Radar | Oct 01,2022

Ethiopia is preparing to send its first shipments through Kenya's Port Lamu, in a move to diversify its trade routes and reduce heavy reliance on ports in Djibouti.

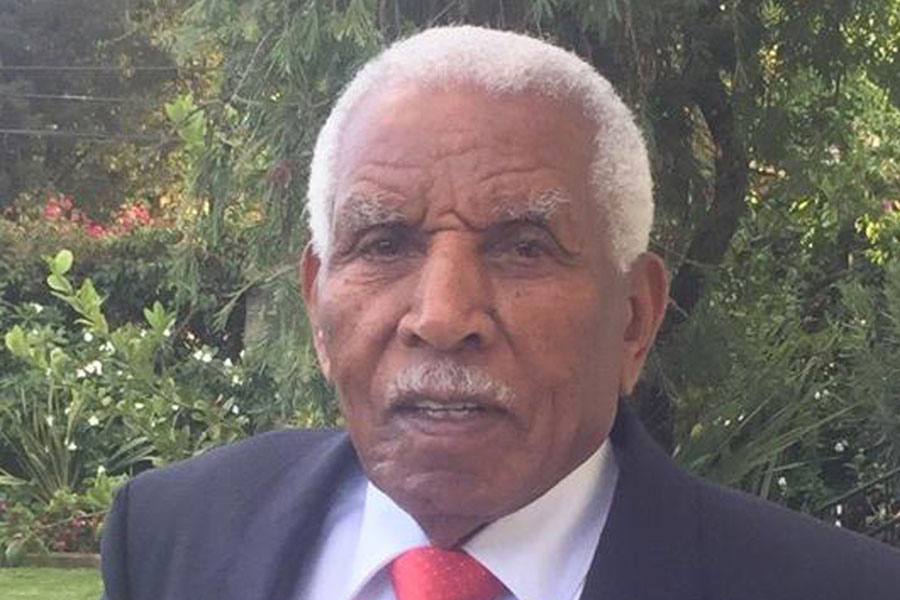

Set to commence with fertiliser imports within the next two months, the move represents a broader strategy to secure alternative maritime gateways, according to Alemu Sime (PhD), minister of Transport & Logistics. He told Parliament last week that Ethiopia is eyeing the Kenyan port for trade activities, including exporting livestock through the Southern border.

According to the Minister, the decision to explore alternative trade routes through Port Lamu demonstrates Addis Abeba’s proactive approach to addressing the logistical and security issues plaguing its main trade route through Djibouti. There is a growing sentiment that the country's reliance on Djibouti ports has been marked by frequent regulatory changes and security concerns, compelling the federal government to seek cost-effective alternatives for imports and exports.

Stringent requirements on the minimum values of letters of credit leading to extended port dwelling times and Prime Minister Abiy Ahmed's (PhD) insistence on diversifying transit corridors prompted the exploration of alternative routes.

It matches the significant overhaul of fertiliser imports with the revision of procurement modalities under a new board comprising senior federal officials, including Alemu. Chaired by Girma Amentie (PhD), minister of Agriculture, the board includes Mamo Mihretu, governor of the central bank; Alemtsehay Pawlos, chief of Cabinet; Semereta Sewasew, state minister for Finance, and Abie Sano, president of the Commercial Bank of Ethiopia (CBE).

"We need to match or find prices lower than what Djibouti offers," Alemu told Fortune.

Djibouti ports, operated by the Djibouti Ports & Free Trade Zones (DPFTZ), have served as the main entrance point for fertiliser inbound to Ethiopia through its 18 berths over the last two decades, costing Ethiopia around 1.5 billion dollars annually. From the 7.6 million tons of freight goods imported or exported in the past six months, 95.1pc went through Djibouti, with Tadjoura Port accounting for 2.75pc. The remaining 1.78pc was processed through the Berbera Port in Somaliland, with 0.2pc coming through Sudan.

Two months ago, leaders of the Ethiopian Freight Forwarders & Shipping Agents Association (EFFSAA) raised concerns about the stringent requirements on imports through Djiboutian ports.

However, Abdulber Shemsu, head of the Ethiopian Maritime Authority, dismissed most claims as "exaggerated with little substance." According to him, minor operational issues or small fee changes as low as five dollars are often magnified, overshadowing the absence of major problems.

Anticipating the first round of fertiliser shipments through Port Lamu, Abdulber disclosed that preliminary engagements between the involved parties have largely been concluded.

"Setting a definite date is complex when it involves coordination between two countries," he told Fortune.

Ethiopia's interest in Port Lamu comes at a time when the logistics and trade dynamics in the Horn of Africa are increasingly complex. Ethiopian officials believe the region's strategic importance, coupled with ongoing geopolitical shifts, demands a diversified approach to international trade. According to Alemu, by tapping into Port Lamu, Ethiopia aims to secure a more stable and efficient route for its trade.

"The port is strategically located for vital fertiliser suppliers," Alemu told Fortune.

Fertilisers are essential for enhancing agricultural productivity, a critical concern for Ethiopia as it strives to boost its food security and support its farming communities.

