Oct 7 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

A recent amendment dubbed the "wall and roof tax" - colloquially known as the "property tax" by the populace - is under scrutiny. This tax faces stiff legal resistance four months after its inception, led by the Ethiopian Federal Advocates Association (EFAA), an influential legal body comprising 5,300 members.

The Association’s leaders sought clarity from city officials, submitting four-page comprehensive references from property rights documents, tax regulations, and the law hierarchy in the country. Authors of the document have referred to statements of Adem Nuri, Abdulkadir Redwan and Asmamaw Mulgeta, bureau heads of the revenues, finance and property tax project office, respectively.

Addressed to the Addis Abeba City Administration’s Finance Bureau a week ago, the Association’s inquiry raised several contentious issues from the legitimacy of the Bureau setting rent estimates, the tax’s alignment with an administrative services proclamation from three years ago, to the application of the amendment without a superimposed approved regulation and whether inflation rate was taken into account.

Legislation enacted 47 years ago served as the foundation for the recent amendment. This law, albeit archaic, allowed for property value approximations by a provisional project office, nestled within the city’s Finance Bureau. In what could be dubbed "archaeological economics", city authorities used a seemingly faded transfer of legal prerogatives dating back nearly half a century. The authorities are candid about the causes that triggered these changes. A marked discrepancy between tax revenues and the infrastructural demands of the capital is attributed to their controversial move beginning last year.

However, the Association’s President, Tewodros Getachew, voiced his concerns over the tax’s broader implications.

“Possession of property does not prove capacity to pay,” he told Fortune.

Backing their inquiry, an elite team of legal specialists guided by the Association has sifted through laws and directives spanning the Imperial regime and subsequent regimes for two months before penning their concerns to the authorities.

“The aim is to amplify citizens' concerns,” Tewodros told Fortune.

He echoed the shock property owners experienced at the tax’s imposition at a time of runaway inflation and aggressive tax collection methods.

A particular bone of contention, highlighted by the Association’s leaders, is the perceived sidelining of the country’s administrative procedure. They argue that a simple letter lacks the legal heft required to establish authority, pointing out that the present amendment appears to overstep its boundaries, commandeering responsibilities initially vested in the defunct Ministry of Urban Development.

While the Finance Bureau’s response remains eagerly anticipated, the Association has already demonstrated its mettle by submitting a review of a criminal bill tabled in Parliament last year.

The new “property tax” has seen an astonishing 53-fold surge since April, skyrocketing from 47.5 million Br the previous year to a staggering 2.5 billion Br, and the fiscal year is not even over; a five-month tax window remains. A significant portion, 60pc, of Ethiopia’s federal budget hinges on tax revenues, leading to increased financial pressures on retired pensioners and irregular-income citizens.

Alemnesh Mohammed, a 56-year-old widow, is one of these citizens who found herself on the receiving end of an unpopular law. She lives in a studio apartment, sharing it with her son, his wife and their child. A sole breadwinner for her family, Alemnesh is already reeling from the pressures of the property tax imposed on her. Earning an additional but meagre income from washing clothes, she paid 1,700 Br in property tax last year.

This was half the estimated value for the year the authorities demanded. Alemnesh is unsettled about what is yet to come. With the looming amendment, Alemnesh’s tax liability is poised to double, casting a shadow over her financial future.

“I’m afraid of the future,” said Alemnesh.

She is concerned about security when contemplating renting her apartment, which is in a prime location around Mechare Meda, Sar Be’t area, and moving to the capital’s outskirts. Alemnesh suffers from chronic back pain triggered by her long hours washing clothes. Having accrued 3,000 Br unpaid fees from Community-Based Health Insurance (CBHI), a scheme where the state subsidises medical expenses, she must pay her debt before getting further treatments.

“Hospital payments are too much for me,” she told Fortune in a drafted tone.

As inflation gallops forward, there is another development on the horizon. Legal experts at the Ministry of Finance are working on a nationwide property tax proclamation to bolster the tax base, hoping to generate massive income to cover the federal budget deficit expected to exceed 90 billion Br this fiscal year.

