Radar | Nov 24,2024

Fortune: You have said that you are not here [the Africa Investment Forum] for the sound bites. You have been talking about deal-making and transactions, and have signed a memorandum of understanding with Power Africa. But what else are you here for?

Admassu Tadesse: We'll be signing an investment agreement between Trade & Development Bank (TDB) and the Arab Bank for Economic Development in Africa (BADEA) tomorrow. They will become a new shareholder of TDB. We have also had many conversations and discussions with current clients and prospective clients talking about transactions, projects and trade deals that need to be done.

There are oil and gas deals that we have discussed, which are valued at 120 million dollars. We are also discussing a precious metal mining project. And then there is a railway company that was also talking to us about some prospective equipment financing that they would like done. We had one discussion with a telecommunications company, where we are in the process of negotiating a 100-million dollar-investment into this company. I cannot talk about the name or the country.

Q: Is it Ethiopia's?

No, it is not. But that would be something we would be interested in as well.

Q: Do you have a project that is close to your heart, either because of the significance of the project or the impact it will have on society? Something you have been longing for?

There are some very exciting big projects that we have been doing this past couple of months. It is going to be a pioneering intervention for us in Mozambique, which is a new country that joined the membership of TDB. We will be announcing that very soon. We have put over 100 million dollars into the project. It is very exciting, because it is not only a new market for us, but it is also a new resource that has been discovered. We are actually a pioneer in helping unlock this country’s new resource potential. When it gets out in the public, it is going to be a milestone, a watershed transaction that everybody will be noticing and applauding.

Q: Your bank has been going through some changes and rebranding. One of your historical missions is to promote inter-regional trade. But trade within Africa is one of the lowest across the world. Why?

It is an area of underperformance in terms of what we have all agreed we should be doing differently. Our continent, four or five decades ago, raised this as an agenda, but not much movement has happened. Many in Africa have not managed to diversify their economies. It has taken longer to get the infrastructure agenda onto the table and get that going.

But we at the TDB are now beginning to see many cross-border projects that are in half pregnant stages that will be very strong integrators of our economies. We are, for instance, looking at three railroad projects in North-East Africa, East Africa and Southern Africa. And these are network infrastructure projects that will connect many economies. They will produce efficiency in transport and reduce the unit costs of transporting goods.

We have done this in telecoms, and we are also doing it in power. We see a lot of opportunity for trade in the power sector. Ethiopia is one country that should be exporting much more power in the years to come. And that will also need to be financed, because the cross-border movement of excess power sometimes needs intermediaries.

These are new areas of investment such as agri-business, light manufacturing and textiles that will produce opportunities for countries now to source the products across borders. In the past, we did not have these. We now have industrial and agri-business parks. Of course, we have been very slow in unlocking this benefit stream for the region, but we see the seriousness and the momentum building up that will allow us to play our role as a financier.

