Apr 9 , 2022

By Mikael Alemu

An ancient general once said, “just because you don't take an interest in politics doesn't mean politics won't take an interest in you.” Today, geopolitics will come for almost everybody and everything regardless of interest, including in energy transition, writes Mikael Alemu (@mikael_alemu), co-founder and CEO of '10 Green Gigawatt for Ethiopia' (www.10G.energy).

Two millennia and a half ago, the most famous general of Ancient Greece and a leader of Athens, Pericles, made a statement that would ring throughout the ages.

“Just because you do not take an interest in politics, [it] doesn't mean politics won't take an interest in you.”

Today, geopolitics will get to us regardless of our interests. Addis Abeba might be 6,900Km from Kyiv, the capital of Ukraine, but the Russian-Ukrainian war echoes in Africa almost in the same way as it sounds in European countries.

Popular historian and bestselling author of "Sapiens: A Brief History of Humankind," Yuval Noah Harari (Prof.) thinks that the conflict will impact long-term budgeting priorities for Western countries: military budgets will rise substantially (case in point is Germany doubling its military budget) and less money will be spent on humanitarian causes. It is impossible to argue with this simple math as there is no other way to keep a budget in order, but it is extremely unlikely that the West will roll back its assistance to Africa. Western society is becoming more and more involved in humanitarian causes and environmental issues. Every liberal politician will be interested in expanding Africa-related programmes, and Western corporations will not be lagging behind as they are interested in exploring the latest emerging market on the planet.

Still, there is a good chance that the amount of financing per programme will be reduced, and we will see those activities getting lean and (hopefully) more efficient. Such a scenario can lead to more and more projects being assigned to local teams rather than to international ones.

It is important to differentiate pure humanitarian programmes from economic development activities. The latter will grow substantially in the near future as more impact capital flows to Africa: investment firms will increase local presence and raise African commitments by orders of magnitude of one to two.

Another point made by Yuval Harari is that when Vladimir Putin, president of Russia, decided to invade the largest country in Eastern Europe, he united the whole West against himself. One can clearly see unification among Western countries as different as Germany and Poland, Denmark and Hungary. Different political groups within countries are being united as well – look at Marine Le Pan and Emmanuel Macron.

Well-known American political analyst and an influential boss of The Eurasia Group, Ian Bremer, describes the potential outcome of the Russian war and tough Western sanctions imposed on Russia as distinct in three ways. Russia will be much weakened economically; China will emerge as its senior partner in trade, buying resources for cheap and supplying manufactured goods for a premium; and the Russian economy will be completely disconnected from the West.

These assessments point to a simple thing: the post-war world is not a multi-polar one. The post-war world is strictly bi-polar, with one pole being a re-united West and another pole – an always united China. There is no doubt that Africa will continue to be an area where the two world poles are competing.

Three researchers from a Dutch think-tank, European Centre for Development Policy Management, recently published a discussion paper on European and Chinese investments in Africa. They compare new ‘Global Gateway Initiative’ (GGI) launched by the European Commission in December of 2021 and the famous Chinese ‘Belt and Road Initiative’ (BRI) launched in 2013. Thus far, China is far ahead with 153 billion dollars in loans committed to African countries – compared to a mere 11 billion euros provided as Official Development Assistance (ODA) by Europe. On the other hand, Ursula von Der Leyen, president of the European Commission, announced that GGI will amount to 300 billion euros.

The Dutch researchers stress an important difference between Chinese and Western programmes. The latter's international development model is built upon invasive conditionalities and reform requirements. Such an ‘instructional’ approach is not limited to economic development policies; it is also expanded to SDG (sustainable development goals).

“West needs to help and encourage countries who are highly dependent on oil for their economics to pivot with us, go away from oil and gas”, wrote Amy Myers Jaffe, managing director of the Climate Policy Lab at Tufts University.

Meanwhile, China offers an opportunity to quickly fill in critical and long-standing infrastructure gaps with a “non-interference and equal partnership” narrative that is considered a welcome break from Western practice. Opinion polls have shown a continued trend of favourable opinions towards the influence Chinese presence has on African societies.

However, it is critical to keep in mind that Chinese activity is shrinking. Investment into the countries of the BRI (worldwide) have totalled 47 billion dollars in 2020, 54pc less than the year before, while Sub-Saharan Africa saw a decline in new commitments of 69pc. Researchers also see a geographical rebalancing of Chinese overseas finance towards its more direct neighbourhood in East and West Asia.

