Commentaries | Jul 13,2020

Mar 16 , 2024

By MUNIR SHEMSU ( FORTUNE STAFF WRITER )

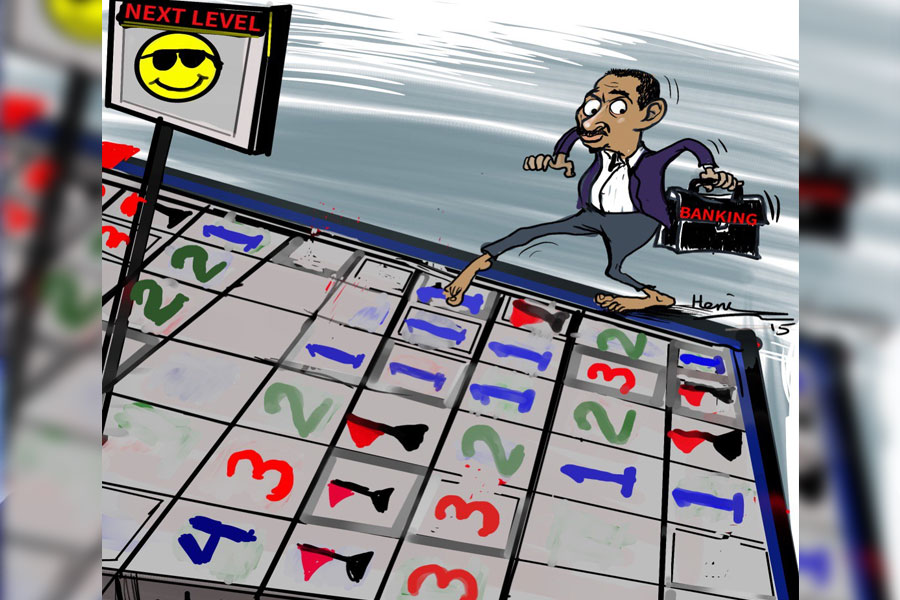

The National Bank of Ethiopia (NBE) introduces a draft directive limiting commercial banks' equity investments in non-banking businesses to 10pc of their total capital. The move is designed to anchor banks to their primary roles in lending and deposit mobilisation, steering clear of speculative ventures.

It carves out an exception, allowing banks to fully invest in capital market service providers, signalling a strategic opening towards developing the nascent capital markets within the financial sector.

Central bank regulators have delineated the regulatory framework, hoping to safeguard the traditional banking sector while developing the nascent capital market. The initiative is part of the federal government’s ambitious efforts to diversify the financial services industry yet cautious foray into capital markets. According to senior officials of NBE, this enables the banks to participate in the capital market's growth without veering away from their fundamental banking operations.

Despite the proposed limitation, the bill allows banks to acquire up to 100pc equity shares in capital market service providers.

Frezer Ayalew, the central bank's head of Banking Supervision, believes that most Ethiopian banks are already well-capitalised, exceeding the minimum capital threshold of five billion Birr set forth by the central bank, with a deadline in 2026. Although a directive issued six years ago did not explicitly cover capital markets, it laid the groundwork for the current regulations, offsetting the need for an additional adjustment period for banks to comply.

The regulatory posture reflects a meticulous approach to integrating capital markets into the financial ecosystem, according to a central bank official.

He noted that regulations governing banking businesses for foreign entrants are expected to be addressed separately in a pending proclamation.

"This [the bill] applies to local commercial banks," he told Fortune.

The banking system's total capital increased by 23.7pc, reaching 246.7 billion Br in the last quarter of the fiscal year 2022/23, a significant growth. One-tenth of the amount is equivalent to the tax revenue collected by the federal government in October six years ago. A study conducted by PricewaterhouseCoopers (PwC) in 2018 examined the impact of regulations on banks' activities in the capital markets, with findings that the reduction in banks' market-making capacity contributed to a deterioration in liquidity conditions. It concluded that regulatory measures may have affected the ability of banks to provide liquidity and facilitate trading activities in the capital markets.

However, the central bank's draft directive, distributed to bank executives for feedback, is seen as a crucial step toward creating a more dynamic and diversified financial sector that can offer a wider range of investment opportunities and equity sources.

