Radar | Jun 08,2019

Dashen Bank’s performance last year represented a marked rebound in its foreign exchange dealings, complemented by considerable revenue and asset growth. It has also capitalised on strategic investments and treasury adjustments to reverse previous forex losses, achieving a net gain of 129.34 million Br in foreign exchange operations, transforming a loss of 342.9 million Br registered the previous year.

“Shareholders should be delighted for such performance in the face of adverse business conditions,” said Abdulmenan Mohammed (PhD), a financial statement analyst based in London.

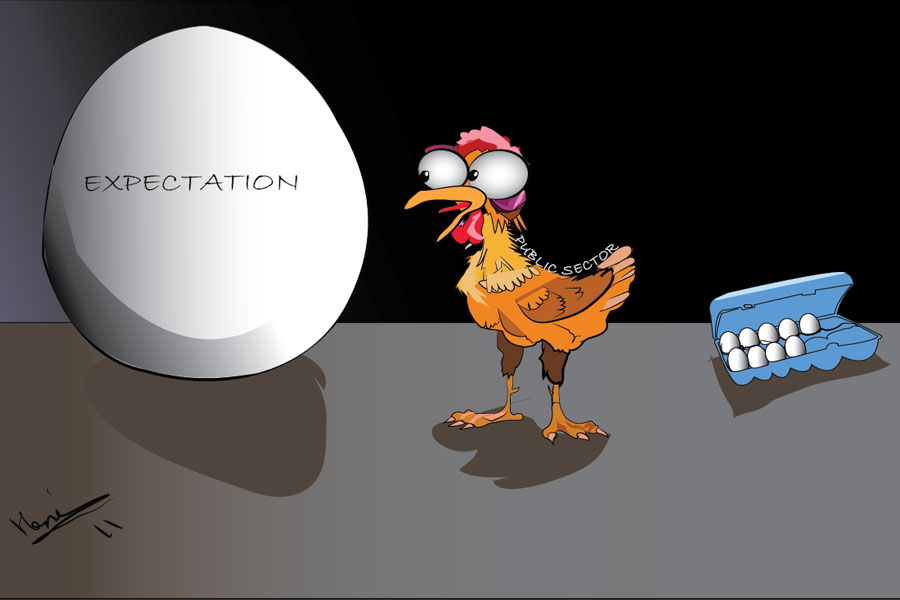

A keen and close observer of the financial sector for two decades, Abdulmenan echoed how banks operate in an economy experiencing inflationary pressures and foreign exchange shortages, which impact loan portfolios and operational costs. The National Bank of Ethiopia (NBE) has imposed policies to curb inflation, including a 14pc cap on credit growth and an increase in the emergency lending facility rate by two percentage points to 18pc. These policies have constrained banks' lending capacities and earnings potential, pressuring financial institutions to seek alternative revenue streams.

Despite these headwinds, Dashen Bank reported a net profit of 4.88 billion Br for the last fiscal year, marking a substantial 37pc increase over the previous year and building on a prior year's growth of 22.8pc. Its total revenue surged by year-on-year growth of 33.8pc to 23.5 billion Br. Interest income from loans, advances, and government securities rose by 30pc to 17.44 billion Br. While interest income from loans and advances grew modestly by 1.27pc to 15.39 billion Br, interest income from Treasury bills, government bonds, and deposits soared by 55.3pc to 2.05 billion Br.

Dashen Bank's ability to achieve substantial net income is believed to reflect effective risk management and operational efficiencies.

Analysts attributed this shift to a carefully recalibrated approach within its treasury, which optimised overnight foreign investments and strategically managed forex allocations.

“It was a deliberate action,” Asfaw Alemu, president of Dashen Bank, told Fortune. “The Treasury wing undertook this major assignment.”

According to the analysts, this shift reveals a strategic choice toward investing in government securities to offset limitations on credit growth.

Asfaw concurred.

"Our strategy centred on income diversification and operational efficiency has been instrumental in navigating adverse business conditions," he told Fortune, speaking from Washington DC, where he attended the IMF-World Bank summit last week. "We've focused on market enhancement, cost optimisation, and improving customer experience."

An economist by training graduating from Addis Abeba University and the University of Ghana, Asfaw has been with Dashen Bank for nearly two decades, serving as president for 10 years. Under his managment, the Bank's total assets expanded by 26.9pc to 183.72 billion Br. He serves on the boards of Nyala Insurance, EthSwitch, and Debremarkos University and is the Deputy President of the Ethiopian Bankers' Association (EBA). His extensive career began as a project officer at the Development Bank of Ethiopia (DBE), a state-owned policy bank, advancing through roles at Wegagen Bank as vice president for Credit & Risk Management, and later working in finance and business development at Unity University.

Under his watch, liquidity improved markedly, with cash, bank balances, and short-term Treasury bills (T-bills) increasing by 48.7pc to 19.79 billion Br. Investments in three-month T-bills increased by 301.9pc to 6.35 billion Br, and fixed-time deposits surged by 443.9pc, enhancing interest income from these sources.

“We worked hard to manage it properly,” said Asfaw.

The Bank's total loans and advances increased by 14pc to 114.28 billion Br, although this represented a slowdown from the prior year's 28.5pc growth due to the Central Bank's lending restrictions.

The Bank mobilised 145.86 billion Br in deposits, a 26.9pc growth, while its liability to total assets ratio rose from 8.3pc to 10.8pc. However, the loan-to-deposit ratio dropped from 87.2pc to 78.75pc due to policy caps on credit growth, signalling a more conservative lending approach under regulatory constraints. Dashen Bank's return on assets (RoA) increased to 2.7pc, and its return on equity (RoE) rose to 20.4pc, both up by two percentage points from the previous year.