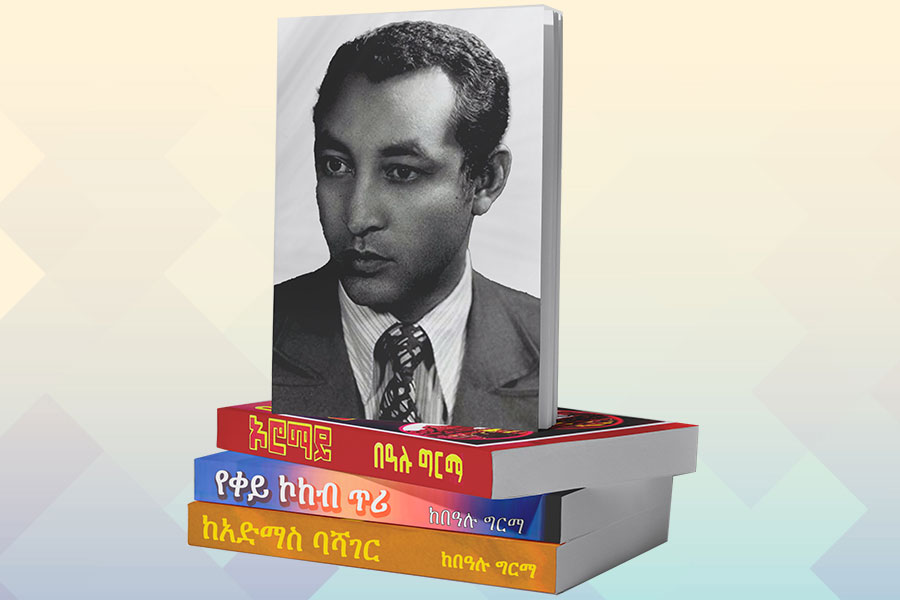

An alumnus of Harvard Business School, Admasse Tadesse runs a regional bank with assets of over five billion dollars. A president of the Eastern & Southern African Trade & Development Bank (TDB) for seven years.

Q: The African Union wants to create a space for a continental free trade area. But in the absence of diversified economies, don't you think the cart is coming before the horse?

It is a reasonable observation to make because we need the complementarity to be there, to enable that mutuality of trade. I agree we are not there yet. But I think, even the Continental Free Trade Area will take time to mature. We have about 44 countries that have signed up, but few countries have ratified it. By the time all the institutional frameworks are in place, it might be a couple of years. By then you will see some of these industrial and agri-industrial parks beginning to generate products that could have a lot of value in terms of cross-border trade.

The sequencing will be iterative, so you need to put in place institutional frameworks, reduce the tariff barriers and reduce the non-tariff barriers in terms of infrastructure. At the same time, stimulating and advancing the diversification should start. And they have to be on multiple tracks, all moving along at the same time.

Q: Do many of the African countries have the right governance systems for opening up their economies? As far as we can see, many governments in Africa prefer the status quo to remain.

The political economy of opening up is different for different types of countries. The countries that are blessed with large populations and significant markets are the ones who have much less need to open up. Whereas the small countries who are landlocked - and even if they are not landlocked - need access to markets. Thus, you see certain countries championing the issue much more than others.

But the continent as a whole seems to have a clear mind about the imperative of creating a continental market. There will be bumps and laggards along the way. But in the end, it is going to happen. Obviously, countries will optimize at their national level and not always do it the same way as others will. I think the bottom line is that it will always be variable geometry in that regard. And different regions will move at different speeds.

Q: You were quite upbeat today about the promise of Africa. You were talking about not just investment for Africa but investments that are durable; not resource-based kinds of investments that have been the case since the 1970s and 80s. But you are a banker. You assess risks, and you still have a continent that is mostly defined by political unrest, poor contract administration and an inflexible business environment. Is it not risky trying to bring capital to Africa where these things abound?

There is definitely that concern. But there has been an improvement in the investment environment. The number of conflicts, for instance, are dramatically down from what they were in the 80s and 90s.

At the same time, there have been resets. Just in 2018 alone. We have seen dramatic changes in at least six or seven countries in Eastern and Southern Africa. We have had a reset in South Africa, Zimbabwe, Angola and Ethiopia. These are four very significant countries that have gone through a very significant political change. And then, we also have new peace that has been achieved in South Sudan, which, of course, we want to see how that holds up, but it looks better than anything we have seen in recent years.

We see that sanctions have been lifted from Sudan. We see the whole peace that is surrounding the developments in Ethiopia, whether it is Eritrea or Somalia. And when you talk about risk, political risk is the major one for many of these investments. This is not to say you will not have setbacks or it will not be messy. But at least the direction is very positive.

Q: How about the weakness of the judicial system in almost every African country, which is quite crucial for businesses to survive?

That is again is something that will depend on the reset that is going on. The sanctity of contracts is important. Our legal and administrative systems around that are weak. And there is a lot of work that needs to be done. What is important is that at least you will get a leadership in a country that views it as important. You look at South Africa, which has a very strong legal establishment. You see high-profile contestations going on, and you see that the role of the judiciary and the discipline of compliance with the law is there. It is possible to be achieved elsewhere too.