Let us also not forget that sanctioned Russia is the third and second largest producer of oil and natural gas, respectively, in the world. The West will likely do everything possible to stop buying the country's oil and gas, thus hindering its government's budget. The US is self-sufficient in terms of both natural resources, while Europe would certainly be doing as much as possible to speed up the transition to renewable energy. This trend will push innovation in the sector. Simple things like solar (PV) will become cheaper. Complex things like hydrogen will see faster development. In some new areas like decarbonised cement production, we should expect the emergence of new, cost-efficient solutions.

Ethiopia will certainly benefit from technological advances in renewable energy as we need to develop our capabilities of zero-carbon energy generation as cost-efficiently as possible.

Five years ago, the International Energy Agency (IEA) described four large-scale technology revolutions that were supposed to change the energy equilibrium in the world. All of them were grounded in geopolitics: discovery and exploration of shale gas and oil in the United States; the emergence of cheap photovoltaic panels; China moving to clean energy; electricity becoming the major energy conduit, replacing oil and coal.

In the turbulent times of today, these four factors play a crucial role.

American shale oil is expensive to extract, and therefore its production was reduced by 15pc as soon as demand went down during the COVID pandemic. Nowadays, the US government is calling on shale oil producers to restart drilling. There is no cheap oil in sight, while the expensive oil will be abundant as long as it is economical to extract complicated oil. We are indeed entering a new era when oil will no longer be a rational source of electricity generation.

Cheap photovoltaic panels are mostly produced in a peaceful China from Chinese raw materials. The Russian war will not impact this market negatively. In contrast, the second-degree impact of the war (namely Europe’s drive toward renewables and demand to replace diesel) will increase the market and hopefully drive prices further down. China’s movement toward clean energy will persist.

The long-term trend to electricity as a dominant source of energy is supported by the Ethiopian energy situation and market conditions that have emerged now (expensive oil). We need to realise that any world crisis leads to the closing (encapsulation) of national economics. The only future-proof way for Ethiopia is to become energy independent while being energy abundant, and solar energy is the most cost-effective path to this goal.

PUBLISHED ON

Apr 09,2022 [ VOL

23 , NO

1145]

Viewpoints | May 04,2019

Radar | Jun 15,2025

Editorial | Oct 07,2023

Viewpoints | Jul 17,2022

View From Arada | Aug 20,2022

Radar | Apr 30,2024

Editorial | May 25,2019

Radar | Aug 31,2019

Commentaries | Dec 11,2021

Fortune News | Mar 16,2019

Photo Gallery | 174294 Views | May 06,2019

Photo Gallery | 164520 Views | Apr 26,2019

Photo Gallery | 154679 Views | Oct 06,2021

My Opinion | 136660 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

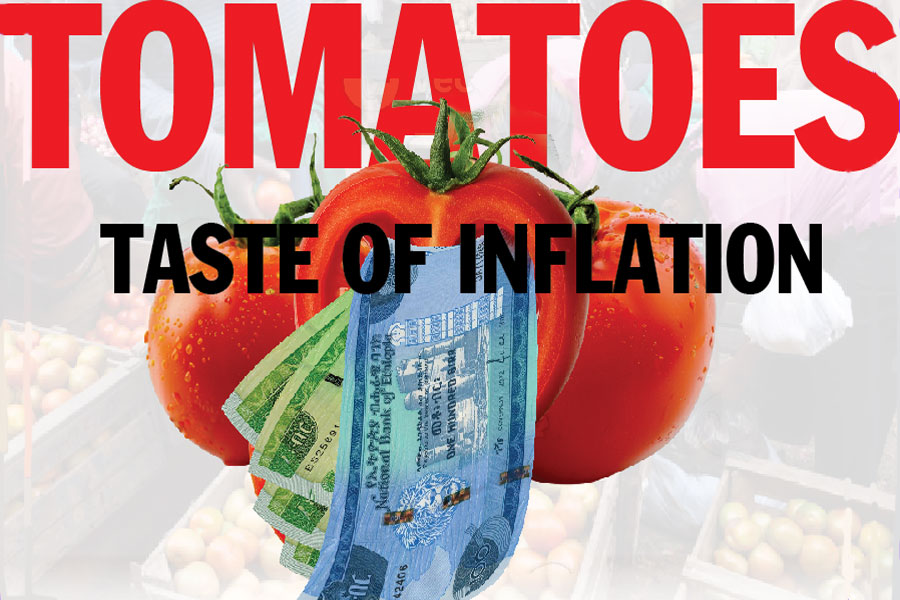

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...