Its strategy of diversifying income sources and focusing on non-interest income, such as fees and commissions, which increased by 29.8pc to 4.75 billion Br, has paid off in boosting its financial performance.

However, Dashen Bank's earnings per share (EPS) experienced a slight dip due to capital expansion efforts. The EPS dropped by one percentage point to 43.3pc, down from last year's 442 Br. Asfaw sees this as a temporary dilution, a natural outcome of raising capital, and believes that further capitalisation will be made to enhance future profitability. The Bank increased its paid-up capital by 28.4pc to 12 billion Br, not only achieving a capital adequacy ratio of 15.6pc, but also nearly double the regulatory minimum.

Abdulmenan believes Dashen Bank's strong capital position provides a cushion for absorbing potential losses and supports future growth initiatives.

Dashen's income profile positioned it as the second-largest among the private banks, facing intense competition from peers such as Awash International Bank (AIB) and the Bank of Abyssinia (BoA). Its net income of 5.07 billion Br in the 2023/24 fiscal year accounted for approximately 8.69pc of the industry's total net income of 58.3 billion Br. The state-owned Commercial Bank of Ethiopia (CBE) posted a net income of 21.06 billion Br, and the AIB posted 8.13 billion Br. BoA generated 4.01 billion Br, and Cooperative Bank of Oromia (Coop Bank) earned 2.96 billion Br.

The close competition among top-tier private banks compelled Asfaw and his senior executives to review strategic initiatives to maintain and enhance their position.

Operational challenges also persist, including managing rising expenses and improving customer service. Total expenses amounted to 17.2 billion Br, with interest expenses on deposits growing by 30pc to 5.28 billion Br, driven by intensified efforts to mobilise deposits and offer competitive rates to retain customers. Wages and benefits rose by 37.8pc to 6.53 billion Br, and other operating expenses surged by 45.3pc to 4.3 billion Br.

The Bank's impairment losses on loans and other assets increased by 17pc to 703.07 million Br. The rise is partly attributed to loans disbursed in conflict-affected areas, signalling stringent credit risk assessment and management. According to Abdulmenan, the rising costs in wages, operations, and impairments warrant close attention from the Bank's senior executives.

"While these expenses have risen, we view them as necessary investments in human capital and infrastructure to support future growth and competitiveness," said Asfaw.

He argued that employees are Dashen’s greatest assets, advocating for salaries and benefits aligned with productivity metrics such as the branch-to-employee ratio. With a nationwide network of 882 branches and a workforce of 18,555, Asfaw believes Dashen’s pay philosophy is central to its retention strategy, keeping the Bank competitive.

“Wage adjustment is reasonable with the inflation,” said Asfaw, justifying the rise in employee expenses in light of the economic climate.

Dashen Bank’s largest district, East Addis Abeba, oversees 82 branches. Located in a prime area on Namibia Street (Bole Medhanealem), it caters to high-net-worth clients and exporters. According to its District Director, Wubshet Deribe, branches under his supervision focused on loan interest and foreign exchange allocations, areas of high demand among their clientele. He observed that the recent market-based economic liberalisation presented challenges and opportunities for the District.

“It’s a double-edged sword,” Wubshet said.

Dashen was one of the first banks to hold its annual general assembly at the Millenium Hall on Airport Road in mid-October. Incorporated in 1995 with a modest paid-up capital of 14.9 million Br equity raised from 11 founding shareholders, it has expanded over the years to a shareholder base exceeding 4,932.

Among these long-term shareholders is Girma Desalegn, who bought shares 15 years ago while working with Equatorial Business Group (EBG). Girma hoped to see Dashen further specialise in a specific business sector as it raises additional capital. He expressed satisfaction with the Bank’s "solid performance," noting its robust profit growth and liquidity in a demanding economic environment.

Board Chairperson Dulla Mekonnen concurred. According to him, the Bank has met its commitments to customers despite conflicts, forex shortages, supply chain disruptions, and price hikes in global trade.

“Heightened competition and macroeconomic issues left the industry with limited resources,” he told shareholders.

Branch managers, such as Tiruneh Getahun, noted the hardwork required in acquiring new clients and adapting to market uncertainties.

"We need to focus on attracting new clients with active transaction accounts and enhancing retention strategies," said Tiruneh, speaking of the importance of improving fund transfer efficiency and leveraging the Bank's successful record in tracking real-time gross settlement (RTGS).

Dashen Bank's senior management acknowledged these concerns and conceded that enhancing customer service culture and operational efficiency are critical strategic priorities.

"We plan to implement branch optimisation," Asfaw told Fortune. "We'll invest in technological assets to enhance operational efficiency and customer experience."

According to the President, Dashen Bank has recognised the need to adapt to the evolving financial sector, which includes potential competition from digital disruptors and foreign banks. The anticipated liberalisation of the financial sector for foreign capital could introduce additional competition, pressuring Dashen to innovate and improve service quality.

"We must prioritise innovation, operational efficiency, and customer service enhancement to maintain our market position and drive future growth," Asfaw told Fortune.

PUBLISHED ON

Oct 27,2024 [ VOL

25 , NO

1278]

Radar | Jun 08,2019

Radar | Mar 19,2022

Fortune News | Nov 30,2019

Radar | Oct 30,2021

Fortune News | Feb 19,2022

Editorial | Dec 19,2018

Radar | Aug 12,2023

Fortune News | Apr 20,2024

Fortune News | Mar 25,2023

Radar | Nov 23,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...