Life Matters | Apr 03,2021

Jun 5 , 2021

By NEGA ZINABIE ( FORTUNE STAFF WRITER )

Despite struggling with a lack of financing, cooperatives and unions have only utilised less than half of the 800 million Br credit allocated to them by the National Bank of Ethiopia to mitigate the impacts of the COVID-19 pandemic on their business activities. The cooperatives cite the "high" interest rate levied on the loan coupled with the short repayment period stipulated as the factors behind their lack of interest so far.

The financial support, approved by the central bank just two months after the pandemic came into the picture, is part of the two billion Birr stimulus package implemented by the government to reduce the impacts of the outbreak on marginal economic actors, including small and medium enterprises and cooperative unions. The loan was provided through the Development Bank of Ethiopia (DBE) with an annual interest rate of seven percent.

There were 1,145 registered cooperatives in the country at the end of the first quarter of the current fiscal year. Almost 1,700 agro-processing industries were registered under these cooperatives, which had traded commodities worth 3.5 billion Br over the first nine months of the fiscal year.

So far, just 51 cooperatives have managed to take 341 million Br in loans after fulfilling the requirements, which demand having a capital higher than their outstanding credit and presenting an audit report as well as a business plan. An additional three are waiting for the approval of 77.7 million Br in loans from the DBE, according to the Federal Cooperative Agency.

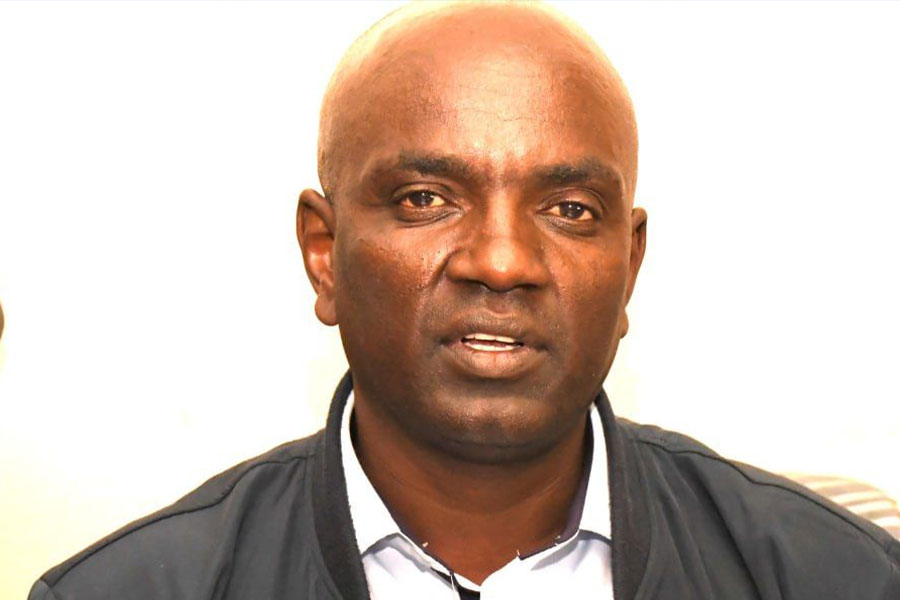

"The majority of the cooperatives are already indebted and they were not able to qualify for the loan," said Demelash Gebeyehu, a senior expert of credit and commodity trade at the Agency. "There is a large chunk of money that they can still borrow."

Even before a Coronavirus case was reported in Ethiopia, cooperatives, especially those established by farmers, had been under pressure due to low bargaining power resulting from the presence of intermediaries, inflationary pressure, and shortage of finance to buy inputs, although they are among the entities that got relatively better support from government agencies, in terms of the loan. COVID-19, however, has exacerbated things with the disruption of supply chains following the reports of the country's first positive case in March last year.

"Following the social-distancing rules applied for a few months after the pandemic, we were unable to reach our customers, affecting our sales, while our customers, who'd already bought some goods from our company on credit, were not able to pay us," said Habtamu Abera, general manager of Zengena Irrigation Cooperative Union. "Even though this has impacted our financial standing, we were not able to get a loan since our loan book has not been clear."

So far, cooperatives have repaid 169.5 million Br of their loans, over 57 million Br lower than they should have just less than a year after borrowing from the DBE, which requires cooperatives to repay their loan within a year; a prerequisite that experts say fails to take their circumstances into consideration.

"Cooperatives have a strong credit habit. So placing such a requirement at a critical time when they are struggling to remain afloat is not fair. This has to be reviewed," says Wossenseged Assefa, an economist.

Habtamu agrees.

"Not only the repayment period, but the interest rate also has to be adjusted as well," he underscored.

Attempts to reach executives of the DBE for this story bore no fruit.

PUBLISHED ON

Jun 05,2021 [ VOL

22 , NO

1101]

Life Matters | Apr 03,2021

Sponsored Contents | Jun 17,2021

Radar | Sep 10,2021

Fineline | Jun 20,2020

Radar | Jan 26,2019

Fortune News | Jul 07,2024

Fortune News | May 28,2022

Fortune News | May 21,2022

Radar | Jun 21,2025

Fortune News | Sep 18,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...