Radar | Dec 19,2020

Ethiopian Airlines Group has extended an invitation to financial institutions and newly licensed foreign exchange bureaus, offering the possibility to rent space within the bustling Terminal Two at Bole International Airport. The Group seeks forex providers to fill seven rental spots at the terminal, which accommodates around 25 million travellers annually.

With a promising lineup of 25 bidders, including recently licensed non-bank forex bureaus, the tender is intended to enhance service quality and accessibility for passengers, according to Ali Asfaw, bid lead from the Group’s strategic sourcing department.

The move follows recent regulatory adjustments by the National Bank of Ethiopia (NBE), which licensed five non-bank forex operators: Dugda Fidelity Investment Plc, Ethio Independent Foreign Exchange Bureau, Global Independent Foreign Exchange Bureau, Robust Independent Foreign Exchange Bureau, and Yoga Forex Bureau. Each of these new entrants may transact up to 10pc of the daily forex auction volume determined by the central bank.

Despite the expanded market access, industry players remain cautious. Ethio Independent Foreign Exchange Bureau, one of the tender's participants, considers the opportunity primarily a means of boosting visibility. Its co-founder and CEO, Efrem Tesfaye, observed that arriving passengers typically conduct minimal exchanges at the airport, opting for more substantial transactions at hotels and urban exchange centres. He noted that to succeed, new entrants will need to provide distinctive services to attract customers amidst existing competition from banks.

Licensed independent bureaus are presently restricted to spot transactions, requiring immediate currency delivery. Under NBE regulations, they may purchase up to 10,000 dollars in foreign currency from a customer without a customs declaration and conduct higher-value exchanges with a declaration. Sales to travellers are capped at 5,000 dollars for personal travel and 10,000 dollars for business trips, contingent on documentation.

Ethiopian Airports, a central division of the Ethiopian Airlines Group, oversees Bole Airport and manages an extensive network of domestic airports. Bole serves as the country's main international gateway and includes amenities like a 97-room transit hotel. The federal government has further ambitions for the sector, with plans underway to build Africa’s largest airport 40Km from Addis Abeba near Bishoftu (Debre Zeit). Expected to handle up to 130 million passengers yearly, the new airport will eventually connect to Bole by rail.

In a recent address to Parliament, Prime Minister Abiy Ahmed (PhD) underscored Ethiopia’s growing appeal as a conference destination, with 20 international events hosted over the past three months. The Ministry of Tourism reported that Ethiopia generated 4.3 billion dollars from 1.1 million visitors in the past year, and the government aims to raise this figure to 5.47 billion, targeting an additional 200,000 tourists this year. Nearly 400,000 of these are expected during the peak season from September to January.

As Ethiopian Airlines seeks new forex providers at Bole, analysts recommend that operators focus on customer-centric services and efficiency to capture market share and establish a profitable presence in Ethiopia’s evolving forex market. For forex operators, the airport offers a substantial market, yet industry experts caution that profitability may remain elusive due to high operational costs. Banking and finance consultant Tilahun Girma noted that while passenger volume presents a large potential customer base, profitability depends on careful market analysis and cost control.

PUBLISHED ON

Nov 03,2024 [ VOL

25 , NO

1279]

Radar | Dec 19,2020

Verbatim | Jan 07,2024

Sunday with Eden | Apr 22,2023

Radar | Jul 27,2025

Fortune News | Jul 17,2022

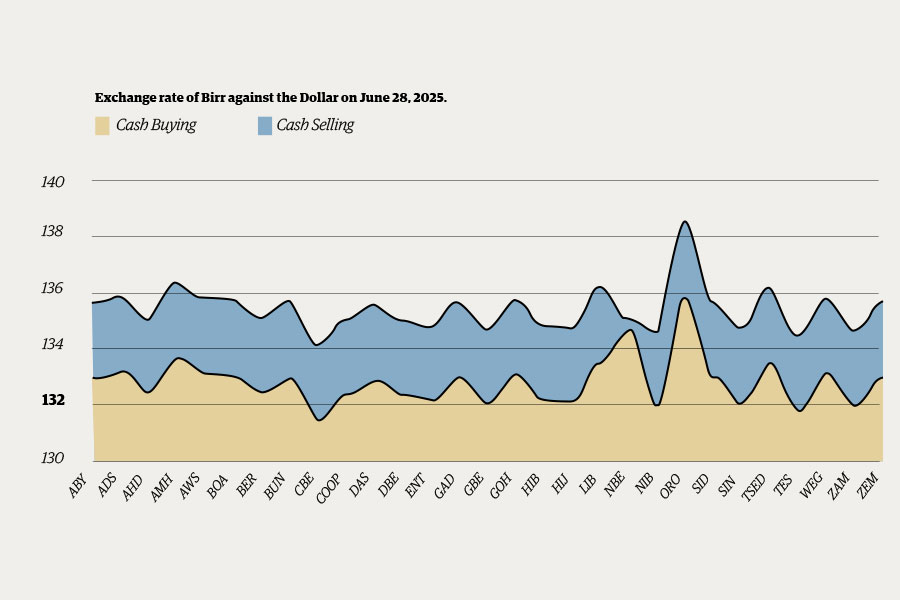

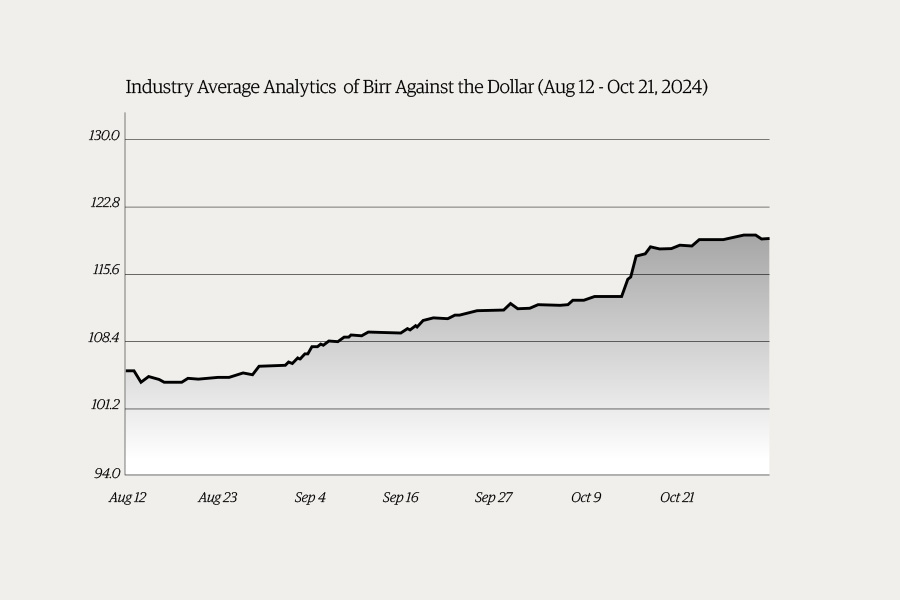

Money Market Watch | Jun 29,2025

Agenda | Jun 07,2022

Sunday with Eden | Jul 20,2024

Exclusive Interviews | Aug 04,2024

Money Market Watch | Nov 03,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...