Fortune News | Apr 04,2020

Mar 7 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Global started the process of obtaining a license from the National Bank of Ethiopia (NBE) to launch the service by filing a request this month, which is pending approval.

Global started the process of obtaining a license from the National Bank of Ethiopia (NBE) to launch the service by filing a request this month, which is pending approval. Global Insurance is on its way to becoming the first company to launch Takaful, an insurance product that is as required by Shariah law.

Global started the process of obtaining a license from the National Bank of Ethiopia (NBE) to launch the service by filing a request this month, which is pending approval. The company plans to start the service in a window-based Wakala model. It has a plan to provide the service mainly in the major cities, including Addis Abeba, Dire Dawa, Harar and possibly Jimma.

The firm started the process of getting the license following a proclamation that was legislated this January to allow the service for the first time. Takaful depends on members of a community who contribute a certain sum of money into a pool to support each other during times of hardship including loss or damage. Takaful covers health, life and general insurance.

Before starting the process to introduce the service to the local market, Global has conducted rigorous research with the AlHuda Centre of Islamic Banking & Economics, said Asseged Gebremedhin, deputy CEO of Global.

Established in 2005 and headquartered in the United Arab Emirates with two regional offices in Pakistan and South Africa, AlHuda also supported Global by conducting a feasibility study.

The feasibility study examined the possibility of providing the service in Ethiopia, identified potential market areas, and suggested strategies to penetrate the insurance market, according to Asseged.

Global and Alhuda have been working on the project for the past year, according to Ahmed A. Sherief, chairperson of the board of directors of Global, which had 109 million Br of gross written premium in the last fiscal year. Its paid-up capital also reached 136 million Br.

Asseged explains that there is a need for the service.

"A lot of effort has been exerted to start the service," he said.

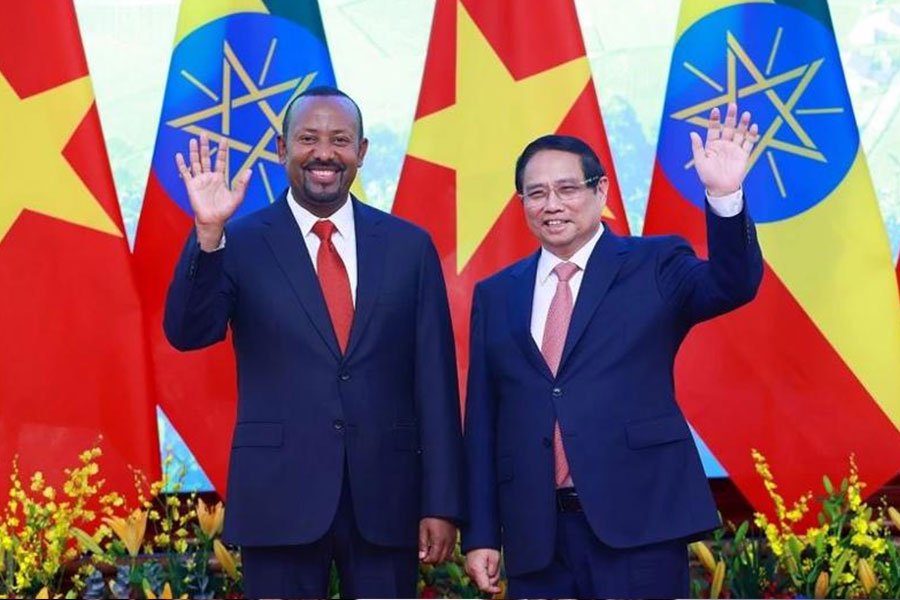

The service was allowed after Prime Minister Abiy Ahmed (PhD) came to power. The Prime Minister also gave consent to the financial institutions to launch full-fledged, interest-free banking services.

“While we're waiting for a response from the central bank," said Ahmed, "we're working on fulfilling all the preconditions to start Takafulservice and building our human resource capacity with the assistance of AlHuda."

Hikmet Abdella, director-general of the Accounting & Auditing Board of Ethiopia (AABE), emphasised that maintaining the capacity of institutions and their human resources by drawing on other country’s experiences is vital for the success of such types of service.

"Drafting a proclamation is one of the first steps, and issues of directives, tax implications, and the standards and regulation aspects should be considered," she said.

In the last fiscal year, the 17 insurance companies operating in the country have increased their capital by 49.5pc to 8.2 billion Br, of which the share of private insurance companies was 68.3pc.

Fikru Tsegaye, who has worked in the insurance industry for 16 years and has conducted six studies on Takafuland related issues for the East African Finance Forum, says there are issues that must be addressed before the service is launched.

Fikru, who currently manages business development & corporate affairs at Ethiopian Reinsurance, says that before opening the service to the public, issues like the agent model, investment directions, profitability and regulatory reporting supported by a directive should be considered comprehensively.

The regulations that govern the service should support the development of the business and must be incorporated into the government’s financial sector strategies, according to Fikru.

“Unless the public is well-informed, some misconceptions may occur when introducing new kinds of products such as this," he said. "For instance, the public should be aware that Takafulcan be for non-Muslims too."

The insurance firms should also provide appropriate service in regard to surplus distribution and investment issues among others, recommended Fikru.

PUBLISHED ON

Mar 07,2020 [ VOL

20 , NO

1036]

Fortune News | Apr 04,2020

Fortune News | Sep 21,2025

Commentaries | Dec 29,2018

Radar | Apr 19,2025

Radar | Oct 12,2024

Fortune News | May 23,2021

Commentaries | Aug 23,2025

My Opinion | May 06,2023

Exclusive Interviews | Jan 05,2020

Radar | Sep 23,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...