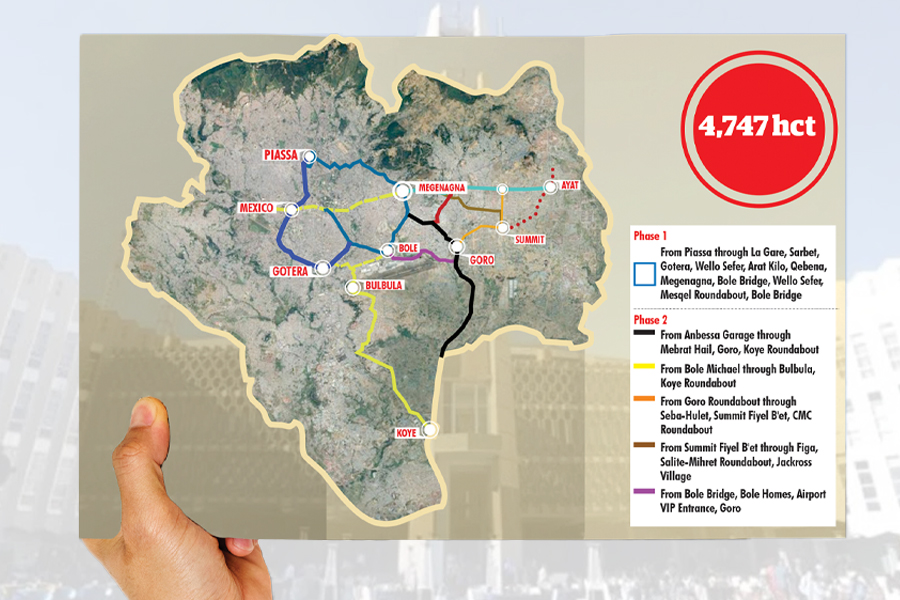

Addis Abeba City Councilers have approved a budget for this fiscal year of 140 billion Br, short of the initial draft budget Mayor Adanech Abiebie cabinet tabled at 203 billion Br. Coupled with the ambitious tax target exceeding 144 billion Br, the urbanites are restless.

Abudlkadir Redwan, head of Addis Abeba’s Finance Bureau, alluded to an impending directive poised to offer relief to the economically disadvantaged, ensuring their exemption from this tax.

“People under safety net programs would automatically get exempted,” Abdulkadir told Fortune.

He remains staunch in his conviction that the amended tax stands robustly on the legal foundations of the country.

“Without a shred of doubt, it [the amendment] is lawful,” he said.

He disclosed that a thorough response from the Justice Bureau was forthcoming to the Association’s leaders.

The Addis Abeba City Administration's lofty ambitions aim to boost the property tax's contribution to the city`s budget from a tiny 0.1pc to a whopping 20pc – with Nairobi's standards as their North Star.

However, the urban populace remains on edge.

Further complicating the sage is a lawsuit by the opposition political party, Enat Party, lodged against the Addis Abeba Finance Bureau. Filed before judges of the Federal High Court last month, the lawsuit brands the “wall & roof tax” as being blissfully unaware of the economic reality of citizens.

The private sector has not remained a silent spectator either. A fiery discussion ensued a few months back with city administration officials, organised by the Addis Abeba Chamber of Commerce & Sectorial Association. Yohannes Woldegebriel, the Chamber’s director of Arbitration and a vocal critic of the property tax, endorsed the Assoctation’s position.

“They’ve finally woken up,” Yohannes quipped, urging its leaders to maintain their focus on public interest.

Editors' Note: This article was updated from its original form on October 11, 2023.