You even see it in Kenya, where an election was annulled in 2017. That is not very common. Despite the noise and the setbacks, the direction is quite positive. The investment climate is not a new discussion in Africa. But it is one thing for global players to talk about Africa’s investment climate; it is another thing for Africans to talk about their own investment climate.

And when you are in a multilateral setting [such as the African Investment Forum], you have the capacity to speak truth to power in a manner that will not be easily dismissed, as it would be if you are a think-tank doing this out of London or Washington. This is now Africans beginning also to champion the issue of creating a more enabling environment so that investments can be realised.

Q: From the investment value and volume that came to Africa between 2016 and 2017, the share of Chinese companies and the Chinese government has become substantial. How do you see the China factor put in to use, to play a role in the African investment climate in the future? There is also politics in this; the United States is quite nervous about the influence China has in Africa. Maybe the Power Africa project could be one way of keeping a balance in this whole geopolitical battle between the US and China. Considering these factors, where do you see China in Africa in the years to come?

The China Factor, on the whole, has been positive for Africa. When you look at the net flows coming to Africa, the previous decade versus the 1990s, you had negative resource flows to Africa. Now, we have very positive levels of net flows. At a very macro level, that is a good sign, because it shows that money is flowing into Africa and is creating assets.

A lot of the Chinese money coming to Africa can be traced to real assets. There can be questions about quality or missing aspects. But you cannot discount that it has had a huge impact by raising investment levels and improving infrastructure. Of course, lessons need to be learned and I think a lot more can be done, and it can be done better. Sustainability is an important consideration, planning needs to be done better. We discussed in Beijing at the Forum for China-Africa Cooperation a couple of months ago, the old model of just driving debt on a government-to-government basis alone is not adequate. Because there is not enough responsibility on the part of the funder to ensure that there is actual sustainability, the planning is right and that these mega projects will actually be creating the value that will enable the repayment.

One of the things that came out of the Forum on China-Africa Cooperation recently was public-private partnerships. But you will see much more ownership of the outcome and its sustainability. Chinese investors, like any other investor, should be sensitive to ensuring good outcomes that come as a result of their funding.

But, on the whole, when you look at a lot of the mega projects, the footprint is very clear. These are assets that were created. Yes, debt has mounted at the same time, but at least you know you can see the value that was generated. And if the planning and discipline are there, you can ensure that the assets perform. The conversation has sometimes not been very fair. There has been a lot of debt incurred in the past in Africa, but you cannot quite see where that money was spent.

Of course, the question of sustainability is an issue. Because there is a lot of debt burden that has come to African balance sheets. Governments are struggling to repay, because sequencing and completeness have been a problem. Some of these projects are taking a little bit of time to mature. Then again, the Chinese rescheduled a lot of the debt of many of the African governments, because they also realised that the projects were not performing yet. That was a sign of responsibility on their part.

Q: But what will be your expectation from the traditional partners of Africa? Do more of what China is doing?

The traditional partners for Africa, mainly Europeans and the United States, clearly have so much more to do in our region. They have not been investing.

Poverty has been somewhat alleviated, and there has been a lot of progress in human development; life expectancy is up; child morbidity and mortality is down; maternal mortality is down; HIV/Aids has been contained; nutrition outcomes have improved. These are all the soft social and human capital investments that the Americans and the Europeans have been investing in. We should have our hats off to our partners in Europe and the US for having done that.

But, that said and done, I think now that Africa is a viable destination for investment, we need jobs. We need young people to be engaged. I think we need to put the mirror up to our good friends in Europe and the US and let them know that there are opportunities, and they can do well by investing.