Oromia Bank, which reported a net profit of 1.58 billion Br in the previous financial year, views the 10pc investment limit as reasonable and within the operational capacity of most banks, especially those with a history of prudent investment practices. According to Worqu Lemma, its vice president, the investment cap is unlikely to restrict banks' ability to engage in the capital market while prioritising their primary banking activities.

The sentiment is echoed across the banking industry, with the proposed regulations receiving a generally approving nod. The directive's intent to balance the expansion into capital markets with the need to maintain the stability and integrity of the banking system is recognised as a sensible approach. Banks are provided with the flexibility to explore capital market opportunities, either by becoming securities dealers, which requires a minimum capital of 10 million Br or explore other less burdensome options. Larger banks can opt to establish investment banks.

"The market also offers options for partnerships, and it's optional," he said.

The recent approval of the capital market service providers directive, which sets minimum capital requirements for investment banks within and outside banking groups, marks a significant development in the financial sector. According to the directive, investment banks within a banking group must meet a minimum capital requirement of 100 million Br, while those outside the industry can establish with 25 million Br.

Tadesse Hatiya, president of Sidama Bank, views the capital market as a promising opportunity for the two-year-old bank to raise capital through issuing shares in an organised market. The new avenue for capital acquisition is expected to bring clarity and transparency to the financial sector, offering emerging banks like Sidama a formal path for growth and expansion.

"It signals clarity," he said.

Sidama Bank evolved from a microfinance institution, raising 575 million Br in paid-up capital from nearly 2,000 shareholders. Tadesse stressed the Bank's commitment to enhancing its staff's professional capacities to engage in capital markets effectively. Sidama has been actively participating in training programs offered by the Ethiopian Capital Market Authority (ECMA) and partnering with foreign firms to leverage their expertise.

"We've to be able to engage in the market competently," he said.

Ethiopia's venture into capital markets has been in the making for nearly five years, initially established through a project team within the central bank before forming an independent regulatory authority. Establishing the Authority shows the country's commitment to developing a robust regulatory framework for its emerging capital market, according to Brook Taye (PhD), director general of ECMA.

"This is one of the most significant developments," he told Fortune.

He is upbeat about banks' potential to hold significant equity in capital market service providers and anticipates that most, if not all, banks will meet the requirements necessary to obtain a license within the emerging market.

The Ethiopian initiative parallels historical efforts to delineate commercial and investment banking boundaries, such as the United States' Glass-Steagall Act. Enacted during the Great Depression - but repealed in 1999 under Bill Clinton - was one of the earliest attempts to separate commercial banking activities from high-risk investment practices. The recent financial regulations reflect a similar intention to address systemic risks while promoting a conducive environment for the financial sector.

Despite the cautious approach embodied in the central bank's directives, some financial experts argue for greater flexibility.

For Eshetu Fantaye, a seasoned banker, the restrictions may be overly conservative, potentially stifling the dynamism of the banking industry and the capital market.

"It appears to be a strategy aimed at avoiding risks," said Eshetu.

Drawing on international experiences such as Germany after the Second World War and the importance of liquidity in developing new markets, Eshetu advocated for reconsidering the investment cap, which could enhance the banks' ability to support capital market growth without compromising their operational integrity. He believes that while some countries have successfully developed using universal banking models that offer a wide range of services in investment and retail settings, this approach may not be suitable for all.

Eshetu acknowledged that some commercial banks operate in models that expose them to operational risks, even in traditional collateral-based lending practices. However, capping their engagement at a tenth of their total capital may be overly cautious.

"A slight relaxation of restrictions could lead to better outcomes," he urged.

PUBLISHED ON

Mar 16,2024 [ VOL

24 , NO

1246]

Commentaries | Jul 13,2020

News Analysis | Jan 19,2024

Editorial | May 27,2023

Fortune News | May 31,2025

Fortune News | Mar 16,2024

Fortune News | Sep 21,2025

In-Picture | Nov 16,2024

Radar | Oct 05,2025

My Opinion | Jul 27,2024

News Analysis | Nov 03,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...