Radar | Jan 19,2019

Apr 24 , 2021

By KIDUS DAWIT ( FORTUNE STAFF WRITER )

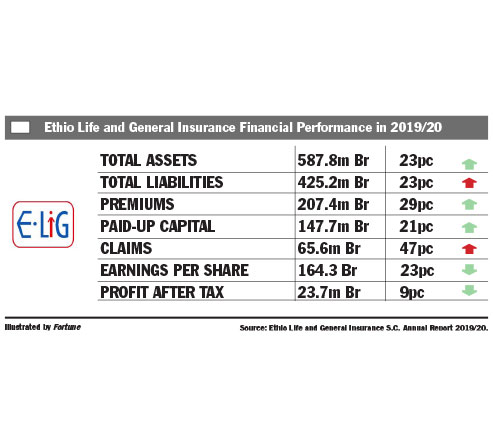

Shareholders at Ethio Life & General Insurance (ELiG) saw their returns drop for the second year in a row after the firm reported a disappointing performance for the year ended June 30, 2020. Its net profit declined by 8.6pc to 23.65 million Br; hence its earnings per share (EPS) were slashed by almost a quarter to 164.31 Br.

A drop in return for shareholders value is consistent with results over the past couple of years when more than 30pc loss in EPS was recorded. The senior management at ELiG concedes to the slump in growth and attributes the stagnation to slowed economic activities, high inflation, political uncertainty, and the shortage of foreign currency.

"It's widely acknowledged that the overall business environment in the 2019/20 fiscal year had posed more challenges than opportunities for the Ethiopian insurance industry," said Yoseph Endeshaw, ELiG board chairperson, in the firm's annual report.

The injection of fresh capital and investments made to acquire a new headquarters in the Mesqel Flower area during the third quarter have also contributed to the decline in EPS and profit. Although not as near in decline as ELiG, the insurance industry's aggregate net profit has fallen by almost two percent to 2.02 billion Br, during the reporting period.

This must have been bad news to the shareholders, according to Abdulmenan Mohammed, a financial statement analyst based in London.

ELiG has reported mixed results in its profit and loss account.

Underwriting surplus increased by 18.9pc to 80.46 million Br, and total gross written premium (life and general) surged by 29.4pc to 207.36 million Br. It is a figure Abdulmenan referred to as "impressive."

Over a quarter of the gross written premium was ceded to reinsurers, leading the retention rate to fall slightly to 72.2pc from 73pc. It shows room for improvement as the average retention rate in the industry sits somewhere around 77pc. Despite the decrease in retention rate, claims paid and provided soared by 47.3pc to 65.6 million Br.

"Such a massive increase should call the attention of the firm's senior management to rectify in the area of risk management," said Abdulmenan.

Representatives from ELiG were not immediately available for comment.

Commissions paid to agents also soared by 47.1pc to 16.67 million Br, a significant amount paid to attract customers, and an expense that the expert advises should be kept under close watch.

Despite the shortcomings, ELiG did report an impressive performance in investment activities. Interest earned on time deposits increased by 14.6pc to 19.03 million Br, while dividend income almost doubled to 3.77 million Br.

Expenses, however, also spiked. Salaries and benefits shot up significantly by 51.6pc to 45.92 million Br and general administration expenses increased by 22.3pc to 24.44 million Br.

The total assets held by Ethio Life & General increased by 23pc to 587.8 million Br, including in fixed time deposits, in shares and bonds and in acquiring properties. These investments account for about a third of its total assets, much lower than the preceding year’s figure of 41pc.

"This must have been because a significant amount of money was held with customers and reinsurers," said Abdulmenan, advising that this money be collected and invested to generate additional income.

Liquidity analysis shows that ELiG's cash-and-bank balances decreased both in value and relative terms. It dropped by 15pc to 62.13 million Br, while the cash-and-bank balances to total assets ratio down to 10.6pc from 15pc.

Despite the reduction, Abdulmenan sees the liquidity level of ELiG, which was established in 2008 by 117 shareholders, as reasonable.

ELiG’s paid-up capital has increased to 147.68 million Br, showing an increase of 21pc. Its capital and non-distributable reserves account for 27pc of its total assets. ELiG is still a well-capitalised insurance firm that should give peace of mind to its shareholders.

At a time of public health risk due to COVID-19, the firm is doing reasonably well, feels a shareholder who requested anonymity. He believes that as ELiG focuses on the life insurance business than most others, it faces its own unique set of challenges.

"There are other insurance firms that have been in the industry for a similar amount of time as ELiG," he said, "and they haven't made as much progress. It is reasonable to say that the firm is successful. It had a few rough years after establishment but has since been performing well."

The firm provided only life insurance products for the first four years of operation, before expanding to general insurance in 2012.

PUBLISHED ON

Apr 24,2021 [ VOL

22 , NO

1095]

Radar | Jan 19,2019

Fortune News | Jan 18,2020

Life Matters | Sep 06,2020

Fortune News | Jan 30,2021

Fortune News | Apr 26,2019

Verbatim | Jan 07,2024

Radar | Sep 06,2020

View From Arada | Jul 24,2021

Radar | Jun 11,2022

Obituary | Jan 28,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...