There is a lot of room for everybody In Africa. We at TDP look at everybody as a prospective partner. We work with Europeans, we work very well with the Americans, and the Chinese have been very strong. We welcome all the new players or even the traditional players that are finally coming to the party in a way they have not before. There is always going to be gaps along the way; thus, it is important for different players to understand that they need to shift gears.

Q: In many economies, it is the medium and small companies that are the largest creators of jobs. You guys are here to be a part of mega projects, which require huge amounts of money. Don't you think that the small- and medium-sized enterprises (SMEs) across Africa are neglected and abandoned by the financiers like yourself?

SMEs should be the backbone of our economies. Those are the companies that create jobs and livelihoods. But because they are domestic enterprises and not big businesses, they need local currency financing. And many of the banks you have seen here are mostly hard currency lenders. It is a little bit more complicated, because we all have mandates and capital. And if your capital cannot be lent responsibly, you do not want to lend dollars to someone who has no income in dollars. Otherwise, you are creating a bad loan overnight and then distress.

What we have been trying to do at TDP is to offer guarantees to local banks in our member states who can lend in local currency, and we share the risk with them. And we would only pay out in the event of distress, and then there is no currency mismatch. We would need to cover our share of the risk that went wrong. We are looking more at this, and many other banks are looking more at this as well.

Q: Since the coming to power of Prime Minister Abiy Ahmed (PhD), Ethiopia is being perceived by the outside world as a place of optimism and hope. But at the same time, there is unrest and conflict. In your dealings with the global investment community, which perception outweigh between the two?

The investment community is, in my experience and my interactions, captivated by the more significant developments such as the peace with Eritrea and the new promise of sustainable peace down the line. We are seeing conflict and unrest still persisting in parts of the country. But these were problems that were created over many years. Nobody that has a sound appreciation for these types of complex problems would expect them to go away overnight. Most reasonable observers would realise that the big fire that was causing this has been extinguished, by and large.

You do have a pot that is boiling and still full of hot water, but the temperature is dropping. There will be bumps along the way and some of the unfortunate seeds of division that resulted in the problems that we have today. It is going to take time to uproot these problematic forces that have caused the problems that we have.

This is a time of integration, not of division. Finally, we are seeing strong signs of regional integration, cooperation around ports, resources, state enterprises, cross-border power trade and special economic zones. For many people, these are the big trends that are breaking out and spell promise for the future.

The fact that we still have a lot of cleaning and fixing to do is a given. But we do have a new momentum going, and I think the hope is that everybody that has a stake will do the right thing.

Q: If you were to advise Prime Minister Abiy, what would be your one most important advice to him?

To say that leadership is all about design and putting people into positions. And the way he has been unflinching in his quest to get solid people and energetic professionals to hold positions in institutions that are charged with developing sectors and programmes is the most important thing any leader can do. And the whole world has been captivated by the manner in which he has embraced equality and sought excellence.

It is something that is very refreshing, and if that continues, it will clearly result in very positive outcomes. Because in the end, if you talk about the Singaporean experience or the East Asian tigers, if you have a developmental state like we have always spoken about, the strategy should be governed and managed by very competent people. Because it is a transformational agenda, it is a very complex process. Anybody that speaks about a developmental state but does not accept that you need very competent people is being very unrealistic, to put it nicely. The better word is actually being completely misguided.

Words mean nothing. Actions are what matter. The new Prime Minister has been clear about bringing accountability and putting strong people in positions. If that alone can be continued, it will achieve tremendous results. And the truth is, in much of our continent, this kind of commitment to competence and capability is rare. I pray that he can continue to keep that pace.

PUBLISHED ON

Nov 21,2018 [ VOL

19 , NO

969]

Radar | Nov 24,2024

Radar | Jun 08,2019

Sponsored Contents | May 22,2023

Radar | Jun 22,2024

Commentaries | Aug 31,2019

Viewpoints | Aug 30,2025

Sunday with Eden | Apr 19,2025

View From Arada | Aug 13,2022

Fortune News | Aug 11,2024

Fortune News | Sep 08,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...