In a move rattling the coffee industry, officials of the Ethiopian Coffee & Tea Authority have imposed a limit on outbound personal coffee carry-ons: two kilograms. This comes on the heels of requests the Authority placed four months ago, to reinforce the Ethiopian Customs Commission’s tight control around airports.

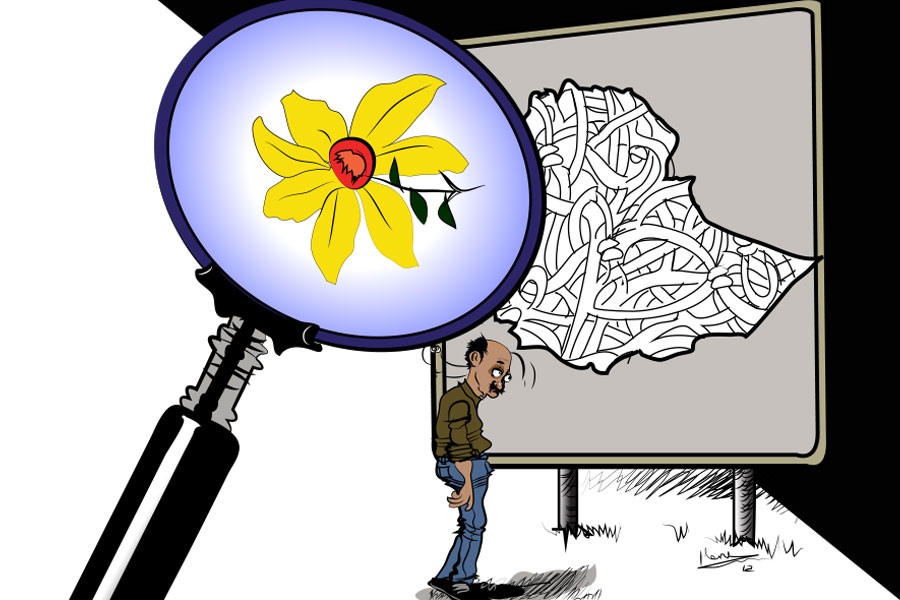

The backdrop to this decision is complicated, as is Ethiopia’s coffee itself. But the implications are vast, sending ripples through everything from the small roasters on the streets of Addis Abeba to the sprawling terminals of Bole International Airport.

Two weeks ago, Cheru Koru, deputy director of the Authority’s Market Development & Regulation Division, issued a letter announcing the restriction. A week after its enforcement, customs agents at Bole International Airport intercepted 2.3qtl of coffee.

Previous limits have been stringent but focused mainly on unroasted and ungrounded beans, as well as intra-regional movement. Restrictions from the last year resulted in coffee seizures valued at around 11.3 million Br.

However, there is a silver lining for international jet-setters and tourists who can buy from duty-free shops using foreign currency. According to Deputy Head of the Authority, Shafi Omer, this logic centres around foreign currency inflows – a vital lifeline for Ethiopia’s forex reserves.

“Passengers buying goods from terminal shops are presumably transacting in foreign currency, bolstering our national forex income,” he told Fortune. “Such travellers face no cap – they’re welcome to buy as they please.”

Passengers such as ex-pats and exporters who wish to carry over the restricted amount will need a permission letter from the Authority.

“Only licensed traders need high amounts,” he told Fortune.

A drive to protect and uplift the Ethiopian coffee brand’s global reputation underpins these changes, Shafi argued.

“Travellers have increasingly been filling their bags with inferior roasted coffee, tarnishing the reputation of our iconic product.”

Million Kibret, a consultant at the BDO Consulting’s Investment, concurred with the Authority’s concerns, referring to the sheer volume of travellers passing through Bole International Airport. The cumulative impact of smaller amounts of coffee being taken out of the country could be significant over the longer term. However, Million sees room for broader policy reforms, advocating an ease in the government’s stringent approach to foreign currency transactions.

“A recalibration of the tight constraints on forex transactions might be prudent,” he told Fortune.

But, as with any sweeping change, the immediate fallout has been noticeable. Over the past week, the 126 export standard and licensed coffee roasters in the city have been inundated with grievances. Customers are upset as they grapple with confiscations on the last leg of their visit.

Menelik Habtu, the erstwhile president of the Ethiopian Coffee Roasters Association and the proprietor of Typica Coffee, is among the aggrieved. He bemoaned a system that seemingly favours duty-free outlets, sidelining the rest.

“We risk becoming an afterthought,” he told Fortune, voicing concerns over the dwindling presence of businesses like his in airport duty-free locales. “Local turnover is what sustains my business,”

Incorporated with a modest capital of 300,000 Br, Menelik’s Typica Coffee sought to bridge a market gap, serving tourists and travellers keen on taking home distinct Ethiopian coffee brands. He refuted the Authority’s implications about the inferior quality of roasters’ coffee.

“Our sourcing is from the Ethiopian Commodity Exchange, meeting stringent export standards,” he asserted.

A 2021 United Nations Conference On Trade & Development report highlighted the uphill battle for roasters aspiring to tap into foreign markets. High branding and promotional costs inflate retail prices, adding another layer of challenge. Yet, despite these hurdles and the price dip, coffee remains the spine of Ethiopia’s export sector. It is an industry that fetched over 1.3 billion dollars this year, covering over one-fourth of total export revenues.

Gizat Worku, general manager of the Ethiopian Coffee Exporters Association, was surprised to learn of the new stipulations by the Authority. He believes it should not matter whether travellers carry five or more kilos as long as they have paid the asked price.

“Local prices are often higher than exports,” he told Fortune in a befuddled tone.

Gizat disclosed that the Association will discuss the issue with the Authority’s officials.

Industry giants have not been immune to the challenges posed by the recent changes.

Kirubel Seyoum, helming operations at Tomocca Coffee, a brand with a storied history dating back to 1954, recounted the dismay echoing through their 23 outlets and among their 300-strong workforce.

Tomocca’s operations, which churn out an impressive 200,000kg of coffee every quarter, operating at a mere 40pc capacity, illustrated their scale. Yet, Kirubel believes the recent decree overlooks potential setbacks for tourism.

“Vendors in duty-free zones at the airport source their coffee from us,” he disclosed. “Yet, our customers face seizures and have been venting their frustrations all week.”

He disclosed some of his customers even asked for their money back.

Those lucky few with a foothold in airport terminals see hope. One such beneficiary is OneKoo Coffee, a brand under the expansive umbrella of the Oromia Coffee Farmers Cooperative Union, with over 407 primary cooperatives as members. The Company’s processing plant, in the Gelan area on the outskirts of the capital, has a capacity to process 120kg in 20 minutes.

The union was established 24 years ago. It has branched out to four outlets and was leased a slot at the Bole International Airport two years ago. Its latest outlet is anticipated to come live in January at the Jubilee Palace, consuming 30 million Br investment.

OneKoo’s duty-free branch offers travellers a kilogram of roasted powder-packed coffee for 19 dollars. Despite past struggles with sales, General Manager Dejene Dadi is optimistic about the future.

“We anticipate better outcomes now,” he said, highlighting the brand’s growth trajectory and expansion plans.

PUBLISHED ON

Sep 30,2023 [ VOL

24 , NO

1222]

Editorial | Sep 11,2020

Radar | Dec 16,2023

Commentaries | Jun 17,2023

Commentaries | Oct 16,2024

Radar | May 31,2020

Radar | Apr 17,2021

Fortune News | Mar 09,2024

Commentaries | May 11,2024

Commentaries | Jan 03,2021

Fortune News | Apr 16,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...