About 64pc of the planned 1.9 million tons of fertiliser imports have already been secured this year. Of this, slightly over 400,000 tons have been delivered to Unions’ gates or are currently at the ports in Djibouti. The state-owned Ethiopian Shipping & Logistics (ESL) has played a critical role in managing freight and logistics operations to import fertiliser through its monopolistic grip on the corridor. In the past six months, it has generated revenues of approximately 23.5 billion Br.

Demsew Benti, the communications director, expressed the company’s readiness to meet the government's expectations.

"We're mere operators, after all," said Demsew.

Alemu disclosed the potential procurement of fertilisers from Nigeria, Africa's largest fertiliser exporter, showing his government's intent to establish diversified and cost-effective supply chains.

A technical committee comprising experts from Ethiopia and Kenya has been established to finalise the details of the nascent trade route, including pricing and volume. The cooperation heralds a deepening of bilateral trade relations between the two countries, setting the footing for future trade and logistics operations.

Despite these new developments, industry voices say the transition from Djibouti to Lamu will require meticulous planning and coordination between the two countries. The logistics capabilities of Djibouti, with its advanced port facilities and functional railway network, set a high benchmark for Port Lamu to match. They warn that Ethiopia's strategic move cannot be without its drawbacks. Transporting goods from Port Lamu to Ethiopia, spanning nearly 677Km to the Ethiopia and Kenya border, requires dependable infrastructure and efficient transport solutions.

According to Matios Ensermu (PhD), logistics expert, the strategic advantages of Port Lamu include a cost-effective route for goods destined for regions south of Shashemene town in the Oromia Regional State. He recalled the logistical challenges of the route from Djibouti ports to Mojo Dry port, spanning nearly 700Km and additional costs to transport fertiliser to Southern areas.

While acknowledging Djibouti's competitive position in the region, Matios also sees Port Sudan as a potential alternative for cargo destined for northern Ethiopia.

"It is essential not to put all your eggs in one basket," he said.

The logistics industry veterans, including Daniel Zemichael, former president of the EFFSAA, stressed the need for infrastructure upgrades and policy harmonisation with Kenya. These include increasing the maximum load capacity for trucks at the border and updating insurance policies, which are critical steps to ensure smooth trade operations through Port Lamu. He supports the idea of diversifying access, particularly to facilitate shipments of essentials like fertilisers or aid during exceptional circumstances such as the ongoing attacks on ships by the Houthi military in Yemen.

"The Red Sea has everyone concerned," said Daniel.

According to Daniel, Lamu's current capacity is well-suited for fertiliser shipments. However, he stressed the crucial role of private investment in both Lamu and Berbera ports for long-term success.

"Strategic foresight in the protocol agreement will be critical," Daniel said.

Daniel recommends prudent planning to capitalise on the potential for lower logistics costs offered by the Lamu Port.

Port Lamu marked a milestone in September of the previous year with the arrival of its first bulk cargo ship, the MV African Swan, which transported food aid for the World Food Program (WFP). The logistics capabilities received a substantial boost in June when six cranes were acquired from German Harbour Mobile Cranes (HMC) for nearly 23 million dollars.

Port Lamu is part of an ambitious project initially conceived in the 1970s on the corridor of Lamu, Port-South, Sudan-Ethiopia Transport, a.k.a LAPPSET. Initiated in 2012, it represents a significant logistical and infrastructural development in the region, aiming to enhance connectivity and facilitate trade across East Africa through a standard gauge railway line connecting Port Sudan and Addis Abeba, three airports, port cities, an oil refinery, and an extensive network of roads.

With the completion of three of the initially planned 32 berths nearly three years ago, Port Lamu emerged as a maritime asset in the region, with the potential to impact the logistics network significantly. It was launched by Kenya's former President Mwai Kibaki, alongside his South Sudanese and Ethiopian counterparts, Salva Kiir and the late Prime Minister Meles Zenawi.

Ethiopia has relied almost exclusively on Djibouti for a transit corridor following the fallout with Eritrea in 1998, signing a protocol agreement in 2002, by Girma Birru, trade minister at the time.

Prime Minister Abiy, a vocal and ardent advocate for diversifying Ethiopia's port access, a position that has led to significant diplomatic initiatives, signed a Memorandum of Understanding (MoU) with Somaliland. According to Somaliland senior officials, the agreement includes the recognition of Somaliland as a sovereign country in exchange for leasing a 20Km coastline for a naval base, for 50 years.

The agreement, signed on January 1, 2024, was preceded by exploratory visits in August by a team of officials and experts led by Minister Alemu to Port Lamu and the Berbera Port in Somaliland.

"These efforts reflect Ethiopia's strategic foresight and commitment to securing sustainable and efficient trade corridors," said Minister Alemu.

PUBLISHED ON

Feb 03,2024 [ VOL

24 , NO

1240]

Radar | Oct 01,2022

Fortune News | Oct 20,2024

Radar | Nov 16,2024

Advertorials | May 30,2025

Radar | Jul 17,2022

Sunday with Eden | Apr 28,2024

Obituary | Jun 17,2023

Fortune News | May 17,2025

In-Picture | Aug 30,2025

Fortune News | Sep 29,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...