Oct 30 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

The insurance industry has a month to advance part of its net income registered in the last fiscal year to buy bonds from the state-owned policy bank. These bonds are projects to bring the Development Bank of Ethiopia (DBE) over half a billion Birr in additional finance.

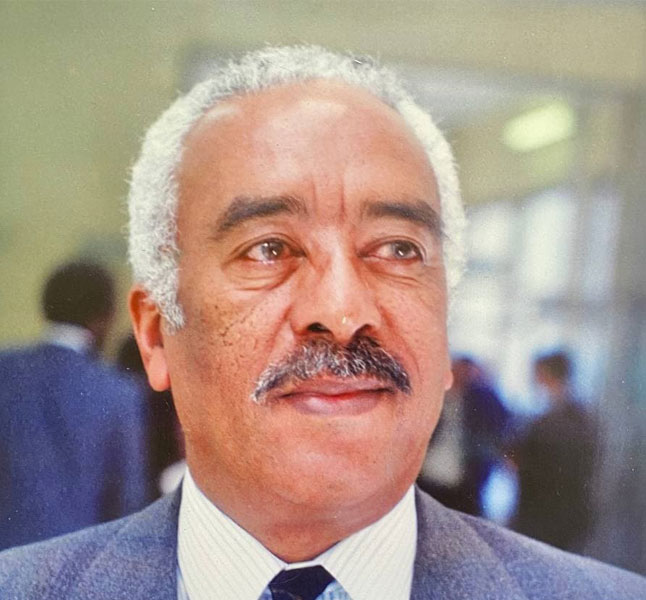

Yohannes Ayalew (PhD), president of the Bank, asked insurance firms to comply with the central bank’s deadline to invest in bonds DBE issues by the end of this month. DBE collected 10.5 billion Br from bonds bought by banks and pension funds last year.

A directive the National Bank of Ethiopia (NBE) issued last year compels insurance firms to invest 15pc of their annual net income in bonds with three years maturity date. The administration of Prime Minister Abiy Ahmed (PhD) wants to rechannel funds mobilised by the private banks to sectors it deems are policy priorities, such as manufacturing, agriculture, energy and tourism.

The insurance industry is not alone in being subjected to the new rules. Commercial banks must also invest one percent of their outstanding loans and advances in buying bonds issued by the DBE. Banks prefer to give out loans instead of investing the outstanding advances due to the significant profit difference, according to Girum Tsegaye, president of Brehan Bank.

“We prefer to advance loans than buy bonds,” said Girum

DBE pays a nine percent annual interest rate on these bonds, two percentage points higher than what the banks pay to depositors. It lends borrowers an interest rate of 11.5pc, much lower than the 19pc average private banks charge. Insurers have complained that the interest rate DBE offers them is much lower than fixed-time deposits (FTD), a type of deposit account with a higher interest rate than a regular savings account.

Insurance industry leaders were not pleased to hear when the directive was first enacted. Their plea to the regulatory authorities for a long extension was not heeded since September last year. The Association of Ethiopian Insurers, chaired by Yared Mola, now serving as the CEO of Nyala Insurance S.C., had pleaded with the central bank to postpone the enforcement date to July this year. The head of the Insurance Supervision Directorate, Belay Tulu, rejected the request for the extension two weeks later, although the authorities related eventually allowed it for a short extension.

According to Yohannes, firms in the insurance industry were reluctant to buy bonds last year, claiming that investing in bonds mid-year affects their financial performance.

No less than 18 insurance firms compete in the market, where the state-owned Ethiopian Insurance Corporation (EIC) enjoys a significant share. The industry mobilised written premiums of 4.4 billion Br in 2020, an increase of 9.4pc from the previous year. General insurance accounted for 90pc of the total, with motor vehicle insurance claiming over half.

With the central bank raising capital requirements for the industry by six-fold a month ago, Berhan is expected to meet the minimum threshold of half a billion Birr in seven years.

The insurance industry, with a combined assets value of over 30 billion Br, is known for having cutthroat competition on premiums. Firms in the industry offer lower premiums to clients affecting their profit margin. They opt to generate income from investment in assets and save their liquidity in time deposits. At 1.2 billion Br, the industry's income from investments two years ago claimed 27pc of total revenues.

Ebisa Mohamed is an insurance expert managing Alpha Consultancy. He believes that the industry, particularly the less capitalised firms, is struggling to meet the requirement. He sees insurers competing by lowering their premiums, to the advantage of the firms with bigger market shares.

Incorporated in 1994, the pioneer United Insurance has already responded to DBE’s Yohannes. Under Meseret Bezabih, the insurance firm registered a 436 million Br paid-up capital two years ago. It has bought 26 million Br worth of bonds.

While pioneers such as United Insurance have less worries about meeting the requirements, experts see it as a challenge for the firms that have joined the industry in recent years.

Relatively young, Berhan Insurance is among these companies required to invest in DBE bonds. Incorporated in 2010, its paid-up capital grew to 200 million Br and registered 45.7 million Br in gross profit last year. According to its CEO, Alemayehu Tefera, investments in the DBE bond come after the legal reserves were deposited.

“The bond investment percent rate is higher than the legal reserve deposit requirements,” he told Fortune. “We’ve no option but to comply.”

Ebsa urges industry leaders to lobby for a minimum threshold to premium prices.

“If the regulators set a price base, the firms would not compete undercutting themselves,” Ebsa told Fortune.

For another voice in the industry, Asseged Gebremedihen, founder of an insurance brokerage and consulting firm, regulators should consider relaxing the investment restrictions imposed on the insurance industry.

“One solution to increase their profit is investments in assets,” he said. “They usually sell shares.”

PUBLISHED ON

Oct 30,2022 [ VOL

23 , NO

1174]

Fortune News | Feb 11,2023

Fortune News | Nov 21,2020

Fortune News | Jun 29,2019

Obituary | Jan 16,2021

Fortune News | Nov 23,2019

Fortune News | Jun 10,2023

Viewpoints | May 23,2021

Fortune News | Jan 01,2022

Exclusive Interviews | Jan 05,2020

Fortune News | Nov 14,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...