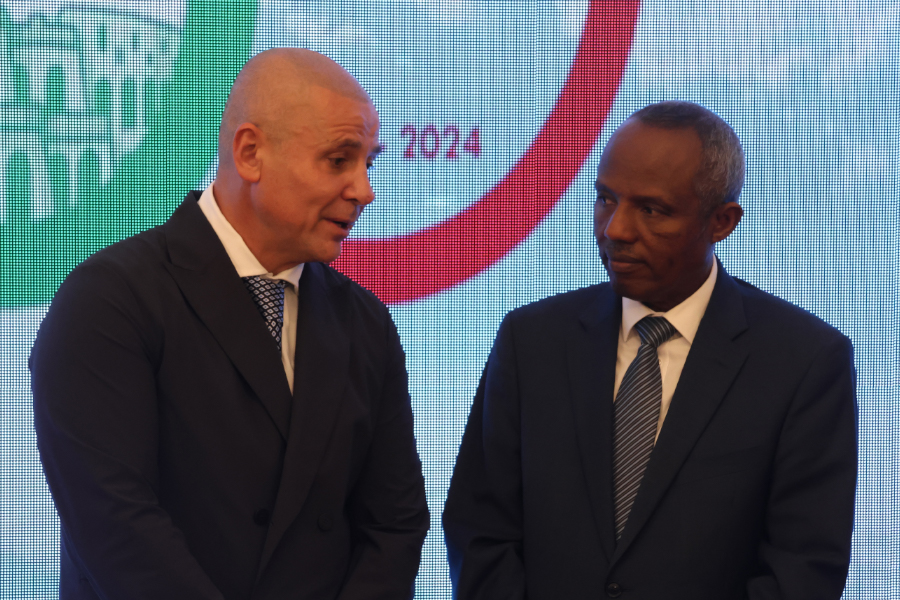

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...