Executives from a few multinational corporations (MNC) gathered last week at the Haile Grand, on Asmara Road, debating the impact of “transfer pricing” as a tool to steer through turbulent waters in an era of geopolitical shifts and supply chain disruptions.

As global inflation rises, monetary policies tighten, and growth shows an unsteady trajectory, these companies search for stability in their international operations. Joined by the Ministry of Revenues representatives, the event saw a decent turnout out of 450 multinational corporations active in the Ethiopian market.

“There’s a real hunger in the room,” said Peter Kinuthia, head of tax and regulatory department at KPMG, expressing his astonishment at the turnout be described as “impressive.”

KPMG East Africa organised the meeting, hoping to help executives of these corporations and tax authorities grasp the impact of “transfer pricing.” The federal government projects to mobilise over 440 billion Br in the current fiscal year, with KPMG estimating revenues from trade taxes making up nearly 188 billion Br.

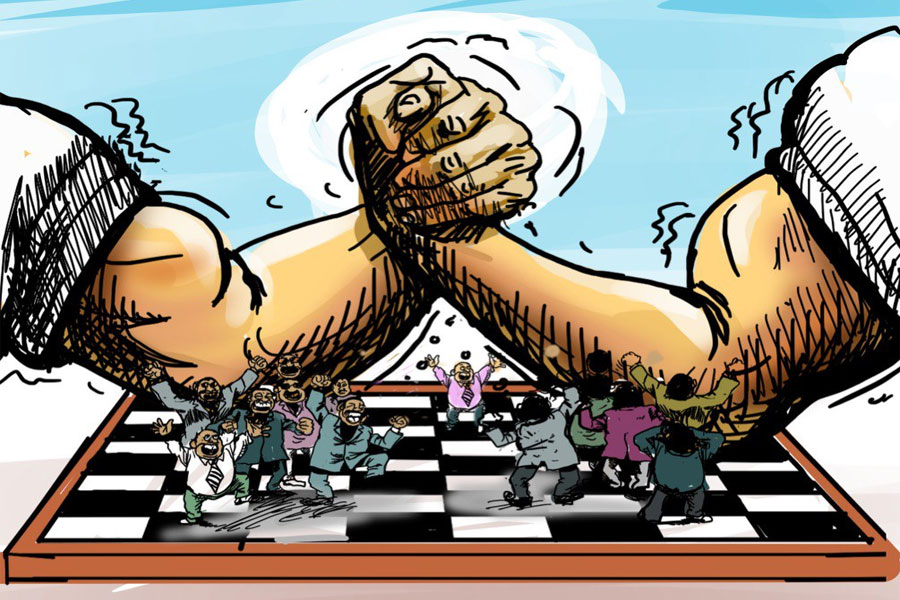

When a parent company sells goods to its subsidiary or two subsidiaries of the same corporation, the price they set for these transactions is known as “transfer pricing.” It determines the value of transactions between related entities within a corporation.

Kinuthia urged the executives to maintain records in compliance with the “arm’s length”, a principle that dictates transaction prices between related entities not to vary from what would be charged between unrelated entities under similar circumstances. It is essential to ensure that transfer pricing does not become a tool for tax evasion or unintentional non-compliance, according to Kinuthia.

For Daniel Hailegiorgis, tax and regulatory manager for KPMG-Ethiopia, outdated or missing documentation, prolonged losses, and questionable cost-sharing agreements are red flags, triggering audit inspection. He believes that, when called upon, companies should be ready to produce relevant documents within a 45-day window upon the tax authorities' request.

Participants agreed that compliance is vital, but voiced concerns over inadequate advance notice before imposing new regulations. They complained about companies’ confusion over timelines when filling out tax declaration forms, which deters effective data comparison for controlled transactions.

According to Stephen Ng’ang’a, transfer pricing head for KPMG East Africa, understanding intergroup relationships, a comprehensive summary and a sound economic analysis backing the nature of transactions are essential.

Despite transfer pricing’s expansive influence on around 60pc of global trade, a primary concern remains “trade mispricing.” Developing countries like Ethiopia are prone to this problem, where information asymmetry between parent companies abroad and domestic subsidiaries can distort fair pricing.

Christian Aid, a UK-based charity, revealed that developing countries lose over 160 billion dollars annually to corporate tax evasion, dwarfing the 103.7 billion dollars combined aid these countries received from wealthier countries.

The capacity of regulatory bodies to effectively manage transfer pricing was hotly debated. Federal tax authorities integrated a special department for auditing multinational companies eight years ago.

Yosef Alemu, an expert who studied the subject, observed that while the intention to regulate is there, Ethiopian authorities might be outmatched by resources and expertise compared to the multinational companies they oversee.

Officials from the Ministry of Revenues concur.

Etaferaw Sisay, who heads the transfer pricing audit process, acknowledged the challenges and admitted a long road ahead.

“Even inter-departmental data exchange within our own country suffers limitation,” she told Fortune.

Her advice for multinational companies doing business in Ethiopia was meticulous record-keeping for smooth audits. Ensuring all transactions are recorded and summarised, preferably converted to Birr, can address potential misunderstandings and disputes during audit inspections.

“That’s a source of argument most of the time,” she said.

PUBLISHED ON

Oct 21,2023 [ VOL

24 , NO

1225]

Commentaries | Jan 13,2024

Radar | Apr 06,2019

Agenda | May 04,2025

Agenda | Sep 16,2023

My Opinion | Aug 26,2023

Life Matters | Oct 12,2019

News Analysis | Oct 30,2021

Editorial | Jul 01,2023

Editorial | May 13,2023

My Opinion | Aug 29,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...