PUBLISHED ON

Oct 07,2023 [ VOL

24 , NO

1223]

In-Picture | May 12,2024

In-Picture | Nov 16,2024

Commentaries | Mar 01,2024

Radar | Oct 20,2024

Fortune News | Aug 25,2024

Radar | Mar 02,2024

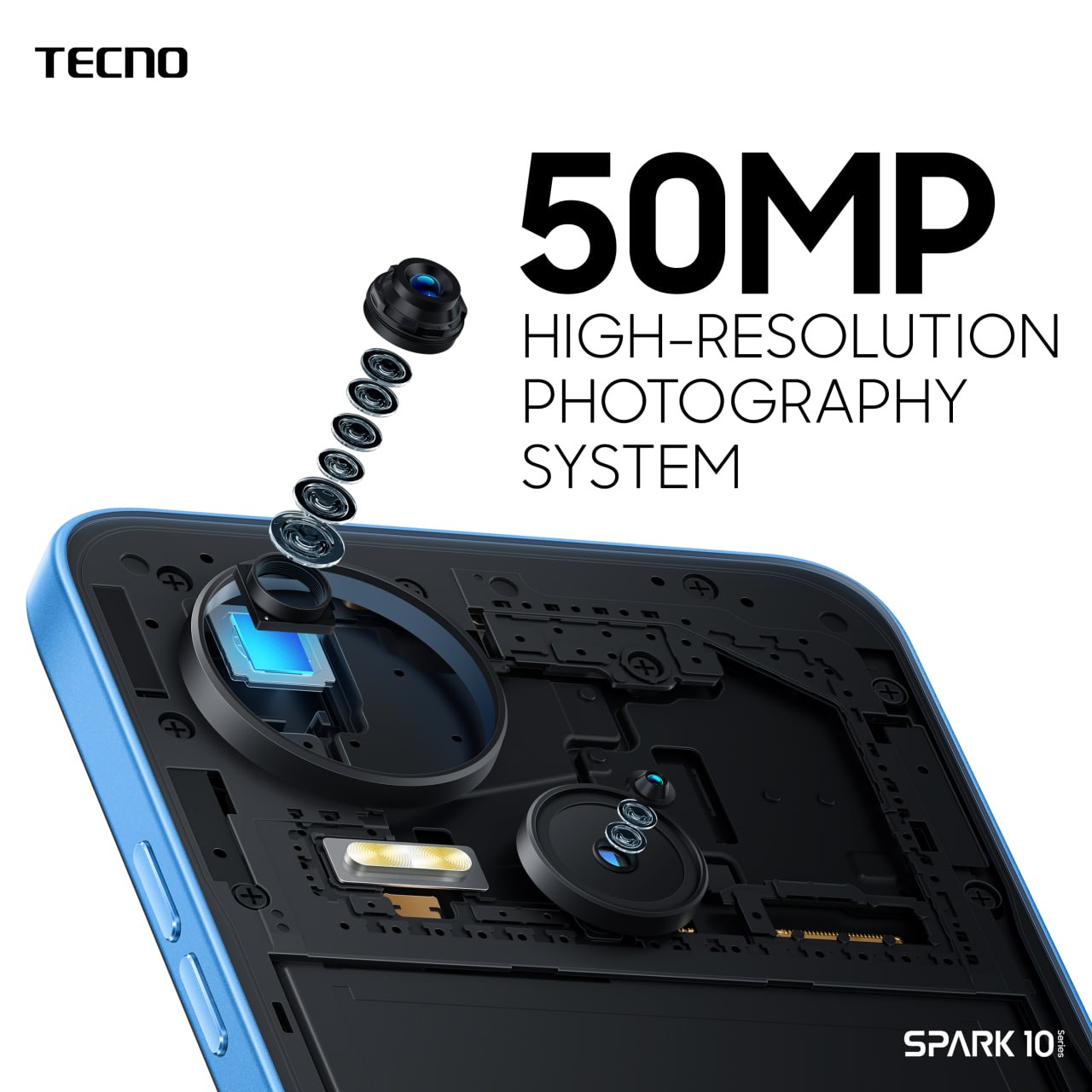

Advertorials | May 15,2023

Fortune News | Feb 10,2024

Radar | Sep 29,2024

In-Picture | Jun 22,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...