Radar | Jan 01,2022

The federal government will likely toss fuel subsidies entirely by the middle of next year. The Council of Ministers has passed a regulation that would see subsidies progressively lifted off in a year, with motorists carrying the full weight of global prices by July next year.

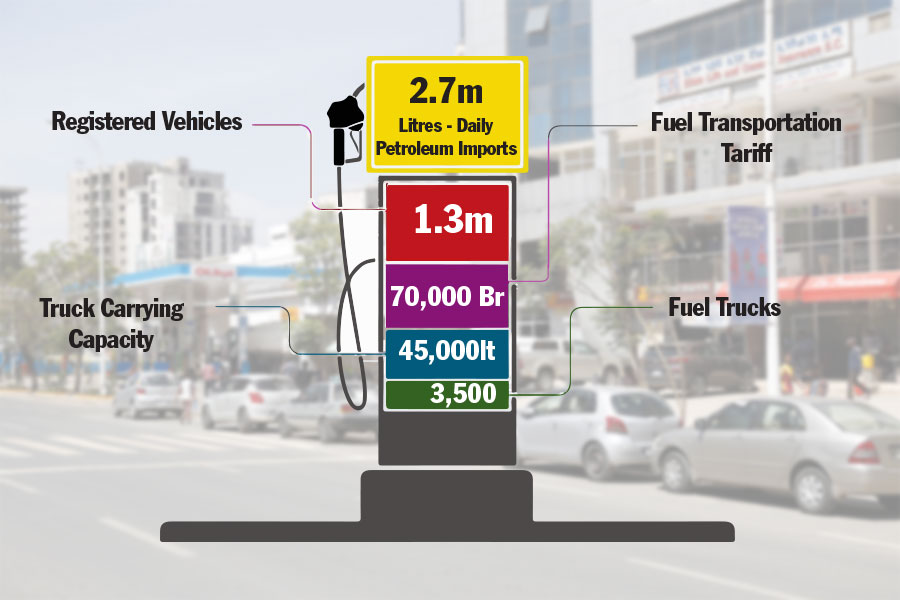

The regulation has introduced a six-month transition; the new scheme begins to apply on prices of benzene, diesel and kerosene products in July. An estimated 300,000 vehicles providing public transport services, excluding ride-hailing, will see a 10pc bi-annual rise in prices for five years. The remaining one million vehicle owners will be subjected to quarterly increases of 25pc for one year. Federal authorities believe the gradual lifting of fuel subsidies is necessary to ease the "burden endured by low-income segments of the population."

However, it is a move likely influenced by the growing federal budget deficit and ways of bridging it outside of monetary measures.

The federal government heavily subsidises fuel to the tune of around 25 billion Br last year through the Ethiopian Petroleum Supply Enterprise (EPSE). The Enterprise buys a litre of benzene at 44 Br, not including transportation costs. Despite the fluctuation of prices in the global market, domestic retail prices have only seen increases over the past years, unable to meet costs. Benzene is sold for 31.74 Br a litre at pumping stations and diesel for 28.94 Br.

Last month, the Ministry of Trade & Regional Integration adjusted fuel prices by record-high increments under the pressure of rising import bills. Its officials saw fit to cut subsidies by a quarter, leaving the cost to be shouldered by the public. The bill to import fuel - more than two billion dollars a year - is also rising. Fuel imports represented 11pc of the import bill last year. Though it was less than the preceding year in dollar terms, depreciation meant the figure was much higher in Birr.

Depreciation and rising costs in international markets have strained government coffers. The increasing prices have also tested the financial standing of the Enterprise, said Ahmed Tusa, acting head of the Petroleum & Energy Authority, during a media briefing last month. The lifting of the remaining 75pc in subsidies would push retail prices to over 50 Br a litre, not accounting for changes in the global market.

A barrel of Brent crude oil has seen prices more than double over the past year, hovering around 88 dollars last week. It was closer to 60 dollars three months ago.

Federal and regional authorities mandated to oversee the distribution will have to prepare to enforce the phasing out subsidy. The Ministry of Transport & Logistics is mandated to compile data on vehicles to continue receiving subsidies, including daily and monthly fuel consumption. It will enforce the installation and use of GPS technology on public transport vehicles and ensure that all cars have unique tags.

The Ministry of Finance will approve a receipt that the Petroleum Supply Enterprise will distribute to the 42 oil companies and the 1,200 gas stations operating under them.

The deficit incurred by oil companies and fuel retailers due to the gradual lifting of subsidies will be refunded by the Enterprise with interest, an official following the case disclosed. The refund period is not determined in the regulation, but it will be prompt not to hold up the companies' and dealers' working capital, according to this official. Dealers will be required to devise administrative procedures to distinguish vehicles that will continue buying fuel at subsidised prices.

Unless reimbursement is carried out on time, it will tie up cash for dealers who are already struggling to make cash-based payments for the fuel they receive, according to Ephrem Tesfaye, board member of the Petroleum Dealers' Association.

The illicit trade that could arise due to the dual-rate system is another concern raised by industry players. The regulation pledges stringent monitoring to prevent those receiving subsidised prices from selling fuel illegitimately. Administrative measures against those found in violation include revocation of subsidy privileges and criminal proceedings.

"I don't think the difference between the two prices is that attractive," said Ephrem.

He believes there is little to worry about illicit trade.

Officials of the Transport Ministry and the Authority have held discussions with managers of oil companies and dealers, giving them a detailed rundown of the scheme to be introduced next July.

"We'll see how efficient it will be," said Ephrem.

Teshager Amare, an economist and a consultant in commodity exchanges in African countries, argues in favour of keeping the subsidies. He worries any increase in the price of fuel comes with inflationary pressure. Headline inflation stood at 34pc in November.

Teshager sees the decision to lift subsidies as ill-timed. He advises officials to focus on developing a post-war recovery plan and rekindle economic activities before further removing subsidies lifts.

"Time should be taken to assess the impact of subsidies that have been lifted already," he said.

PUBLISHED ON

Jan 22,2022 [ VOL

22 , NO

1134]

Radar | Jan 01,2022

Editorial | Jan 22,2022

Viewpoints | Feb 11,2023

Viewpoints | May 11,2019

Agenda | Feb 20,2021

Fortune News | Feb 12,2022

My Opinion | May 14,2022

Radar | Nov 13,2021

Fineline | Dec 14,2019

Fortune News | Mar 23,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...