Advertorials | Jul 17,2023

Ethiopia's euro bond jumped last week, scaling 2.23 cents to 77.48 cents on the dollar, its greatest gain since the previous year, Bloomberg reported. The increase followed a substantial bailout package agreement with the International Monetary Fund (IMF).

The IMF, ready to disburse approximately one billion dollars immediately, pledged 3.4 billion dollars over four years. The package is an integral component of a broader economic reform program, anticipated to facilitate debt restructuring negotiations with Ethiopia’s external creditors.

The IMF allocation is part of the over 10 billion dollars that Ethiopian authorities expect to receive from creditors. This will be through loans, grants, and debt re-profiling. According to the IMF, the program is set to trigger further external financing from development partners, providing a framework for completing the ongoing debt restructuring process.

Ethiopia's external debt, at approximately 28.4 billion dollars, has been under restructuring efforts since 2021. The process has been slow due to the civil war that ravaged the northern regional states for two years, only ending in November 2022. The internal conflict led to the country defaulting on a euro bond payment in December of the same year.

“The IMF endorsement of the program reflects Ethiopia's staunch commitment to significant systemic reforms,” said IMF’s Managing Director Kristalina Georgieva, who lauded the development as a "landmark moment".

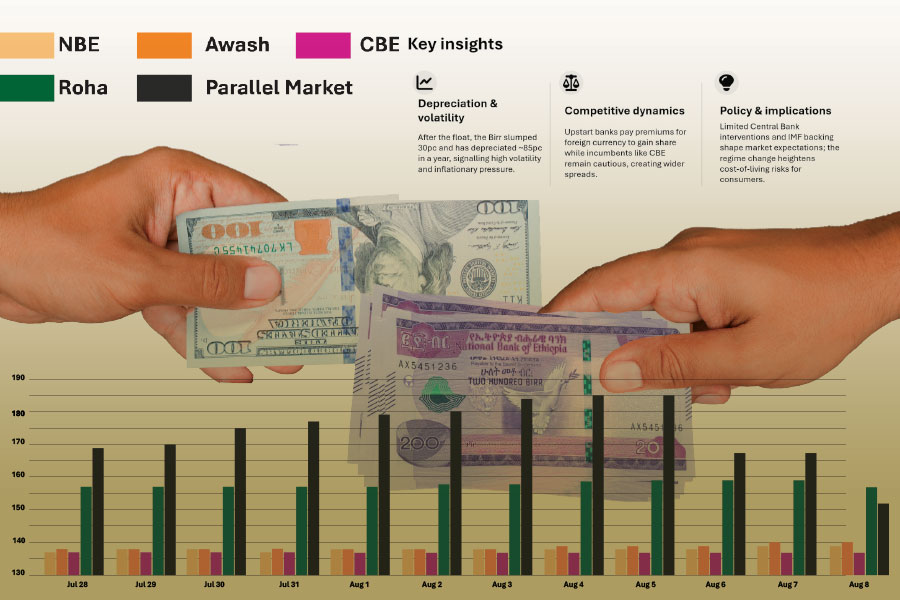

The green light for the deal arrived when the National Bank of Ethiopia (NBE) announced that it would allow the Birr to be traded freely. The move followed Egypt's strategy, where a weakened currency allowed an eight billion dollars in IMF bailout. The Birr plunged by 104pc late last week following the announcement.

However, the speed at which the government will move towards a debt rework with bondholders remains uncertain, according to Samir Gadio, head of Africa strategy at Standard Chartered Plc, who spoke with Bloomberg last week. He recalled Zambia and Ghana took considerable time to see such procedures consolidate.

This month, Ethiopia received assurance of financial support from its official creditors’ committee which expedited the IMF loan approval by its board directors who met on July 30. Ethiopia is the fourth country to restructure its debt under the G20-supported common framework mechanism, designed to harmonise discussions between official, commercial, and private creditors.

Under Prime Minister Abiy Ahmed (PhD), Ethiopia has undertaken measures to open its economy, inviting foreign investment into domestic banks and establishing a capital market. The IMF says its program is designed to address macroeconomic imbalances, restore external debt sustainability, and set the foundation for increased, inclusive, and private sector-led growth. It projected Ethiopia’s real GDP growth to be 6.5pc in this fiscal year, accelerating to eight percent by 2027-28. The rate of inflation is expected to reduce from 30pc to under 20pc within the same period, while the external debt-to-GDP ratio is predicted to decrease from 28pc to about 23pc. (Wires).

PUBLISHED ON

Aug 04,2024 [ VOL

25 , NO

1266]

Advertorials | Jul 17,2023

In-Picture | Jun 22,2024

Featured | Sep 10,2023

Radar | Jun 12,2023

Radar | Nov 16,2024

News Analysis | Mar 04,2023

Radar | May 27,2023

Radar | Aug 26,2023

Radar | Oct 05,2024

Agenda | Aug 09,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...