Sunday with Eden | Jun 07,2025

Jun 7 , 2025

By Vera Songwe , Witney Schneidman

In a thought-provoking exchange with Fox News' Bret Baier, the President of the DRC shed light on the evolving dynamics of international influence in Africa. While China's presence is perceived as increasingly prominent, the United States' influence has seen a downturn. As of 2023, China's trade with Africa surpasses US trade by more than fourfold, signalling a dramatic shift from the year 2000, when the US held the title of Africa's largest trading partner, writes Vera Songwe, a nonresident senior fellow at the Brookings Institution, and Witney Schneidman, a nonresident senior fellow at the Brookings Institution. This commentary is provided by Project Syndicate (PS).

In a recent interview, Fox News anchor Bret Baier asked Felix Tshisekedi, the president of the Democratic Republic of the Congo (DRC), how his government would balance continued ties with the United States, including the negotiation of a critical minerals deal, with its deepening relationship with China. The DRC President responded that China’s influence is not so much “waxing” in Africa as America’s influence is “waning.”

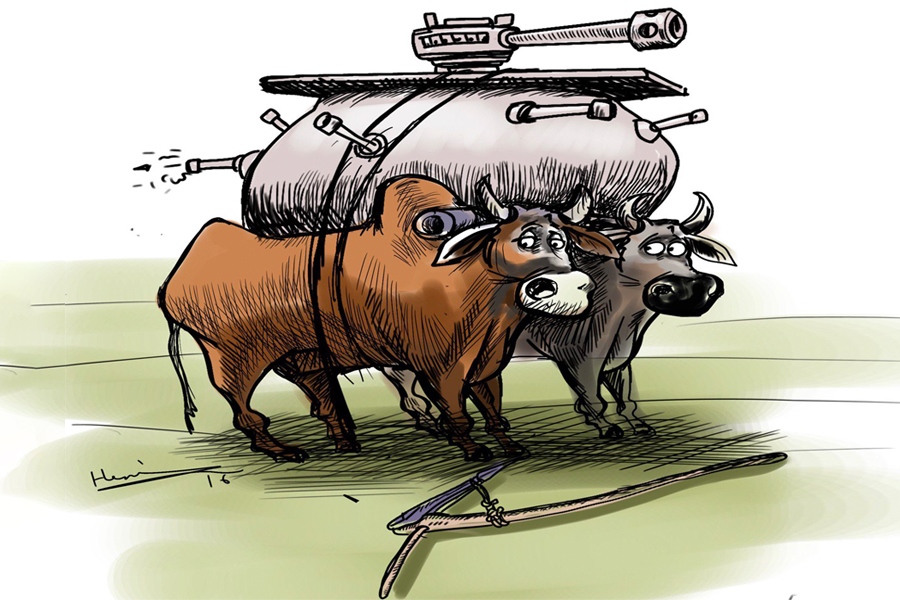

Tshisekedi is right. In 2000, the US was Africa’s largest trading partner; today, China's total trade with Africa is more than four times larger than that of the US. Two US-Africa Leaders' Summits have been held, in 2014 and 2022, and there is no date set for a third, although Congress passed legislation late last year that would compel President Donald Trump to convene a summit this year and every two years thereafter.

Meanwhile, China is preparing to convene its 10th summit with African leaders, through the Forum on China-Africa Cooperation, in 2027. A Gallup poll published last year showed that, for the first time, China’s approval rating in Africa (58pc) had surpassed that of the US (56pc).

Speaking to Baier, Tshisekedi pointed out that the DRC would be “very happy” to see a renewed US commercial presence there. But Trump’s trade policies could have the opposite outcome. And persistent reports that the Trump Administration plans to reduce the number of US embassies and consulates in Africa will only add to this decline in influence.

For the last 25 years, the cornerstone of America’s commercial relationship with Africa has been the African Growth & Opportunity Act (AGOA), a non-reciprocal trade agreement that allows more than 6,000 African products into the US, without duties or quotas. Between 2001 and 2022, African AGOA members exported more than 100 billion dollars worth of non-crude goods to the US. The trade was always supposed to be one-way, but that does not mean it did not benefit US companies, such as Levi’s, Gap, and Walmart, and consumers.

