Feb 22 , 2020

By TEMESGEN MULUGETA ( FORTUNE STAFF WRITER )

As part of the government's new job creation and unemployment reduction initiatives, Dashen Bank availed five billion Birr worth of loans for medium-size enterprises.

To secure the loan, the beneficiaries are supposed to raise half of the project cost and request a loan to secure the remaining funds from Dashen. If not, they have to provide the Bank with collateral, such as the title deed of a property.

Dashen, one of the leading private banks, has already started providing the loans and close to 6,000 youth are registered under the enterprise so far.

Genuine and sound business ideas will get the funds, according to Yihnalem Aknaw, chief transformation and customer experience officer at Dashen, which had a loan-to-deposit ratio of 70pc during the first half of this fiscal year.

"The interest rate of the loan will depend on the type of investment," he said. "The business cycle and investment type will also be the basis to decide on how the loan will be repaid."

The size of the loans that the beneficiaries take will depend on the type of business scheme, and the Bank expects to provide the loans this fiscal year.

The youth find it difficult to get loans, not because the interest rates are high, but because they do not fulfill the policy requirements to get credit, according to Yihnalem.

In this fiscal year, the administration of Prime Minister Abiy Ahmed (PhD) launched an initiative to create three million jobs within the current fiscal year. In the first half of this fiscal year, the government was able to create 1.2 million jobs.

A few months ago, the Bank also launched a new 100-million-Br initiative that will support the government's ongoing job creation activity. Known as the Ethiopian Talent Power Series, the programme provides training and financial assistance to 1,000 entrepreneurs in five cities: Addis Abeba, Adama, Bahir Dar, Meqelle, Dire Dawa and Hawassa.

Out of the total, 25pc to 30pc of the funds will be lent to the manufacturing sector, while the share dedicated to small and micro enterprises is less than one per cent.

A total of 110,253 new micro and small-scale enterprises (MSEs) were established during the last fiscal year. These enterprises employed about 882,000 people and received more than 7.3 billion Br in loans for their operations.

Alemayehu Geda (PhD), a macroeconomist and lecturer at Addis Abeba University, believes that the Bank has started a good initiative for creating jobs but will not solve the problem fundamentally.

Both the state and private commercial banks, as well as the Development Bank of Ethiopia (DBE), disbursed 164.5 billion Br in loans and advances in the last fiscal year. The rate is 42.5pc higher than the preceding year. Of the total loans, about 60.8pc was provided by private banks and 39.2pc by the two state-owned banks.

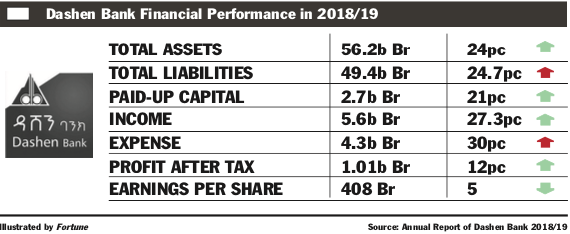

Dashen, which made a gross profit of 1.3 billion Br in the last fiscal year, opened 40 new branches across the country, bringing the total number of branches to 413 as of June 2019. At the end of this past fiscal year, the Bank's total assets reached 56.2 billion Br, while its total capital soared to 6.8 billion Br and paid-up capital reached 2.7 billion Br.

Founded by eleven shareholders with an initial capital of 14.9 million Br in September 1995, Dashen Bank first opened its doors in January 1996 with 11 branches.

PUBLISHED ON

Feb 22,2020 [ VOL

20 , NO

1034]

Radar | Apr 30,2022

Fortune News | Feb 05,2022

Radar | Jul 24,2021

Radar | Aug 14,2021

Radar | Sep 18,2021

Fortune News | Feb 15,2020

Radar | Mar 18,2023

Fortune News | Oct 16,2021

Radar | Aug 22,2020

Radar | Apr 22,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...