Jan 30 , 2021

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

The Council of Ministers approved a regulation that will establish the Liability & Asset Management Corporation, which will be soaking up debts owed by state-owned enterprises to external lenders and the Commercial Bank of Ethiopia (CBE).

Set to be established as a state-owned enterprise with 570 billion Br in capital, the Corporation will be in the business of absorbing and administering the enterprises' debts; managing assets and liabilities; and handling the investment activities of the enterprises that will fall under its portfolio. It can further engage with commercial activities for income by transforming state-owned enterprises' assets into income-generating investments.

In the making for a year and a half under the supervision of the Ministry of Finance, the regulation was approved by the Council yesterday, January 30, 2021.

The formation of the Corporation is part of macroeconomic reforms that include the restructuring of state-owned enterprises, according to Eyob Tekalign (PhD), state minister for Finance. The accumulated debt was a serious macroeconomic issue, according to him.

"It was a tough decision, but profound," said Eyob. "It'll function as a conduit in preventing debt crises."

The Corporation will administer a little over half a trillion Birr in residual debt from CBE and other lenders including China. The Sugar Corporation, Chemical Industry Corporation, Ethiopian Electric Power, the then Metals & Engineering Corporation (MetEC), and the Ethiopian Railways Corporation owe the debt. The EEP carries the largest debt, amounting to 370 billion Br. The Railways Corporation and MetEC follow with 120 billion Br and 74 billion Br in debts, respectively. The Sugar Corporation had 70 billion Br in debt.

The Corporation, which will be reporting to the Ministry, will be capitalised from the industrial fund and funds to be mobilised from development partners, according to Eyob.

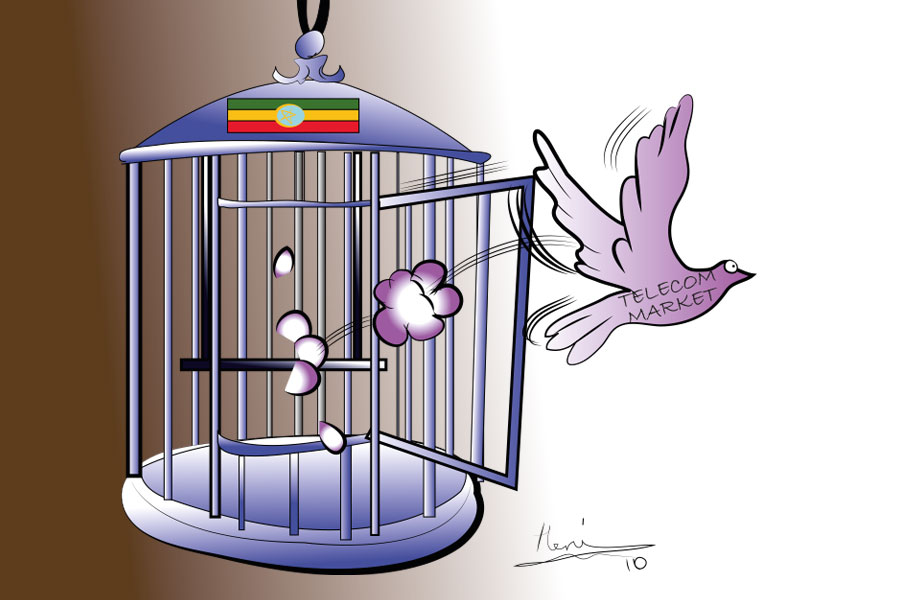

Taking over the enterprises' liabilities, the Corporation will be servicing their debts through the resources to be redirected from the Industrial Development Fund, which was set up by the Public Enterprises Privatisation Proclamation to administer the revenues generated from the liberalisation and privatisation of the state-owned enterprises.

It will also administer the debt of companies selected by the Ministry of Finance and those who have requested their debts be taken off their balance sheets.

A committee composed of members from the Ministry, the National Bank of Ethiopia (NBE) and the Public Enterprises Holding & Supervision Agency proposed the Corporation's formation. The team, which has been diagnosing the enterprises' debt stress, proposed the Corporation's formation to partially absorb the debt and clear their balance sheets. It also assessed the enterprises' solvency, their capacity to pay off their debt, and their debt-service coverage ratio to assess the serviceable and residual debts.

The Ministry has presented a couple of rough organisational structures for the Corporation, according to Eyob, who adds that it will be operated by high calibre experts with a background in finance.

"Most of the legwork to operationalise the Corporation has been done," Eyob said.

It is a new beginning for the company, according to Hiwot Mosisa, CEO of Ethio-Engineering Group, formerly known as MetEC.

"And it comes at the right time," she said. "It came onto the scene when we were about to finalise our major reforms."

The company's new management has been working on the restructuring and rebranding that covers changing its name, restructuring human resources, converting its finance and accounting system into International Financial Reporting Standards (IFRS), and fine-tuning its focus area.

One of the major problems of the company was financial issues, on top of being disconnected from its main objective and diverting into megaprojects, according to Hiwot.

"It'll give us a good financial look and enable us to do better deals with financial institutions," she said, "such as getting working capital, project financing and support in foreign currency."

It will also make the company credible and give confidence to the private firms that want to partner with the company, according to her.

"Now we'll be focusing on import substitution," she said. "Then we'll focus on exporting."

The Group will also contribute its share, such as resources for the capital of the new Corporation, according to Hiwot.

PUBLISHED ON

Jan 30,2021 [ VOL

21 , NO

1083]

Sponsored Contents | Mar 03,2022

Fortune News | Apr 16,2022

Editorial | Oct 02,2021

Editorial | May 29,2021

Fortune News | Jan 22,2022

Fortune News | Mar 30,2022

Films Review | Oct 16,2021

Fortune News | May 23,2021

Fortune News | Jul 11,2021

Films Review | Nov 16,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...