The AGOA was designed to help Africa transform its manufacturing base, thereby shifting the basis of its relationship with the US from aid to trade, a goal that one might expect the Trump Administration, which has slashed foreign aid programs, to support. Participation was conditioned on African governments’ promotion of political pluralism, good governance, and economic liberalisation. And studies have shown that trade with the US increases value-added production, labour productivity, and labour demand in Africa.

But, early last month, Trump introduced "reciprocal" tariffs on many African countries, with some of the AGOA’s strongest performers facing the highest rates: Lesotho (50pc), Madagascar (47pc), and Mauritius (40pc). The 17 African countries that are ineligible for AGOA benefits, mainly due to poor governance, were effectively rewarded with far lower tariffs.

Trump suspended most of these tariffs almost immediately, opening a 90-day window to strike new trade deals. And, to some extent, he is getting what he wanted, with AGOA countries scrambling to salvage their preferential access to the US market. Lesotho, for example, granted Trump ally Elon Musk’s Starlink a 10-year license to operate its satellite network in the country.

Nonetheless, Trump’s tariffs are unlikely to deliver quick wins for the US. Already, African trade ministers have agreed to fast-track policies that will promote trade within the continent, as well as diversify exports to reduce their countries’ dependence on particular foreign markets. Add to that the shuttering of the US Agency for International Development (USAID) and the Millennium Challenge Corporation, the closure of Voice of America (VOA), and the lapse of the President’s Emergency Plan for AIDS Relief, and America’s footprint in Africa is shrinking fast.

But, there is a way for Africa to leverage the US administration’s interests to the benefit of both sides. Trump’s top priority in Africa is securing access to critical minerals. This makes countries like the DRC, which boasts the world’s richest copper deposits and four of the world’s five largest cobalt mines, as well as Gabon, Zambia, South Africa, and even Chad, strategically important. The US is already in talks over a minerals deal with the DRC and others.

The only problem is that China is far ahead of the US on this front.

Chinese state-owned companies and banks control 80pc of the DRC’s cobalt production, and 60pc to 90pc of the world’s cobalt supply is refined in China, whereas the US produces less than one percent of the world’s cobalt. This imbalance drove the former US President Joe Biden's Administration to develop the Lobito Corridor initiative, to expand the 800-mile rail line that extends from the Angolan port of Lobito on Africa’s Atlantic coast through the mineral-rich DRC to Zambia.

This initiative, for which the Trump Administration has signalled its support, will upgrade African infrastructure by establishing partnerships between the US, African governments, African-led financing agencies such as the Africa Finance Corporation, and the European Union. However, African countries should do more to ensure that any critical minerals agreement provides a genuine boost to their economies, especially by insisting that some value-added production occurs on the continent.

To complement access to Africa’s critical minerals, the US should also commit to processing them and adding value on the continent, for example, making cobalt into battery precursors before export. Since Chinese companies have shown no interest in doing this, such an exchange would position the US as a more valuable partner, thereby ensuring its long-term access to these vital resources. Given that Africa has all the minerals needed for production, spread across more than 10 countries in Central and Southern Africa, the development of local processing capabilities would also be consistent with the goals of the African Continental Free Trade Area (AfCFTA).

Africa and the US are both seeking to strengthen their manufacturing sectors, but this is not a zero-sum game. On the contrary, by agreeing to help strengthen Africa’s industrial capabilities, the US could gain greater access to resources its own industry needs, reverse the decline of its commercial influence on the continent, and contribute to the revival of wider, mutually beneficial trade. This could lead to more balanced current accounts, just as Trump desires.

PUBLISHED ON

Jun 07,2025 [ VOL

26 , NO

1310]

Sunday with Eden | Jun 07,2025

Sunday with Eden | May 24,2025

Radar | Jul 28,2025

Radar | Dec 08,2024

Radar | Sep 04,2022

Fortune News | Sep 28,2025

Editorial | Jun 22,2024

In-Picture | Aug 04,2024

Radar | Feb 17,2024

Obituary | Mar 30,2024

Photo Gallery | 178812 Views | May 06,2019

Photo Gallery | 169010 Views | Apr 26,2019

Photo Gallery | 159857 Views | Oct 06,2021

My Opinion | 137117 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...